US specialty food market surges 10.3% to $109.5bn in 2014; new buzzwords include grass-fed, fermented, pickled

To put this into perspective, growth in the overall food and beverage market was up less than 2% over the same period.

According to The State of the Specialty Food Industry 2015, which tracks US sales of specialty food through supermarkets, natural food stores, specialty food retailers, and foodservice venues (the figures include an estimated $19bn in retail sales of specialty foods from Trader Joe’s and Whole Foods Market, which don’t share data), almost 15% of all US food retail sales in 2014 were derived from specialty products, with some categories now dominated by specialty products such as refrigerated salsas & dips; energy bars & gels; and tea.

The fastest growing categories (dollar sales at retail) included refrigerated pasta (+78% between 2012 and 2014), eggs (+76%), refrigerated pasta/pizza sauces (+61%), shelf-stable functional beverages (+48.2%), nut and seed butters (+46.6%), energy bars and gels (+44.7%), refrigerated juices & functional beverages (+37.8%), other dairy and alternatives (+36.5%) and ready-to-drink tea and coffee (+30.9%).

Overall, retail unit sales of specialty food grew 13.6% over the two-year period 2012-2014, said Ron Tanner, VP philanthropy, government and industry relations at the Specialty Foods Association.

“People are looking for fresh products, so items in the refrigerated case are really growing very well in specialty.”

Local, sustainable, whole grains, humane, smoked, pickled, gluten-free, grass-fed, fermented…

He added:"The time is now for specialty food. Consumers are looking for new tastes, foods with fewer and cleaner ingredients, health attributes, and products that are made by companies with values they care about. All of these define specialty food."

While natural and specialty/gourmet food retailers are key channels for specialty foods, the vast majority (82%) of these foods are sold through mainstream retail channels, according to the Specialty Food Association. However natural was the fastest-growing channel. Many distributors, importers and brokers quizzed by the association also reported that online sales were one of their fastest-growing channels.

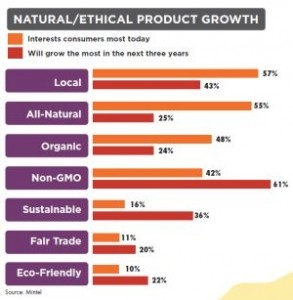

Brokers and manufacturers interviewed for the report said ‘local’ was the most important product claim, but predicted that non-GMO would be the top claim in three years’ time.

Specialty food retailers, meanwhile, said emerging trends included local, sustainable, whole grains, humane food production, smoked flavors, pickled everything, gluten-free, use of beets, kale, seaweed, coconut, grass-fed butter, fermented foods, and ancient grains.

‘Small food purveyors cannot afford the chargebacks, ads, demos, and promotions’

As for the frustrations experienced by players in the specialty food arena, the biggest gripes of importers, meanwhile, were the costs of getting brands to market in retail chains, with one respondent noting: “Small food purveyors cannot afford the chargebacks, the required ads, demos, and promotions, let alone the steep chargebacks imposed by distributors. It just homogenizes the available choices for the consumer.”

Another frustration was that some retailers seemed to expect specialty food manufacturers to “have the same amount of marketing funds as the mainstream brands”.

The Whole Foods GMO challenge

Manufacturers, by contrast, complained about the high cost of distributor networks, the GMO verification requirements of Whole Foods Market (which has said all foods in its stores made with GMOs must be labeled by 2018) and continuing litigation around food label claims.

Around 12% of their sales were from direct-to-consumer sales, meanwhile.

According to the Specialty Food Association: “Specialty foods are defined as foods or beverages of the highest grade, style, and/or quality in their respective categories. Their specialty nature derives from a combination of some or all of the following qualities: uniqueness, origin, processing method, design, limited supply, unusual application or use, extraordinary packaging, or channel of distribution/sales.”

For more details, click HERE.