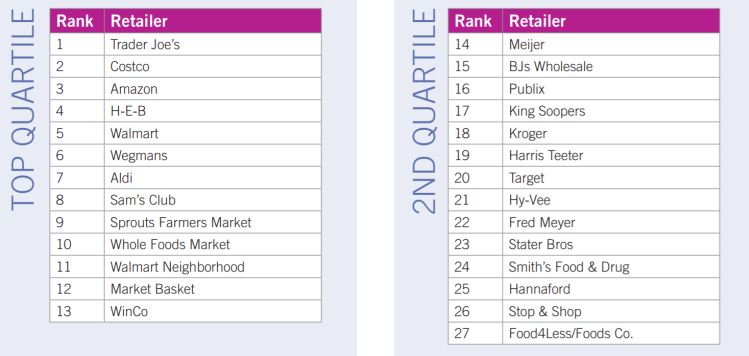

Quality and price propel Trader Joe’s to the top of dunnhumby’s retailer preference index

The RPI rankings, which are based on online survey data from 11,000 US households, coupled with financial performance data, validate what dunnhumby has been saying for years, that “the most customer-centric retailers perform the best financially,” global head of grocery David Ciancio told FoodNavigator-USA.

There are lots of reasons that consumers love Trader Joe’s, which generates industry-leading sales per square foot, he said, but the three key factors are probably its limited assortment and convenience (“customers find shopping there easy”); the element of surprise and delight (“you can always find something different and unusual”); and the consistently high quality.

And while Amazon’s acquisition of Whole Foods has prompted every major food retailer to re-examine its ecommerce strategy, Trader Joe’s success proves that “the best performing retailers are achieving high performance by excelling at the retail basics: right price, right products, and the right store experience,” he added.

Known for its offbeat atmosphere (staff wear Hawaiian shirts), Trader Joe’s stocks a unique combination of gourmet, natural/organic, and ethnic/multicultural foods at far lower prices than upscale specialty grocers and most natural foods stores, and has won by not trying to be everything to everybody, unlike many traditional supermarkets, said Ciancio.

Differentiate or die?

He added: “Many undifferentiated mainstream banners are delivering minimal value to their shoppers. Even though many have been shopped at for a longer period of time, they have the weakest emotional connection. They must focus on improving value perceptions and reconnect with their shoppers.”

One way to achieve this is to harness consumer data to develop more personalized promotional offers and locally relevant product assortments, he added. Others are to improve the private label assortment, and make shopping more fun and convenient by using technology enabling shoppers to scan items as they go and pay via cellphone apps, for example.

Another strategy for retailers occupying big box stores that no longer resonate with shoppers looking for a more convenient experience is turning a portion of the square footage into ‘dark stores’ [for fulfilment of online orders], or sub-letting space to third parties from coffee shops to QSR brands, he said, noting that some non-food retailers such as Kohl’s are in turn considering leasing space to food retail brands in order to bring in more traffic.

According to Packaged Facts, Trader Joe's draws 10.5% of U.S. adults as customers, compared with 6.3% for Whole Foods (defined by the number who shop there at least once a month). And while Kroger has experienced a 10-year compound annual growth rate of 0.2% in its customer base, at Trader Joe's, that figure is 5.9%.

With relatively small stores and a limited assortment, Trader Joe’s targets singles, couples, and small families with its comparatively small pack sizes, and attracts people across a wide demographic.

Trader Joe’s stores occupy about 8,000 to 15,000 square feet—about the size of a typical Walgreen’s. Most carry fewer than 4,000 items, about 80% of which are sold under its own store labels. Packaged Facts estimates the retailer’s sales at approximately $13bn for 2017.

"H-E-B is an outlier among the traditional regional supermarkets. It is the only traditional supermarket to score well above average on both price and quality...

"Albertsons scores among the worst in the study on the measure “sometimes they run out of items I buy regularly...

"Wegmans excels at product quality and store experience, including quality of natural/organic and their store brand. its overall price perception is below average, but perception of natural/organic prices are a little above average..."

Dunnhumby RPI index, January 2018

Partnerships

Ultimately, though, he said, retailers need to work more closely with suppliers and other partners to understand how consumers shop and organize their space accordingly. “You could reinvent the experience of shopping the health and beauty section, for example, the format, the flows, the adjacencies, based on our insights.”

Download the full report from dunnhumby HERE.