Trailblazer Foods CEO: The US private label market has changed beyond all recognition

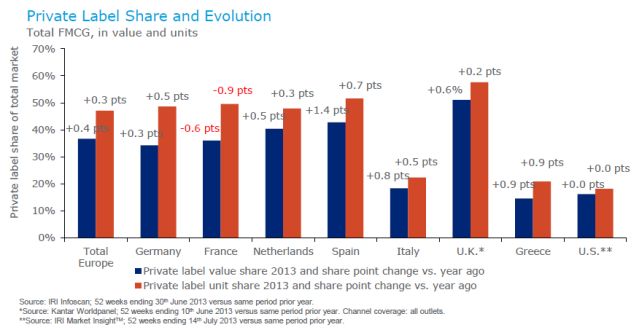

Rob Miller, CEO and president of Portland, Oregon-based private label specialist Trailblazer Foods, was speaking to FoodNavigator-USA after IRI published a report (click here) showing that private label share of fast moving consumer goods (FMCG) unit sales remained unchanged in the US retail market at 17.2% in the year to July 14 , 2013, versus the prior year.

Private label’s share of dollar sales inched up slightly to 14.6%, bolstered, at least in part, by private label price inflation, which has outpaced national brands during the past several years, said IRI.

US retailers are viewing private label much more strategically now

However, Miller believes there is still considerable room for growth.

While markets with the highest private label penetration rates (in the UK, store brands account for more than 50% of unit sales) are a little different to the US in that they have a large fresh and chilled prepared food/home meal replacement market - which is dominated by private label - this part of the market also has a lot of potential in America, said Miller.

“The retailers here that have been the most successful are those that are focused on the store perimeter. I think private label could double its share in some categories [in the US].”

When I was growing up, private label meant a white can saying ‘beer’ on it in black letters

But the biggest change in recent years has been in attitudes, he said.

“When I was growing up, private label meant a white can saying ‘beer’ on it in black letters. Now we’re seeing some really innovative products, and some of the premium private label ranges are vastly superior in quality as retailers see them as a way to differentiate themselves.

“Retailers are viewing private label much more strategically now. They are hiring some very good people and bringing in marketing people that really treat the private label products like [national] brands. There is also a lot more activity in better-for-you private label products.”

He added: “There has also been a lot of consolidation [in the private label manufacturing market] lately. Ralcorp was on a buying spree before ConAgra bought it and TreeHouse has been buying a lot of companies. But we think there is a still a big opportunity for mid-market players like us.”

70% of our coconut volumes for the year are sold in three months

One of the Western United States’ largest producers of preserves and jellies, table syrups, sweetened shredded and flaked coconut, drink mixes, Italian syrups, institutional pie filling and glazes; Trailblazer also produces sauces, marinades, glazes and various other non-oil-based wet products.

A key private label manufacturer for Kroger, Safeway, Walmart and Costco, Trailblazer also supplies foodservice giants including Sysco, Food Services of America, US Foodservice, Costco Bakery and Cash & Carry.

Around 10% of its volumes are generated by branded products such as Walls Berry Farm Preserves and Nalley Lumberjack Table Syrups, but most of the brands it handles are “someone else’s”, said Miller.

“About 10% of the pounds produced by the plant are our brands [Walls Berry Farm Preserves, Nalley Lumberjack Table Syrups and Portland Punch], the other 90% are someone else’s - primarily retail store brands, but we also do some co-packing for other manufacturers.”

We’ve been growing in the low double digits in the past three to four years

He added: “We’ve been growing in the low double digits in the past three to four years - it’s healthy growth but not so fast that we get growing pains.

“The jellies, preserves, and syrups categories are pretty mature, so category growth is pretty flat, but we’ve been growing because we’re gaining market share.”

By contrast, the bagged coconut category is “growing nicely”, he said. “For us, 70% of the coconut volumes for the year are sold in three months: October and November for the holiday season and March in the run up to Easter.”

While the Philippines - which has just been ravaged by a typhoon - is a key source of dessicated coconut (which TrailBlazer Foods blends with water, adds sugar and salt and then bags), recent events have not caused significant supply issues for this holiday season, said Miller.

“We have been in this business long enough to know that typhoons are not unusual at this time of year and we had already got plenty of coconut in the US by the time this happened.”

We could grow 30, 40 or 50% at our current plant without major capital investment

As for production capacity, “We could grow 30, 40 or 50% at our current plant without major capital investment,” he said.

Asked about capex, he said: “Around 2006 we made an investment of several million in the plant and since then around a third of our free cash flow has been invested back into upgrading our operations and systems, especially on quality and safety. We’re also looking to acquire around 100,000 square feet of warehouse space - currently we lease space, but we want to own it.”

So is Trailblazer Foods ready for the Food Safety Modernization Act (FSMA)?

As the company adheres to GFSI (Global Food Safety Initiative) standards and is SQF certified, it has “not had to do a whole lot to prepare for FSMA because were already doing most of it anyway”, claimed Miller. “We’ve been working to HACCP-based food safety plans forever, and food safety is part of our culture.

“We’ve also done a lot of work on supplier assurance as GFSI requirements became more stringent so I feel good about where we are.”

US private label market

According to IRI, in nine macro categories, private label is priced an average 13% lower versus equivalent national brands in the US, with this gap narrowing by 0.2 points during the past year. The only category to see the price differential widen was confectionery.

Click here to download the IRI report on the private label market in the US and Europe.