Hershey and Cargill team up on Ivorian cocoa program

Hershey and Cargill will train 10,000 Ivorian farmers across seven cooperatives on good agricultural practices to reach UTZ certification.

The partnership expands Hershey’s existing ‘Learn to Grow’ programs in Ghana and Nigeria.

Guarantees to pay premiums?

ConfectioneryNews' recent analysis showed that over half of cocoa grown to certification standards could be sold as conventional cocoa, meaning that farmers may be missing out on premium payments.

We asked Hershey if it had made a formal guarantee to purchase cocoa from the 10,000 Ivorian cocoa farmers at a premium when they achieve UTZ certification.

Jeff Beckman, director of corporate communications at Hershey, said that 18% of his firm’s cocoa supply was certified by the end of last year and it had committed to buying 100% certified by 2020.

“With several global chocolate companies, including Hershey, committing to using 100% third-party certified cocoa by the year 2020, the need and demand for certified cocoa will grow significantly over the next six years. This will require more farmers producing certified cocoa.”

Cocoa supply from certified sources or ‘sustainable’ sources

Certified

- Hershey - 18% certified in 2013 (scaling up to 100% by 2020)

- Mars - 30% certified in 2013 (scaling up to 100% by 2020)

- Ferrero – target was 20% certified in 2013, but no announcement made on progress (scaling up to 100% by 2020)

Sustainable

- Mondelēz – 10% ‘sustainable‘ in 2013 (no public target set to scale up)

- Nestlé – 20% covered by its own sustainability program (US went 100% sustainable in 2013, UK to use 100% sustainable by 2015, but no commitment to scale up elsewhere)

- Cargill – 15-20% covered by its own sustainability program in 2013 (no public target set to scale up)

- Barry Callebaut - 12% from ‘sustainable sources’ in 2013 (no public target set to scale up)

Hershey investment

Hershey and Cargill’s three-year program will also help the cooperatives build infrastructure such as cocoa warehouses and cocoa tree nurseries. The platform includes education support in schools to raise awareness of child labor in farming communities. Hershey and Cargill will also build extra classrooms, canteens and toilets in schools.

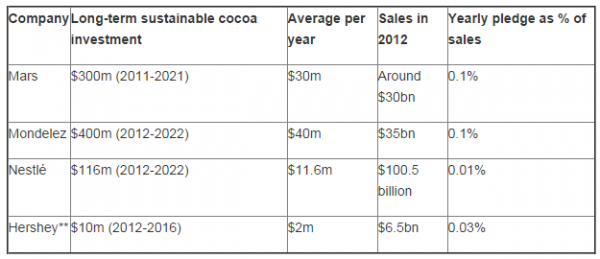

Hershey previously said that its long-term investment in cocoa sustainability, excluding the cost of certification, would be $10m from 2012 to 2016 - $2m a year. This represents less than 0.05% of the firm’s annual sales. But that’s much in line with other companies’ proportional commitments on cocoa sustainability.

Spending on cocoa sustainability 2012*

Beckman said the numbers were out of date and Hershey had committed more money since early 2012, however he didn’t put a figure on the additional investment.

He added Hershey was a founding member of the World Cocoa Foundation’s industry-wide initiative CocoaAction and the firm’s 21st Century Cocoa Sustainability Strategy now encompassed new projects in in Nigeria and the Ivory Coast, including building a primary school in Abokro, Gabiadji, Bas-Sassandra region of Ivory Coast.

Hershey and Cargill previously collaborated on CocoaLink, a program that sends mobile phone messages to farmers with tips on growing and labor practices.

*Excludes certification costs. Companies may have upped their commitment since 2012, but these are the latest figures made public."