'I wouldn’t say it’s out of the question that we could be a public company'

Zevia CEO: ‘One of the things that has been a key contributor to our success is our independence’

Perhaps not. Speaking to FoodNavigator-USA at the Natural Products Expo West show this week, CEO Paddy Spence did not seem eager to jump into bed with a larger rival: “Hats off to these brands [which have sold to large CPG firms in the past few months], but frankly one of the things that has been a key contributor to Zevia’s success is our independence.

“And I mean that both strategically in terms of being willing to do things and take risks that major companies wouldn’t, but also in terms of our relationship with consumers.”

He added: “One of the challenges all companies that are acquired by major CPG companies have is the risk of losing the soul of the brand, and it can happen very quickly. A lack of authenticity can be a real Achilles heel.

“We are the epitome of a transparent, authentic brand. We live and breathe Zevia and consumers recognize that. We have a couple of financial sponsors, but the management owns a significant portion of the business and high percentage of employees own equity in the company.”

I wouldn’t say it’s out of the question that we could be a public company

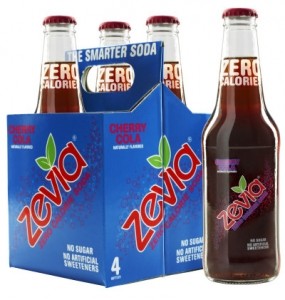

So if he’s in no hurry to sell up and move to the Hamptons, what’s the longer-term game plan when it comes to financing his ambition to turn Zevia (zero-calorie carbonated beverages sweetened with stevia, monk-fruit and erythritol) into a billion-dollar brand?

Said Spence: “I wouldn’t say it’s out of the question that we could be a public company. One thing the public markets value is scalability and within CPG Zevia is one of the best examples of a disruptive scalable brand in a $75bn category. We have radically differentiated, yet very familiar, products.”

The category is coming towards us

With the FDA proposing that manufacturers should list added sugar on the Nutrition Facts panel, more consumers reluctant to drink their calories, the Dietary Guidelines Advisory Committee urging consumers to restrict their consumption of sugar sweetened beverages, and added sugar increasingly replacing fat as public enemy #1 in the nutrition stakes, Zevia is beginning to look more relevant than ever, said Spence.

“As an entrepreneur you try and see trends before they become mainstream. We had a vision for this business and where we thought the consumer was going and it’s been quite amazing. The consumer is looking for a product with our attributes; the category is coming towards us.”

He added: “The Zevia brand is being viewed as a platform by our shoppers, whereas category leaders like Coke and Pepsi tend to market their flavors in silos. If you’re not in the trade you might not know that Fanta, Sprite and Coke Zero are all from the same company.

“But Zevia is all about a platform with the common theme of no zero calories and no artificial sweeteners although we’ve got a whole bunch of other compelling attributes as well. People don’t want preservatives such as sodium benzoate or potassium sorbate in their drinks either.”

“Look at Coke Life and Pepsi True, they use stevia, but they also use phosphoric acid and they are not natural products; they wouldn’t get into Whole Foods – you can go part way there, but that’s not enough.”

Zevia has all the characteristics of a billion dollar brand

Zevia does not disclose its revenues, but Spence says that the brand is still growing at almost 50% year-on-year in the conventional grocery channel, where it has an ACV (distribution) of almost 50%, and importantly for the health of the business, a lot of that growth is coming from strong same store sales (“velocity gains”) as well as distribution gains, he said.

“Look at craft beer. It has 10% of the category in conventional grocery now, and ‘craft’ soda has only 1% of the soda category. We could be the Sam Adams of soda.”

Zevia also has global ambitions, he said: “One of the things we see occurring in CPG is the pace at which ingredient concerns are going global. It took years before concerns about tobacco filtered through to developing markets whereas with carbonated soft drinks concerns have gone global at a far more aggressive rate. Who would have thought that Mexico would have had a soda tax before the United States?”

He added: “There’s no doubt Zevia has all the characteristics of a billion dollar brand. 14-year olds looking for a soda see Zevia as a formidable competitor to Coke and Pepsi whereas 60-year olds may not, but who is the consumer of the future?”

Tea, energy and sparkling water are also extremely ripe for our value proposition

As for the natural channel, he said: ‘Honestly we think this whole category could still grow to four to five times its size."

Asked about new products, he said: “We’re primarily focused on beverages, and we’ve just moved intro tonic water, as there were no naturally sweetened zero calorie products there. But categories such as tea, energy and sparkling water are also extremely ripe for our value proposition.”

For us, distribution is not a strategic problem, it’s a tactical issue

But don’t you need the might of a big CPG company behind you if you want to get serious distribution, both in the US and overseas?

“I’d say we manage very well,” said Spence. “But that’s largely because Zevia is a consumer-driven phenomenon. Our business with Amazon.com grew more than 50% year on year, which is pure organic demand for the brand.

“If your mindset is that distribution is the problem you’re trying to solve, you’ve lost already. For us, distribution is not a strategic problem, it’s a tactical issue.”

The single serve opportunity

So how is he addressing it?

Historically, Zevia has been focused on grocery shelves, where six packs and multi-packs are the key SKUs, he said. “But going forward one of our big opportunities is single serve. The consumer is familiar with Zevia from the grocery store and when she goes into the drugstore or convenience store she wants Zevia for immediate consumption.”

And that’s a very different proposition from going in from scratch as a new brand and trying to claw space in the chiller, he added. “That’s not a game we want to play. We’re an established brand going in from a position of strength.

“We’re entering our first convenience retailers this month, working with Anheuser Busch distributors. We’re one of the fastest growing non-alcoholic brands, so it’s a great fit.”