Sales of sweet baked snacks slow, but single-serve holds promise, Packaged Facts finds

In a new report, it estimates the compound annual growth rate of packaged sweet baked goods, which hit $20 billion in 2014, will drop significantly to only 2.8% over the next four years to reach $23 billion by 2019. This is compared to the more than 4% CAGR of the last four years.

What little growth there is in the category, which includes cookies, cakes, pies and pastries sold at retail but does not include those from in-store or independent bakeries, will come from price increases – as has been the case for the past four years – and not from volume increases, the report says.

“Overall volume will likely remain flat as consumers stay concerned about health and diet, and increasingly seek out healthier snacks,” the report notes.

It points to a 2015 study that found 54% of adults said they always eat healthy foods and maintain a balanced diet, and about 45% said nutritional value is the most important factor in the foods they eat.

Fresh baked goods eat into sales

When consumers do indulge, which 57% of the adults surveyed said there is nothing wrong with “from time to time,” they increasingly are opting for fresher baked goods from in-store and independent bakeries, the report says.

This preference stems from the general belief that in-store and independent bakers sell fresher, higher quality products that are handmade from scratch and, therefore, “taste better than packaged products bought off the shelf,” according to the report.

This is particularly true for doughnuts, pies, cookies, cakes and muffins, it notes, adding that the packaged shelf aisle still holds its own for cookies and snack cakes, such as Twinkies which are seeing resurgence.

The larger consumer trend for “clean label” products that have only recognizable, natural and less-processed ingredients also is fueling the preference for freshly baked sweets.

Some packaged baked goods brands are fighting back with reformulated products that eliminate undesirable ingredients and add trendy ingredients, such as protein and fiber.

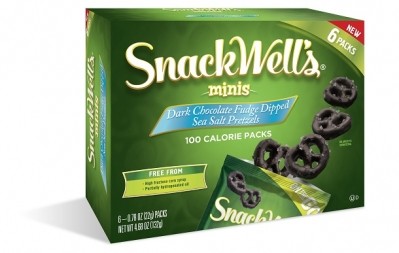

Otis Spunkmeyer’s new line of sweet baked goods promises “no funky stuff,” such as artificial colors and flavors, high fructose corn syrup or partially hydrogenated oils. SnackWells recently revamped line of sweet baked goods makes similar claims.

Private label threatens national brand sales

Continued growth of lower priced private label products also will hamper dollar growth, according to Packaged Facts.

Most retailers offer several of their own brands of bakery sweets, which help differentiate them from competing retailers and offer consumers more price-point and quality levels, according to the report.

Private label brands account for 25% of dollar sales and nearly 26% of volume sales for shelf stable sweet baked goods and penetration is highest in cakes and pies at more than 70%, the report notes. National brands excel at toaster pastries and cookies.

Competition from bars

The sweet baked goods category also is suffering as more people skip breakfast at home, reaching instead for bars or breakfast sandwiches out, Packaged Facts notes.

“Breakfast/cereal/granola bars compete with snack cakes for consumers’ share of wallet and stomach. Both product forms are eaten throughout the day as snacks or as replacements for meals by some people,” the report notes.

Specifically, it found, household penetration in the last 10 years for snack cakes declined from 49% to 45%, while sales of bars increased from 44% to more than 50%.

On-the-go & convenience grow

There is hope for packaged sweet baked goods in the on-the-go formats and at convenience stores, though, the report suggests.

“Smaller products and packaging designed for snacking on the go have been extremely popular and at relatively high price points have helped drive dollar sales higher,” according to the report.

It explains their popularity is linked to a desire for portion control, on-the-go options, as well as “the growing single or dual household segment, older people and consumers watching their weight or overall health.”

Given these uses, the convenience channel is growing for sweet baked goods as a way for consumers to grab a pastry and coffee in a rush.