Analyst: ‘It may be too early to say Pepsi True is a flop, but it’s definitely not a success’

PepsiCo – which has not responded to our requests for comment on the distribution or performance of Pepsi True over the past 12 months - debuted stevia- and sugar-sweetened Pepsi True on Amazon in October 2014 before rolling it out to selected bricks & mortar retailers in Denver, Minneapolis and Washington, D.C. in January 2015.

Designed to help consumers “get back to the fun and refreshing side of cola", Pepsi True has 30% less sugar than regular Pepsi, and uses green packaging to communicate its more ‘natural’ positioning, flagging up that it has ‘no high fructose corn syrup’ and ‘no artificial sweeteners either’ in bold type on the back of the pack.

The mid-calorie cola – which contains carbonated water, sugar, caramel color, phosphoric acid, natural flavor, caffeine, and purified stevia leaf extract – is still available on Amazon in 10oz cans, and has a 4.5 out of 5 star rating from 59 reviewers, but is not widely available at retail, according to industry sources.

‘I don’t think people are paying any attention to it’

One beverage CEO told FoodNavigator-USA: “Both Pepsi True and Coca-Cola Life were kind of interesting offers in that they went to caloric no man’s land, which was in the middle, but you don’t even hear anyone or any retailers talk about Pepsi True now.”

A second beverage industry CEO added: "The most recent data I have seen (SPINS/IRI for Total US Food for the four weeks ending 3/20/16) appears to indicate that the line is exiting distribution. Dollar sales are down 95%+, and distribution went from 4% ACV to 0%."

One beverage industry analyst who asked not to be named, told us: “I don’t see it on shelf anywhere. It may be too early to say it’s a flop, but it’s definitely not a success. It’s not even on the radar [of equity analysts that cover PepsiCo] because it’s so insignificant, I don’t think people are paying any attention to it.”

While the product is still generating sales, said another, it was not making waves at retail, which might also explain why PepsiCo has not mentioned the product once in an earnings calls over the past 12 months.

“It doesn’t seem to be doing well…”

“We've broadened our beverage portfolio to lessen our reliance on colas, and today we have the leading non-carbonated beverage portfolio in the United States. In fact, globally, just 12% of our revenues come from trademark Pepsi and less than 25% comes from carbonated soft drinks on a global basis.”

Indra Nooyi, CEO, PepsiCo, Q1, 2016 earnings call

Coca-Cola Life not setting the world on fire

Coca-Cola, meanwhile, has also been tight-lipped about the performance of its sugar- and stevia-sweetened mid-calorie cola Coca-Cola Life, which rolled out nationally across the US in October 2014.

According to Bernstein data, sales peaked in spring 2015, when it achieved a value share of 0.14% of the carbonated flavored drinks market in the four weeks to March 21, but have been declining ever since, with its value share dropping to just 0.06% in the four weeks to December 26, 2015.

According to Nielsen data supplied by Wells Fargo, dollar sales of full-sugar carbonated soft drinks rose 2.1% in the year to Jan 23, 2016 driven in part by a shift in emphasis to smaller, higher-margin packaging formats.

However, dollar sales of diet/low calorie carbonates slumped 4.4% over the same period, with unit sales down 7.3%.

Tom Vierhile: Mid-calorie colas are like the Bermuda Triangle of carbonated soft drink marketing

Market researchers we spoke to earlier this year were not surprised by the apparently lukewarm reception for Coca-Cola Life and Pepsi True, however, with Tom Vierhile, innovation insights director at Canadean, telling FoodNavigator-USA that, “Mid-calorie colas are like the Bermuda Triangle of carbonated soft drink marketing: They don’t appeal strongly to any one group and launches seeking this elusive niche tend to disappear.”

He added: “Soft drink companies kept coming up with these products because they wanted the so-called “dual user” of full-calorie soft drinks and diet soft drinks. So they split the difference, creating a product that didn’t appeal strongly to full-calorie soft drink consumers or diet soft drink consumers. It didn’t work. And it doesn’t work.”

“The challenge with mid-calorie CSDs like Coca-Cola Life or Pepsi True is that they seek to attract a shopper that is looking for low sugar beverages with better for you ingredients, yet they still contain significant amounts of added sugars, as well as other ingredients that today’s consumer is trying to avoid, such as phosphoric acid and caramel color.

And so they have been unable to bring new users to the category, because consumers don't believe that these are ingredients are compatible with a 'better for you' product. Today’s shopper is looking for trusted ingredients, and Pepsi True and Coca-Cola Life just don’t deliver on this expectation."

Paddy Spence, CEO, Zevia

Howard Telford, senior analyst at Euromonitor International, said he too struggled to see their appeal: “Low-calorie cola has been one of the weakest performing categories in the US, and consumers are moving into waters and non-cola options.”

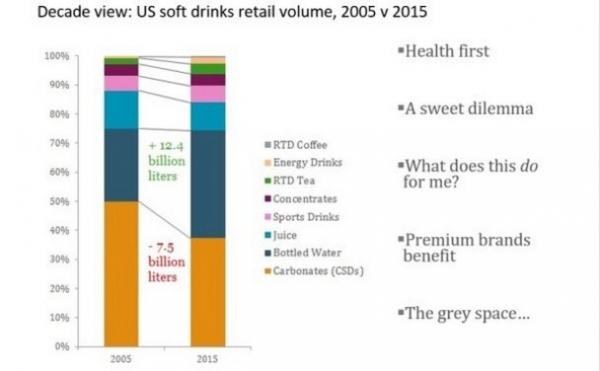

The above chart from Euromonitor International highlights just how much volume the carbonated soft drinks category has lost over the past 10 years, although juice has also lost ground. So what are consumers drinking instead? Bottled water (easily the biggest winner), energy drinks, ready-to-drink coffee and tea, and sports drinks, said senior beverages analyst Howard Telford during our Feb 2016 beverage innovation summit.

“Pundits are predicting that bottled water will be bigger than carbonated soft drinks quite soon. Regular, lower priced bottled water is growing at 5%, total premium is growing at 20%, and the higher alkaline sub category at almost 60%...quarter in and quarter out. That equates to 9% growth across the total category.

"This is good for the industry, the premium bottled water category, our higher alkaline sub category, and specifically for AQUAhydrate.”

Hal Kravitz, CEO, AQUAHydrate