New Year’s resolutions to eat at home could boost grocery sales, but industry faces challenges

“Although this industry experiences relatively consistent demand year around, major companies Kroger and Publix often report heightened revenue during and directly following the holiday season,” the market research firm says in a recently released report.

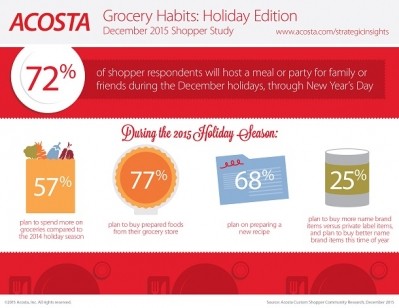

During the holidays, the boost likely comes from the purchase of more food to serve guests, and this heightened spending continues into the New Year because many consumers perceive cooking at home as a way to save money.

While grocery stores and supermarkets will start the year strong, revenue growth in the next five years will slow compared to the past five years as competition from limited assortment stores, club stores and supercenters increases, IBISWorld predicts.

Specifically, it says revenue for the supermarket and grocery store industry in the US will grow only 0.8% annually in the next five years from about $587.5 billion currently. This is down significantly from an annual growth of 1.2% from 2010-2015, IBISWorld notes.

Sources of slowdown

A major contributor to the revenue slowdown in the coming five years is the shift of bargain-hunting consumers to lower costing club stores, supercenters and limited assortment stores, the report suggests.

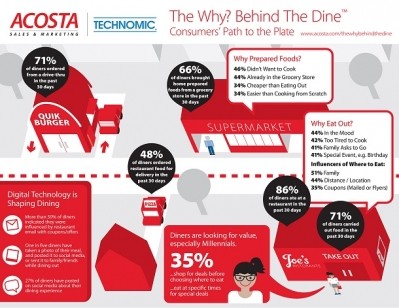

It explains consumers are drawn to warehouse club and supercenters, such as Costco and Walmart, because of the cost savings they can offer either through bulk purchase for consumers or by passing on savings to shoppers that they generate due to the scale of their operations.

“These stores also offer convenience, as they sell a variety of nonfood items, including clothing and furniture,” it adds.

Consumers are drawn to limited assortment stores, such as Trader Joe’s and Aldi, for different reasons. For example, unlike larger stores, limited stores offer cost savings for consumers by offering mostly private label products, which are less expensive for consumers and more profitable for retailers, the report notes.

“While private label brands often are perceived as inferior, stores like Trader Joe’s have positioned their store brands as premium products without premium price,” the report says.

This is extremely influential to millennials, who are less brand sensitive than earlier generations and, according to Mintel, 42% of whom find private label foods more innovative than branded products, IBISWorld says. In addition, 70% believe that the quality of store brand products has increased in recent years.

These stores also appeal to time-pressed shoppers because they are faster to navigate and the curated selection simplifies decision-making, the report notes.

Some larger grocery store chains are responding by creating smaller, limited format stores to more directly compete in this space. Namely, Whole Foods Market is opening smaller format stores targeted and millennials.

Profitability also is shrinking due to costs related to mergers and consolidation among grocery store chains and retailers, the report suggest. It explains that many grocery stores turned to acquisitions as a way to expand their footprint and sales when organic profit growth slowed.

Volatile commodity prices in the last five years also have dampened grocery store performance, according to IBISWorld, which suggest this will change in the coming five years when prices stabilize.

Growth drivers

While growth will be slower in the next five years there are several bright spots for retailers to look towards, IBISWorld predicts.

For example, it says Americans’ disposable income will continue to increase, allowing shoppers to buy more premium products, including natural and organic goods that have a higher profit margin.

Sales of organic and natural products “have grown tremendously in a stagnant industry, increasing 12% in 2013 alone,” IBISWorld says, citing data from IRI.

It adds, according to the Department of Agriculture, “premiums on organic fruits and vegetables can range from 30% to 100%.”

Grocery stores also likely will see a boost in revenue as more consumers more to urban areas, where foot traffic and frequency of shopping trips is higher, IBISWorld says.

Strategies for boosting profitability, sales

Grocery stores and supermarkets can further improve revenue by adding amenities to existing stores, rather than expanding the number of new stores, IBISWorld recommends.

The addition of home delivery, movie rental services, ATMs and dining areas with beer and wine bars, increase the perceived convenience of grocery stores – making them more appealing, the report says.

Other key success factors for grocery stores and supermarkets include access to the latest technology – such as self-checkout, payment through smart phones and automated warehouse equipment, the report adds.