Value, nostalgia, indulgence… and plant-based? Food & bev cos tell Mattson how COVID-19 might impact innovation plans

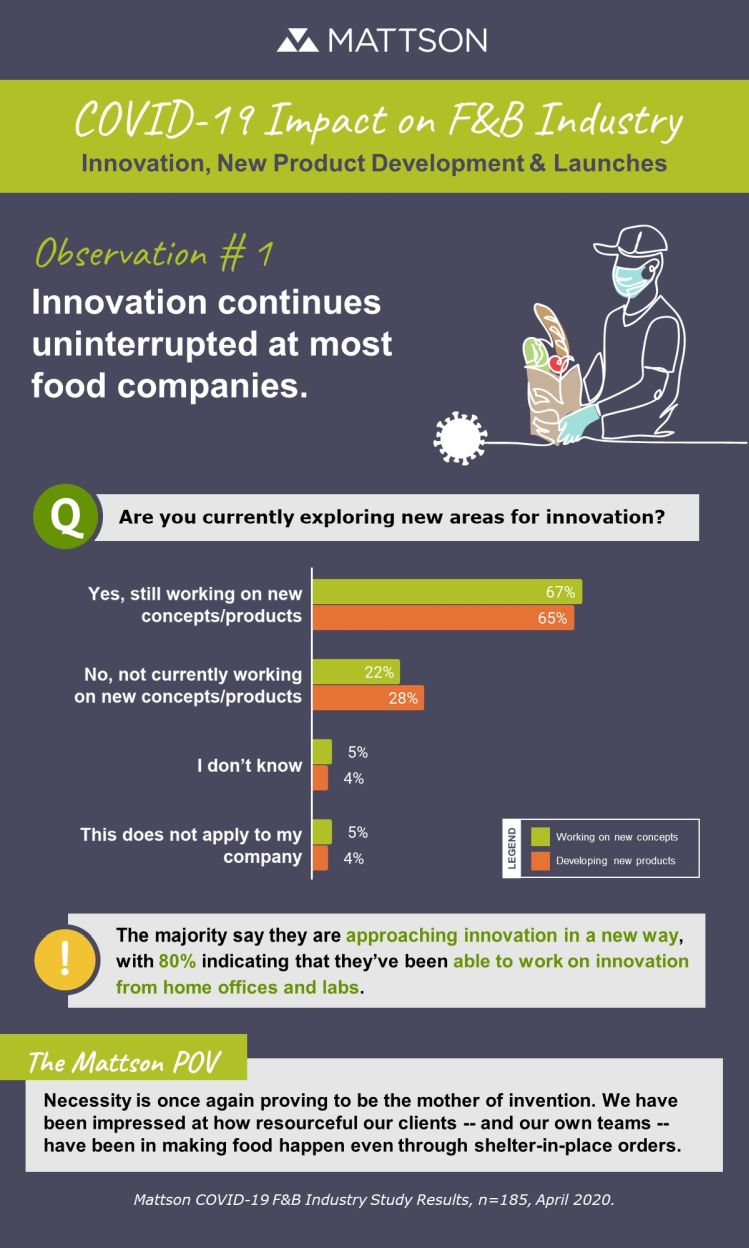

While a lot of firms have been pumping out consumer research in recent weeks, Mattson was keen to understand how industry professionals are navigating this crisis, said the Foster City, CA-based firm, which surveyed 185 industry stakeholders between April 8-19: “As an innovation agency, we were curious to learn about attitudes and perspectives from leaders inside the industry.

“In particular, how they think COVID-19 might impact the future of food innovation, development, launch, and success with retail customers and consumers.”

Post-COVID-19, retailers 'will face an important strategic decision to lead with innovation or to lean into the familiar'

