Betty Crocker, Goya, and Hershey’s are the leading US brands for social influence

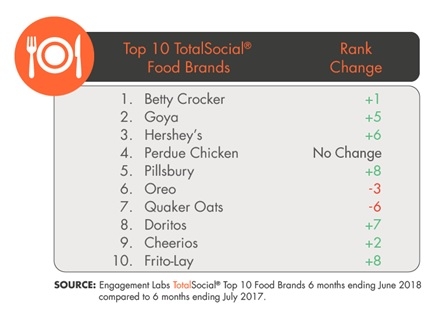

According to the latest TotalSocial ranking by Engagement Labs, Betty Crocker, Goya, and Hershey’s are the top three, with some big moves into the top ten for Pillsbury and Frito-Lay.

The ranking combines face-to-face (offline) offline and social media (online) consumer conversations*. The brands in the top ten (see table below) have earned the highest TotalSocial scores in the category for the last six months, compared to the Company’s previous ranking in September 2017.

“Our research has shown that consumer conversations drive approximately 19% of consumer purchases, or about $10 trillion in sales each year in the United States,” Brad Fay, Chief Commercial Officer of Engagement Labs, told FoodNavigator-USA. “About half of the impact comes from offline conversations, and half from online.

“We also find that online and offline conversations are not closely correlated to each other‡. They are really two separate conversations, but both matter.

“Brands can improve their business performance, and the return on marketing investments by adjusting their targets, channels, and messages to increase the likelihood that people will talk about and recommend them,” added Fay.

Goya rides the wave of online sentiment

Noteworthy movers in the top ten include Goya, which climbed five spots to number two due to an increase in online sentiment and offline influence. Engagement Labs linked this to the company’s Goya Gives initiative, which led to the donation of one million pounds of supplies to the people of Puerto Rico after the devastation of Hurricane Maria. This resonated positively with consumers.

The company also successfully engaged with bloggers to help generate buzz for meat-free recipes as part of its “Can Do” program with Meatless Monday, which donates food to Feeding America with every purchase.

Another big climber was Pillsbury, which moved from 13th spot in 2017 to fifth place this year. The company successfully engaged with consumers in February when they announced a winner for its "Pillsbury Bake-Off," an iconic baking competition that partnered with celebrity chef and Food Network star Ree Drummond after a four-year hiatus, said Engagement Labs.

Top spot on the ranking went to Betty Crocker, which rose one place from the previous rankings. However, the brand’s parent company, General Mills, did not fare as well, and dropped out of the top 10 entirely. This was due to a significant drop in offline influence as well as offline brand sharing, which measures the extent to which consumers are talking about a brand’s marketing campaigns in face-to-face conversations, explained Engagement Labs.

Helping brands better engage consumers

Ed Keller, CEO of Engagement Labs, says: “With so many competing food products available to shoppers today, it is imperative for brand marketers to understand what values resonate with consumers and are driving conversations. For most of the brands in our ranking, these conversations may serve as the determining factor as to whether or not their product lands into shopping carts.”

The rankings help companies to understand how consumers are talking about their brands, on- and offline.

“Our focus is on helping brands improve their performance and rankings,” said Fay. “We have a beverage client that was able to improve its conversation performance from fifth place to first over the course of four years by focusing on its websites to connect with brand advocates, and by using in-store marketing to achieve those improvements.

“We have also worked with a retail brand to identify deficiencies in its holiday season marketing strategy, with recommendations to be implemented during the coming season. All of these clients recognize that brands need to engage consumers in conversation to drive brand growth.”

Engagement Labs has also participated in several market mix modeling projects that have estimated the contribution of consumer conversations to sales, added Fay. “We have used weekly syndicated point-of-sale purchase data alongside media expenditures and conversation data,” he noted. “Our most recent study found that 19% of sales are attributable to these conversations. For beverage brands the figure is 22%, with offline conversations dominating, and for food/grocery brands it is 15%, with online conversations dominating.”

* Offline conversations are measured with an online consumer survey that collects conversation behavior data from the day prior to interview, explained Fay. The company interviews 36,000 respondents every year, and they are representative of the national population. Respondents start the survey with a memory exercise to remind them of prior day social contacts and conversations, then they report on categories and brands they talked about. The online data is collected by keywords mentioned on Twitter, public Facebook, Reddit, Instagram, blogs, forums, and consumer review sites.

‡ Journal of Advertising Research, 2017: "Why Online Word-of-Mouth Measures Cannot Predict Brand Outcomes Offline"

Authors: Brad Fay & Rick Larkin. DOI: 10.2501/JAR-2017-021