What does Amazon Prime Day 2019 hold for grocery?

Now in its fifth year, Amazon Prime Day has become one of the most successful 'manufactured' holidays, with each year’s event grossing more sales than the last, said Profitero.

Last year, 63% of Prime members purchased more than 100 million products on Amazon Prime Day. This year, Profitero predicts a spike in sales with 76% of Prime members planning to shop on Prime Day this year.

Profitero surveyed 1,000 Prime members each in the US and UK in May 2019 to get insight into what type of purchases they will make this year.

‘Prime Day is a great time to introduce new products’

While electronics, apparel, and home goods are the top three types of products Prime shoppers are most likely to purchase, grocery items are moving up in the ranks.

“We predict grocery sales will be bigger this year than last, as almost 1 in 4 Prime members in the US (24%) and 1 in 5 in the UK (18%) shopping during Prime Day look to make a grocery purchase on Amazon. Expect Amazon to extend more Prime Day deals inside Whole Foods stores too like it did last year,” said Profitero.

Prime members said they are also more likely to try a product they wouldn’t normally buy on Prime Day.

“So, for food and beverage brands in particular, Prime Day is a great time to introduce new products — not only because of the extra awareness and traffic, but because it’s a great way to ramp up trial, and ultimately increase your number of reviews, which are heavily weighted in Amazon’s search algorithm.”

Small brands to shine on Prime Day

Profitero predicts that emerging brands are likely to see significant sales lifts next week as they did last year – according to Amazon, small and medium-sized businesses worldwide exceeded $1bn in sales during Prime Day 2018.

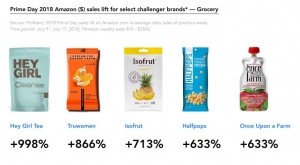

According to Amazon weekly sales data, 'challenger brands' in the grocery category saw sales increases up to 9X during last year’s Prime Day (sales from July 9 through July 17, 2018).

“This is a clear indication that smaller brands can, and frequently do outperform on Amazon — and not just on Prime Day,” said Profitero.

This year, Profitero expects even more sales success for small, emerging brands.

A few examples of “challenger brands” from last year’s Amazon Prime Day results that saw high triple digit sales increases during Prime shopping days:

Finding the right promotional strategy

Since Prime shoppers are usually looking for the hottest deals during Amazon Prime Day, many brands offer big discounts on their products such as 40% to 50% price reductions. However, Profitero said the brands don’t necessarily need to break the bank to see increased sales.

Out of stock = the kiss of death for brands?

It’s crucial for brands to do inventory planning to ensure product availability not just prior to Prime Day but all year round.

About half of Prime members (55% US, 46% UK) surveyed by Profitero agree they usually make an unplanned purchase on Prime Day, therefore, brands should anticipate some unexpected demand spikes.

“It’s smart to get your stock levels in order now, or plan an inventory backstop, because out of stock means out of luck for both shoppers and brands.”

According to Profitero, infant formula brand Similac lost out on $20,000 worth of sales due to out of stocks during the three days around Amazon Prime Day last year.

“Sure, big discounts, such as 40%- 50%, can provide huge rewards, but our analysis from Prime Day 2018 shows that even brands that offer a modest discount, e.g., up to 20%, can get a 2X sales lift,” said the firm.

While many brands’ promotions may be locked in at this point with less than three days until Prime Day, Profitero suggests using Prime Day 2019 as a learning opportunity to improve promotional strategies for next year.