Fresh prepared food elevates groceries, drives foot-traffic

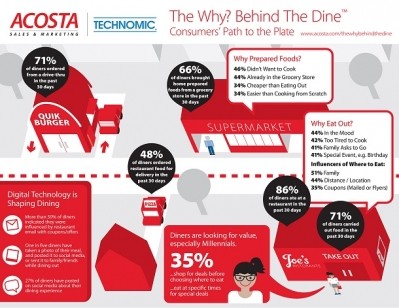

“The landscape of supermarket fresh prepared foods has changed dramatically in recent years,” with more stores evolving beyond simple salad bars, rotisserie chickens and prepared salads to include “high quality meal solutions that directly compete with restaurant offerings,” according to a survey of 28 banners representing 8,000 stores conducted by the Food Marketing Institute and Technomic.

As a result, sales of fresh prepared foods have grown $15 billion to $27.58 billion from 2006 to 2014, according to the study. This 10.4% increase far outpaces that of traditional food service, which rose only 2.1% in the same period.

For most stores, the sales of fresh prepared food also has significantly outpaced that of total store sales, which includes the sale of CPGs and fresh foods sold throughout the center store and perimeter, Wade Hanson, principal at Technomic, said.

“While only 8% of responding supermarkets reported total store sales growth of more than 5% in 2014, 69% reported that same level of growth – or much higher – in their prepared fresh departments,” he said.

More specifically, he noted, a significant 16% of supermarkets reported total store decline, whereas only 5% reported a decline in fresh prepared foods. “Additionally, the vast majority of supermarkets are seeing total store growth of only 0-5%, but seeing prepared food sales climbing 14-41%,” he said.

What these figures illustrate is that “at a time when consumers have myriad away-from-home choices, they are gravitating toward supermarkets FPF in growing numbers and with growing frequency,” according to the report.

This is good news for retailers and CPGs in that FPF is increasing foot traffic at a time when supermarkets not only face competition from restaurants but also club, mass and c-stores, the report notes.

This development also spells trouble for CPGs in the struggling center store, which already are losing sales share to perishables, because stores increasingly are abandoning efforts to revitalize this space and instead are focusing on FPF – which are returning on the investments, Hanson said.

Tactics to improve FPF

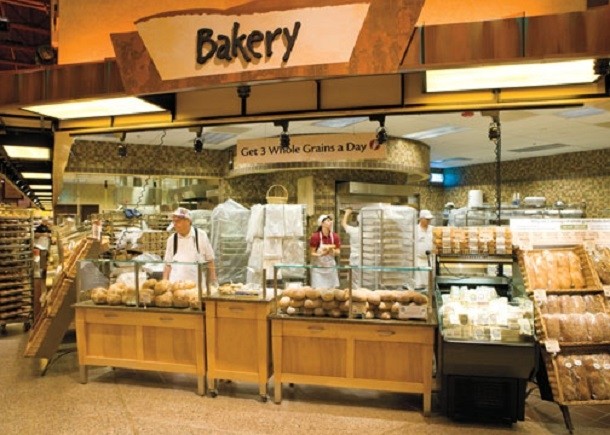

The study reveals that grocers nationwide are investing heavily in improving their FPF offerings and the shopping experience surrounding this space.

In particular, 88% of banners now employ a corporate executive chef tasked with contemporizing the prepared foods menus of leading supermarket chains, according to the survey.

In addition, 23% of responding supermarkets report having re-modeled deli departments in the past three years to better replicate a restaurant-style experience. This includes 96% offering in-store seating, 89% beer and wine tasting, 86% free Wi-Fi, 72% a wine and bar area and 32% offering full in-store dining complete with table service, according to the survey.

FPF continues to grow

Going forward, FPF will continue to be a driving force for supermarket sales and foot traffic, but its growth rate will stabilize, predicts FMI and Technomic.

Nonetheless, they expect it will remain high-growth compared to all other retail food and traditional food service segments with an anticipated 8.5% increase to $35 billion by 2017.

With that much money on the line, CPG manufacturers likely will rise to the challenge of gaining facings in this segment.

Manufacturers and CPGs can take advantage of these changes by offering more ready-to-eat options, single serve packs and on-the-go products that can be enjoyed easily in stores. Or they can branch out into wholesale and offer branded FPF options.