Convenience and health driving growth in $25 billion branded refrigerated meals and meat market: Packaged Facts

Meat and meat-based products are America’s #1 protein source, with ‘convenient’, ‘healthy’, and ‘creative/new’ the watchwords for the sector, according to the Branded Refrigerated Meats and Meals: U.S. Market Trends report.

The report, authored by Howard Waxman, notes that consumers are demanding more convenience with their food products. “Refrigerated meat products are right in the middle of this trend, because a solid protein option is key to the value of these prepared dishes. Some companies are meeting the demand head on with products that offer a major dose of protein in an on-the-go format.”

Brands are also diversifying their portfolios with strategic acquisitions to try to achieve the top two spots in select categories, and Tyson’s acquisition of Hillshire Brans in the top example here, said the report.

Tyson is the biggest U.S. chicken processor and a major processor of beef and pork, and its acquisition of Chicago-based Hillshire Brands (best known for its Jimmy Dean, Ball Park, Hillshire Farm, State Fair, Aidells and Gallo brands) helps Tyson build a business in branded meat products.

“Our strategy has been to grow our prepared foods business, and it has been our aspiration to be a leader in retail prepared foods just as we are in chicken,” said Donnie Smith, president and CEO of Tyson Foods. “Now we will have those iconic #1 and #2 brands in numerous categories.”

Healthy

In the refrigerated meals and meats sector health is often used to indicate that a product is from animals that have been raised under humane conditions and without the use of antibiotics or GMO ingredients in their feed. It can also be a reference to the use of leaner cuts.

Similarly, the idea of “safe” in the food and beverage industry can be considered a subset of healthy, said the report. “Some consumers are less concerned about getting products that improve their health but rather want to be sure the products they purchase won’t do them harm,” says Packaged Facts research director David Sprinkle.

At home or dining out

Supermarkets continue to be the main retail grocery channel for the products, with data from the USDA’s Economic Research Service (ERS) indicating that 62.1% of total grocery sales ($420.8 billion in 2012) come from the 20 largest food retailers, up from 39.2% in 1992.

“Despite the still strong position of supermarkets, changes are in the offing,” states the report’s executive summary. “A new generation of consumers is concerned with such issues as whether the animals that provided the meat they purchase were raised and slaughtered in a humane fashion and what pharmaceuticals were given to the animals directly or put in their feed. This has led to increased purchasing of local produced products and of products identified as either organic or natural.”

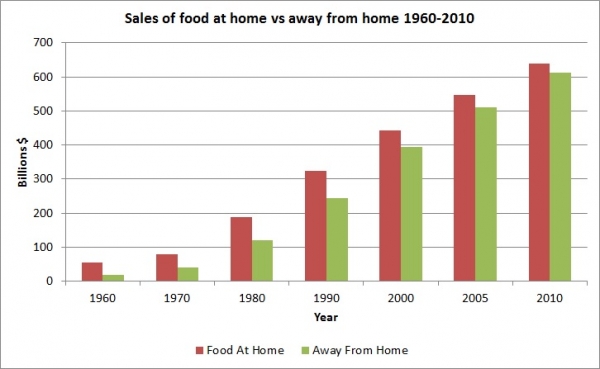

Food service is also competing for the consumer dollar, with the figure below showing just how food service now accounts for almost 50% of all food spending.