Millennials, Hispanics and coffee: IRI picks the rising stars in the $737bn CPG marketplace

Grocery and drug channels are experiencing flat to negative trip frequency and declining basket size during the past year, said the report, while the Internet saw a modest uptick in both frequency and trip spending.

In addition, Dollar channel trips were largely flat, but the average basket size rose considerably, with an increase of 3%. Club trips slipped slightly, but spending growth outpaced the industry average at 0.9%. These shifts underscore the depths of consumers’ willingness to try new channels and banners along their pursuit for value, said the report.

“Following years of economic trials, the ‘golden ring’ of CPG shopping is value,” said Susan Viamari, editor, Thought Leadership, IRI. “Today, more than 80% of shoppers visit three or more channels to carry out their CPG shopping journey. And, as more nodes crop up along the path to purchase, capturing shoppers’ attention and wallet will become increasingly complex. Retailers and manufacturers must provide value to each and every shopper through individualized targeting and flawless execution.”

Millennials & Hispanics on the rise

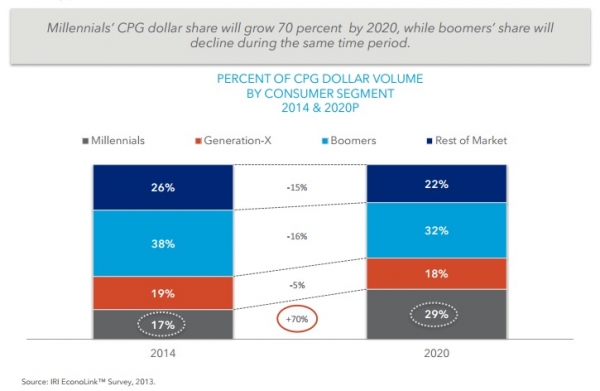

The 100 million Americans born between 1980 and 2000 – the Millennials – currently account for about 17% of the total CPG dollar volume, while Boomers dominate with 38%. There will be a major shift by 2020, says the report, with Millennials rising to 29% of the total CPG dollar volume, and increase of 70%, while Boomers will drop to 32%.

“This [increase in Millennial spending] translates to more than $250 billion annually,” says the report. “Millennials are a key growth market for CPG marketers in the coming decades.

“Millennial shoppers consistently demonstrate unique consumption and shopping habits, which must be understood and delivered against by CPG marketers who wish to win their loyalty.”

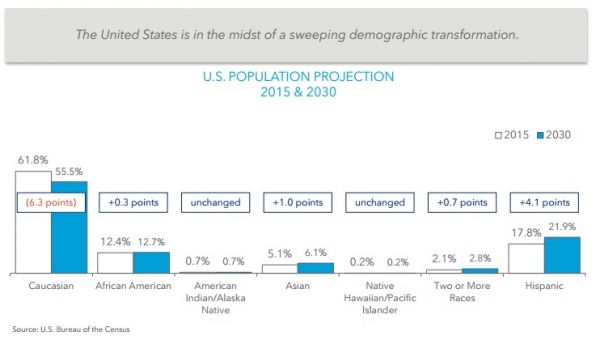

CPG marketers will also have to adjust to shifts in the cultural and ethnic make-up of its consumers in the coming years. The Hispanic population, with its preference for authentic ingredients, is expected to increase from 17.8% to 21.9% of the US population by 2030, while Asians are predicted to increase by 1% to 6.1%.

“[Asians bring] with them a higher-than-average focus on health and wellness, and a relatively high disposable income.

“CPG marketers will need to embrace diversity and serve it well,” adds the report. “While this seems a monumental task, taking the right approach – using common cultural traits and needs that transcend country of origin and acculturation level differences – marketers can target effectively and impactfully.”

Coffee: A top growth category in multiple channels

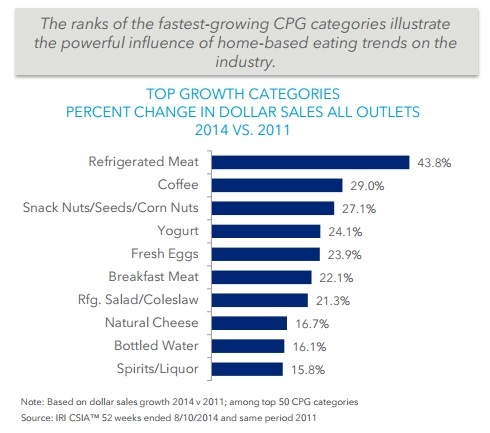

While grocery overall may be flat or declining slightly, it still has multiple growth categories, with coffee, refrigerated meat, and spirits/liquor the three stand-outs.

Coffee also makes the top three in a number of other channels, including Mass/Super and Internet (pick up/mail order). Other food categories displaying significant growth in the categories include refrigerated meat and yogurt in the mass/super channel, frozen dinners/entrees and milk at dollar stores, and snack nuts/seeds/corn nuts and yogurt at club stores.

‘Adopt a strong multi-channel relevance’

“Consumer engagement and the CPG journey have forever changed,” said Viamari. “CPG marketers must adopt a strong multi-channel relevance, including a strong and seamless digital presence, or they will undoubtedly become obsolete.

“To ensure growth, marketers must execute well against four key strategies: protect and grow the base; maintain solid availability against existing and evolving channel preferences and behaviors; optimize marketing mix by media and retail channel; and develop channel-specific products and packages.”

IRI is offering a free webinar, entitled “Channel Migration: The Road to Growth Has Many Lanes,” at 11 am CT on November 5. To register for this webinar, hosted by Susan Viamari, editor of Thought Leadership, click HERE.

To read the full report “Channel Migration: The Road to Growth Has Many Lanes” for free, please click HERE.