Takeout Kit bets big on shelf-stable gourmet meal kits: ‘We’re already profitable with a strong customer retention rate’

The brainchild of former financier Rachael Lake - who moved from New York to Orange County in 2015 and started using fresh meal kits but found that they didn’t fit with her lifestyle (“they added more stress to my life than they actually eliminated”) - Takeout Kit was launched in 2016, is available nationwide, and is already profitable.

The long shelf-life pantry kits, which are offered on a subscription or an a la carte basis, come with the option to add fresh ingredients, but contain all the components you need to make a complete meal, including proteins, explained Lake, who has not sought outside capital to date.

“We do offer the option on some kits for you to add your own protein, such as frozen shrimp or chicken, or an egg if you’re making Pad Thai, but we do have proteins included in the kits, many of which are vegetarian and include plant-based proteins [such as tofu].”

If you’re the 10th company offering a chicken and rice meal kit you turn yourself into a commodity and then you basically need to compete on price

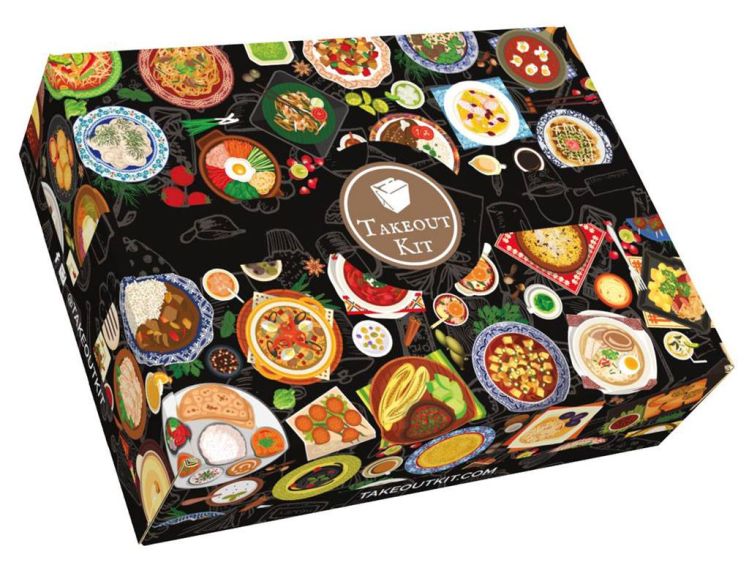

Made with “authentic ingredients you wouldn’t find at your local grocery store or know how to cook with such as tamarind paste, Peruvian yellow pepper paste and Sichuan peppercorns” the kits offer “restaurant-quality international food” delivered in colorful boxes that serve as great personal and corporate gifts (that you don’t need to cook right away), and are designed to “make learning about a new country's cuisine accessible and fun,” added Lake.

“I think the meal kit industry will survive, but you have to have a business model that’s sustainable. Our subscription is more of a convenience than something we need to do [to recover customer acquisition costs]; we’ve had better luck with the a la carte model especially on seasonal kits.

“If you’re the 10th company offering a chicken and rice meal kit you turn yourself into a commodity and then you basically need to compete on price. But we believe that our meal kits bring a deeper cultural experience to our home chefs. How much would you be willing to pay for an evening in Buenos Aires where you can make empanadas from scratch with a bottle of Malbec and a guitar playlist? It’s about experiences and creating a special occasion.”

According to new research from Magid, meal kit subscriptions have grown 67% over the past 12 months, although many of the subscribers are “triers/researchers (40%), who frequently try many subscriptions in the same category before fully committing,” it says.

“Surprisingly, men make up the majority of the meal kit subscription market (58%), compared to women, who make up 42%. This group is overwhelmingly young, as millennials make up 58% of the market, and skew on the lower side of income, as 55% of subscribers make less than $100,000/year.”

We attract customers that are a better fit in the first place

Rather than seeing Takeout Kit as competing with the likes of HelloFresh or Blue Apron, said Lake, “We think our market is the ~$300bn online grocery market.

“I think we’re one of the only meal kit companies that offers a reward program, so instead of rewarding new customers we reward existing customers. We offer a modest new customer discount code, but as we’re not offering huge discounts, I think we attract customers that are a better fit in the first place.

“We’re not spending huge sums of money on customer acquisition; we’ve found it’s been most effective to be where customers are looking for meal kits such as on the Amazon marketplace under the meal kit category, or on Walmart.com, so most of the time they’ll discover us there and then their second purchase will be direct from takeoutkit.com. We’ve also had success with sites such as Cratejoy.com where people are looking for unique gifts for the holidays and we've had 10x growth this year."

She added: “Meal kit companies should be managed more like CPGs or grocery stores than startups. Yes, you should always invest in the brand, product, and efficient marketing. But avoid high new customer acquisition costs, especially when you learn that they are not sustainable based on average CLV [customer lifetime value] data.”

Our best partners to-date have been suppliers that share our goal

The kits appeal to a wide range of consumers from students and new home chefs, to suburban and rural families and feature unique gourmet ingredients from artisanal suppliers that also serve as marketing partners, said Lake, who is looking at selling her kits in stores, and says the fact they are shelf-stable makes them potentially more appealing to retailers than some of the short-shelf life kits on the market.

“Our best partners to-date have been suppliers that share our goal; they are either international brands wanting to reach a new US market, or artisans with a passion for global flavors, including a 5th generation ghee maker, a company that grows teff grain in Idaho, and a sriracha entrepreneur that created a tastier preservative-free sauce. They provide inserts on our boxes to educate people and in exchange we get their products for a discount.”