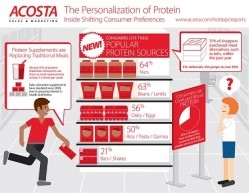

Consumers confused about whether sufficient protein can be obtained from meat-free diet

Nearly a third of shoppers purchased a meat alternative in the past year with younger consumers leading the way, according to Acosta’s Hot Top Report “The Personalization of Protein” published this month. It notes more than half of Millennials bought meat alternatives followed closely by a third of Generation Xers before sales tapered to 19% of Baby Boomers and 12% of shoppers older than 65 years.

Tofu is the best-selling meat alternative with 21% of shoppers purchasing it in the past year, followed by texturized vegetable protein (12%), tempeh (10%) and Quorn (8%). Seitan, which likely suffers a negative image as the gluten-free movement continues to march forward, brings up the rear with only 6% of shoppers buying it last year, according to Acosta.

It adds that sales of tofu have been climbing for the past five years, a trend that likely will continue as younger consumers enter the market.

But this still leaves 69% of shoppers not buying meat alternatives, even though 32% of shoppers said they bought less meat and 24% said they bought less pork last year, according to the report.

Bridge knowledge gap to reach more consumers

Marketers could increase sales of meat alternatives and other protein sources, such as dairy, beans and grains, by helping to close the knowledge gap about the benefits and amount of protein in meat alternatives and other sources, the report adds.

“Many consumers indicate interest in meat alternatives, but need guidance in making smart choices,” the report notes.

In particular, they need help understanding “whether you can achieve sufficient protein levels from a meat-free diet and what kinds of meat alternative offerings are available,”the market report says.

The study found 41% of Millennials, 46% of Generation X, 49% of Baby Boomers and 52% of consumers older than 65 years were either unsure or did not think that a person could consume their necessary daily amount of protein without meat.

In addition, the study found 30% of shoppers indicated they did not know the recommended daily protein requirements for adults are 56 grams for men and 46 for women, even though 30% said it was the most important nutrient for a healthy lifestyle, followed by vitamins (25%) and fiber (22%).

And finally, more than a quarter of consumers were not sure if eating protein would make them feel fuller or stay fuller longer, which are key marketing messages for weight management products relying on protein for increase satiety with low calorie counts, according to the report.

This helps explain why “U.S. has some of the highest protein consumption in the world,” and yet “Americans are comparatively less likely to obtain protein from vegetable sources,” the report notes.

Acosta researchers recommend firms address consumer confusion and increase their interest in meat alternatives and protein products by highlighting the amount and benefit of protein on packaging, the report suggests.

Specifically, they can address missing and misinformation about alternative protein sources’ benefits by calling out on packaging the amount of protein per serving in a product compared to other sources, the percentage of the recommended daily amount that each serving provides as well as advice on how to prepare the protein (think recipe cards, online cooking videos or sample daily menus), the report suggests.

For weight management products, messaging should explain: “Foods high in protein require more energy for your body to digest, metabolize and use for fuel, which can expend more calories. Because they are slower to digest, protein leaves you feeling satiated longer and provides more sustained energy than high-carb foods,” the report notes.

Make alternative proteins affordable and accessible

“Sixty-eight percent of shoppers who are buying less meat cite cost as the primary reason, followed by health and wellness at 39%,” while 45% of consumers who abstain completely from meat do so because of the rising cost of meat and seafood compared to 61% who cited personal health concerns, according to the study.

And yet, consumers who buy meat alternatives tend to have higher income levels.

“Shoppers with annual household income of more than $75K have the highest interest in meat alternatives, with more than 55% purchasing an alternative protein source in the last year,” according to the report.

The discrepancy between consumers’ concerns surrounding the cost of animal protein and the restriction to the higher economic bracket of those buying less expensive plant-based proteins suggests marketers need to improve messaging surrounding the lower price point of many plant-based protein products.

Make protein portable

Firms can further drive sales of alternative protein source products by making them portable, fast and easy to eat on-the-go, the report says.

“Consumers are increasingly more likely to partake in two traditional meals a day, using meal replacements and/or snacking to augment dietary needs. This movement away from three square meals a day is reshaping consumer demand for traditional protein sources,” which historically “have been at odds” with on-the-go products because meat and eggs take time to prepare, the report notes.

Now, at least once a week 30% of consumers turn to meal replacement shakes and 55% eat breakfast bars, making them good platforms for delivering protein, the report notes.

According to the report, other strategies to drive growth of protein products include:

- Offering more organic and antibiotic free protein-packed products,

- Connect products to diet and fitness trends, such as the paleo and raw movements, and

- Work with retailers to place protein products in unexpected places in the store, such as with produce so consumers think about it as a salad topping.