Food brands missing the boat on digital couponing

E-commerce currently represents just 3.3% of grocery, though that market share is expected to jump to between 6.7% and 16.9% over the next decade, according to a study from Brick Meets Click. Indeed, Walmart is developing an omni-channel retail strategy incorporating online ordering and in-store and drive-through pickup; and e-commerce leader Amazon is piloting same-day grocery deliveries with AmazonFresh.

But the real digital promise in grocery so far has been in couponing, with redemptions on food products leading the way. In 2013, redemptions topped $66 million, a 141% increase, with 40% redeemed on food products. Browsing for coupons is the second most popular digital activity for grocery shoppers (55%) after reading online circulars (62%). Recent surveys from Google suggest that mobile shoppers spend upwards of 15 hours a week researching products or services on their smartphones and are 4.8 times more likely to convert in-store than on other phones. Moreover, once in store, 90% of smartphone shoppers use their device in the aisle to search for recipes (37%), look for coupons (24%) and research nutritional information (19%).

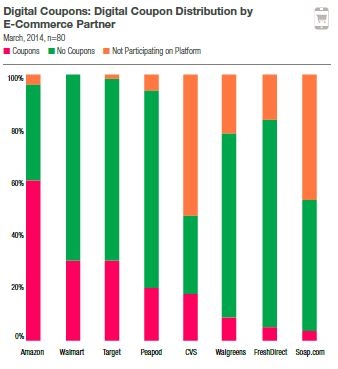

But L2’s Food Index review of 80 major food brands shows that most of them are missing the boat on digital coupons—both on their brand and enterprise sites and on e-retailer sites.

Although 36% of the brands have coupon sections on their websites, just 24% were offering coupons during the data collection period (January to April 2014), L2 found. Even as Amazon and Walmart ramp up their online grocery platforms, less than two out of three food brands distribute coupons on Amazon and only one out of three on Walmart. The numbers are even lower through online grocery leaders Peapod and FreshDirect, as the majority of brands still rely on the consumer to print coupons at home for in-store redemption.

Couponing in email promotions a missed opportunity

Kraft Foods and Kellogg Co. led in brand and enterprise site coupon availability, with 80% of their brands providing coupons on their sites. Two-thirds (63%) of General Mills’ brands offered digital coupons, while 29% of Nestle and 14% of Pepsico Inc. brands had digital coupons available. Notably, the Hershey Co., Unilever Group and Mars Inc. brands’ websites don’t include coupons at all.

Just nine of the brands in the index requested consumer data in exchange for coupon access. Indeed, while 74% of female shoppers say they obtain coupons from email promotions (according to Google Think Insights), just 5% of branded food emails highlighted coupons.

Of the centralized food enterprise hubs, only the three largest—Campbell’s Kitchen (1.2 million unique monthly viewers), ConAgra ReadySetEat (335,961) and General Mills Live Better America (371,948)—offer coupons, despite their notable unique monthly viewer numbers.

Given the relatively small audiences food brand and enterprise sites attract, online couponing’s future looks brighter in online grocery sites and coupon aggregators, according to L2. Ahold’s Peapod led the market in 2013 with 8.7% of total share and $550 million in revenues, followed by FreshDirect, with 5.8% share and $374 million in revenues. (Together, Amazon and Walmart don’t even reach 2% of market share.)

Brands most focused on Amazon for digital coupon distribution

Printed Peapod coupons can be presented at delivery or pickup, while FreshDirect coupons are directly integrated into the selection and checkout experience. Walmart has yet to integrate coupons into its online grocery strategy; coupons are only redeemable in store.

Most brands have concentrated digital couponing on Amazon, whose coupon strategy integrates coupons directly into the order process for redemption at checkout (and enables shoppers to brose for coupons by category). L2 found that 61% of brands offered coupons on Amazon during the data collection period, compared to 33% on Walmart and Target, 20% for Peapod and 5% for FreshDirect. Only nine (14%) of the brands distribute digital coupons with five or more e-commerce partners; a quarter don’t offer digital coupons on e-retailer sites at all.

Millennials present likely the biggest opportunity with digital coupons, as 92% have downloaded coupons onto a retailer loyalty card as a form of pre-shopping. Walgreens and CVS currently offer this service, but just 18% of brands tracked by L2 are pushing coupons to CVS, and just 9% to Walgreens.

Mobile coupon aggregators filling the gaps

Coupon-dedicated mobile aggregators—Shopkick, Coupon Queen, Cellfire and Grocery iQ—are filling the couponing void left by brands and e-commerce grocery retailers, as 17% of consumers say they use a mobile app to manage digital offers. Eighty-one percent of the brands in L2’s index have active offers on Coupon Queen, followed by 21% on Grocery iQ and 15% each on Cellfire and Grocery iQ.

For the 88% of food brands actively engaged in online display advertising, coupons were the most common call-to-action strategy, with 23% of the L2 index brands using them. A further 20% called on shoppers to “learn/read more”, 16% used a campaign or promotion as a call to action, and 16% used a “get the recipe” call to action. Six percent used no call to action at all. The calls to action used by less than 10% of brands included “buy now/add to list” (8%), social media (6%), “Spanish language content” (4%) and “watch now” (2%). On an enterprise level, General Mills, Nestle, Kraft and Hershey made significant use of coupons as a call to action strategy.