New data reveals winners in the US snacks aisle: RTE popcorn, bean chips & dried meat snacks

The annual state of the industry report in the May issue of the SFA’s Snack World publication relies on multi-outlet (MULO) data from Chicago-based market researcher IRI.

MULO data covers retail sales through US supermarkets, drugstores, mass merchandisers, club stores, dollar stores (excl Dollar Tree), and military commissaries, but does not cover convenience stores or chains that don’t share data such as ALDI, Whole Foods and Trader Joe’s, so the figures below only provides a picture of conventional grocery channel sales.

- RTE popcorn: Dollar sales +24.1%; unit sales +13.5%

- Meat snacks: Dollar sales +16.3%; unit sales +10.8%

- Sunflower/pumpkin seeds: Dollar sales +5.5%; unit sales -0.1%

- Pork rinds: Dollar sales +5.4%; unit sales +0.5%

- Cheese snacks (extruded cheese puffs etc): Dollar sales +4.5%; unit sales +1.5%

- Potato chips: Dollar sales +3.6%; unit sales +3.6%

- Tortilla/Tostada chips: Dollar sales +3%; unit sales +3.9%

- Snack nuts: Dollar sales +2.7%; unit sales +0.8%

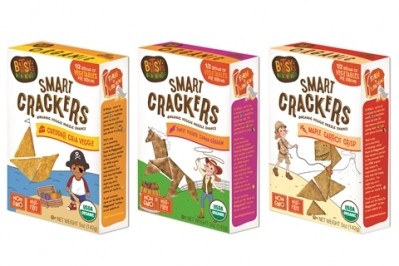

- Crackers: Dollar sales +0.4% (saltine -2.2%, with fillings -3.8%, Graham +4%); unit sales +0.6%

- Pretzels: Dollar sales -2.1%; unit sales -3.3%

Some top-performing brands in the IRI multi-outlet universe (dollar sales 52 wks to Feb 22, 2015) included:

RTE POPCORN:

- SkinnyPop (RTE popcorn): +141.3%

- Angie’s Boom Chicka Pop (RTE popcorn): +202.1%

- Smartfood (PepsiCo): +16.6%

PULSE-BASED SNACKS:

- Calbee Harvest Snaps (lentil and pea-based snacks): +115.2%

- Beanitos (bean-based chips): +50.6%

VeGGIE SNACKS:

- Sensible Portions veggie straws: +73.9%

- Terra (veggie chips, sweet potato chips): +23.7%

SPROUTED GRAIN SNACKS

- Way Better Snacks (sprouted grain snacks)+20.2%

SEEDS:

- Nature’s Harvest seeds: +25.4%

TORTILLA CHIPS:

- Garden of Eatin’ Blue Chips (blue corn tortilla chips): 47.2%

- Late July (organic tortilla chips): +17.8%

- Doritos (tortilla chips): +8.7%

- Xochiti (tortilla chips): +16.2%

- On the Border tortilla chips: +17.5%

MEAT SNACKS:

- Slim Jim (meat snacks): +18.3%

- Jack Link’s (meat snacks): +17.6%

- Baken-Ets (pork rinds): +16.8%

POTATO CHIPS:

- Ruffles (potato chips): +11.8%

- Cape Cod (kettle-cooked potato chips): +22.4%

CHEESE SNACKS:

- Cheetos (extruded cheese snacks from PepsiCo): +7.1%

- Baked Cheetos: +15.6%

- Cheetos Simply: +12.2%

NUTS:

- Hampton Farms (snack nuts)+24.2%

- Planter’s nuts: +7.5%

Brands that didn't perform so well over the 52 week period included:

- PopChips: -19.1%

- SunChips: -7.6%

- Cracker Jack RTE popcorn: -15.1%

- Cheetos Mix-Ups: -29.4%

- Imperial snack nuts: -23.3%

Find out where snacking entrepreneurs from KRAVE, Health Warrior, Fruigees and Barnana think the US healthy snacks market is heading by clicking on the link below:

Snacking Trends Forum highlights: ‘Packaged food doesn’t have to be junk food’