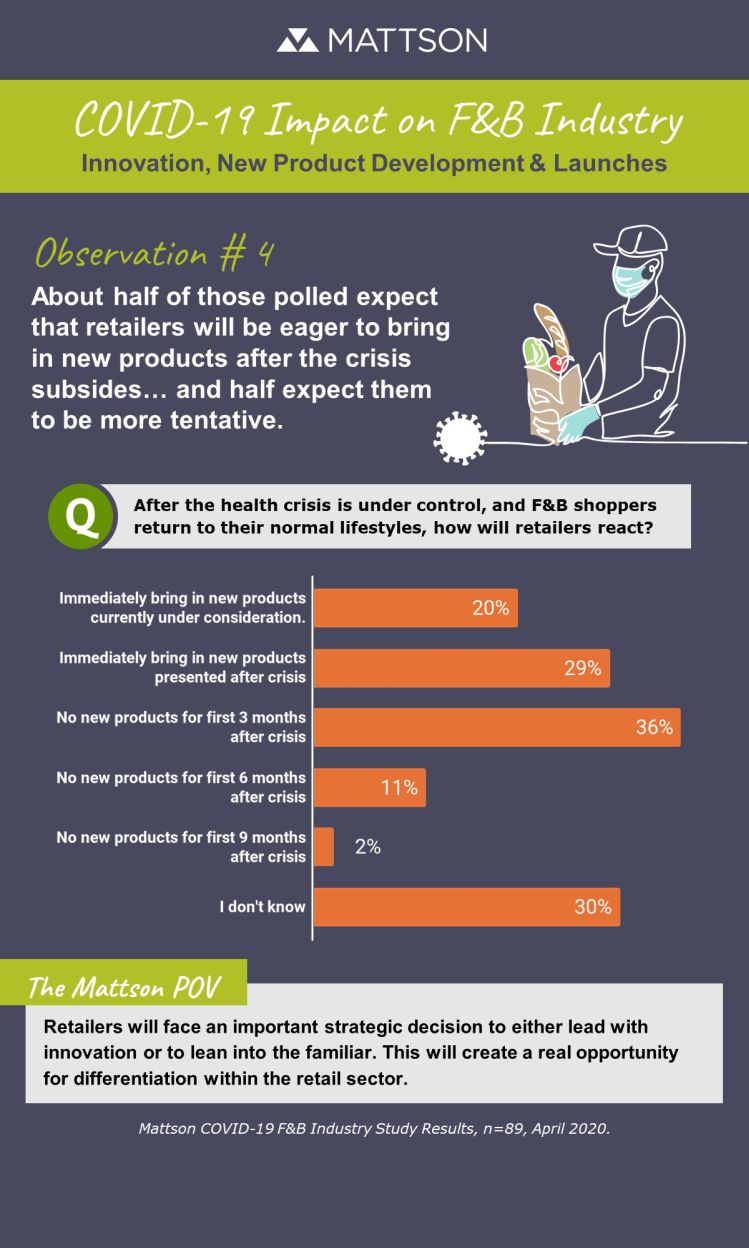

Not surprisingly, the majority (84%) of respondents said presenting new products to retailers has been more challenging, with views on how receptive retailers might be to new products in the coming months decidedly mixed.

Around half (49%) expected retailers to “immediately bring in new products… after the crisis subsides”, but 36% believed retailers would bring in no new products for three months and 11% believed retailers would wait six months before accepting new innovations, said Mattson.

“Retailers will face an important strategic decision to either lead with innovation or to lean into the familiar. This will create a real opportunity for differentiation within the retail sector.”

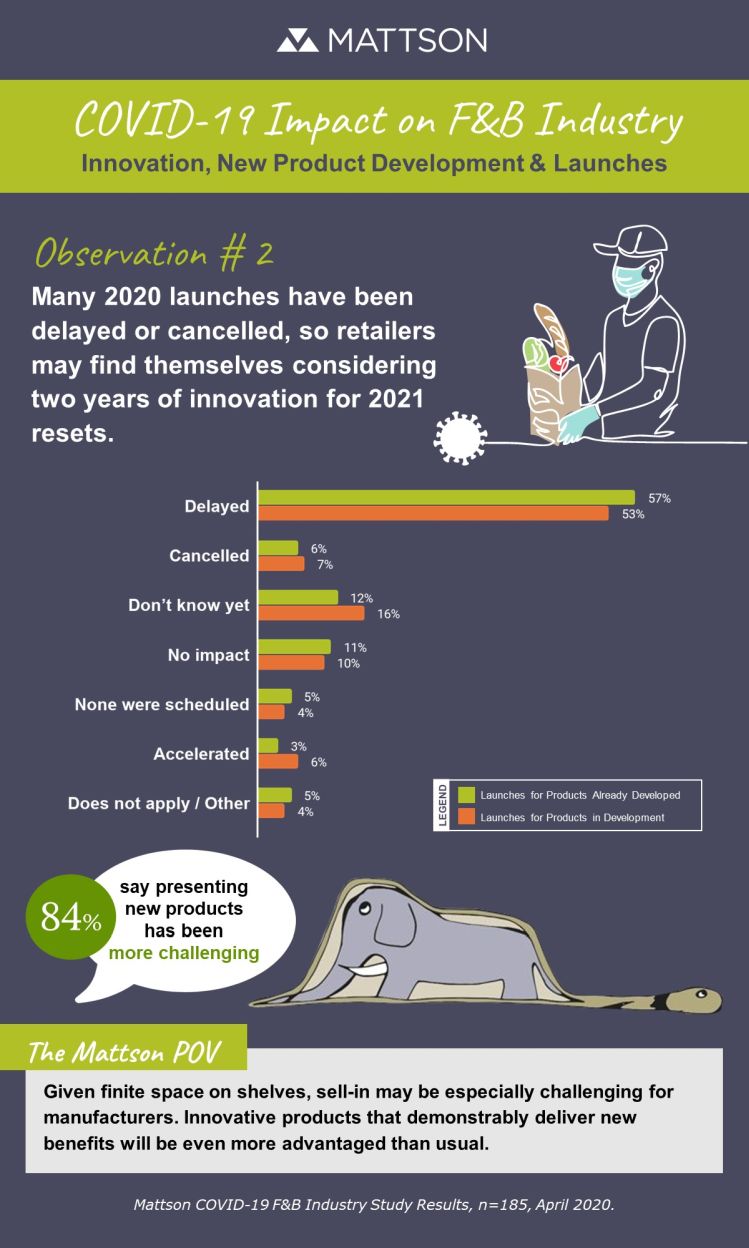

Flavor extensions deprioritized in favor of bigger ideas?

Mattson, however, believes that "retailers’ appetite for new products will be strong," coming out of this, Al Banisch, EVP new product strategy and insights, told FoodNavigator-USA.

"Many category resets were cancelled in 2020. As such, there will be a backlog of two years of innovation to consider in 2021, giving retailers lots of exciting new ideas from which to choose.

"While some retailers might today feel that a gradual flow of innovation is in order given consumers’ desire for familiarity and comfort, they will also need to protect their share. Our research suggests that consumers will want new products, and retailers who are slow to respond may regret not being more assertive."

He added: "On the manufacturer side, however, we do expect that some will deprioritize new products that might not have brought quite as much news -- flavor extensions for example -- in favor of the bigger ideas they’ve been working on."

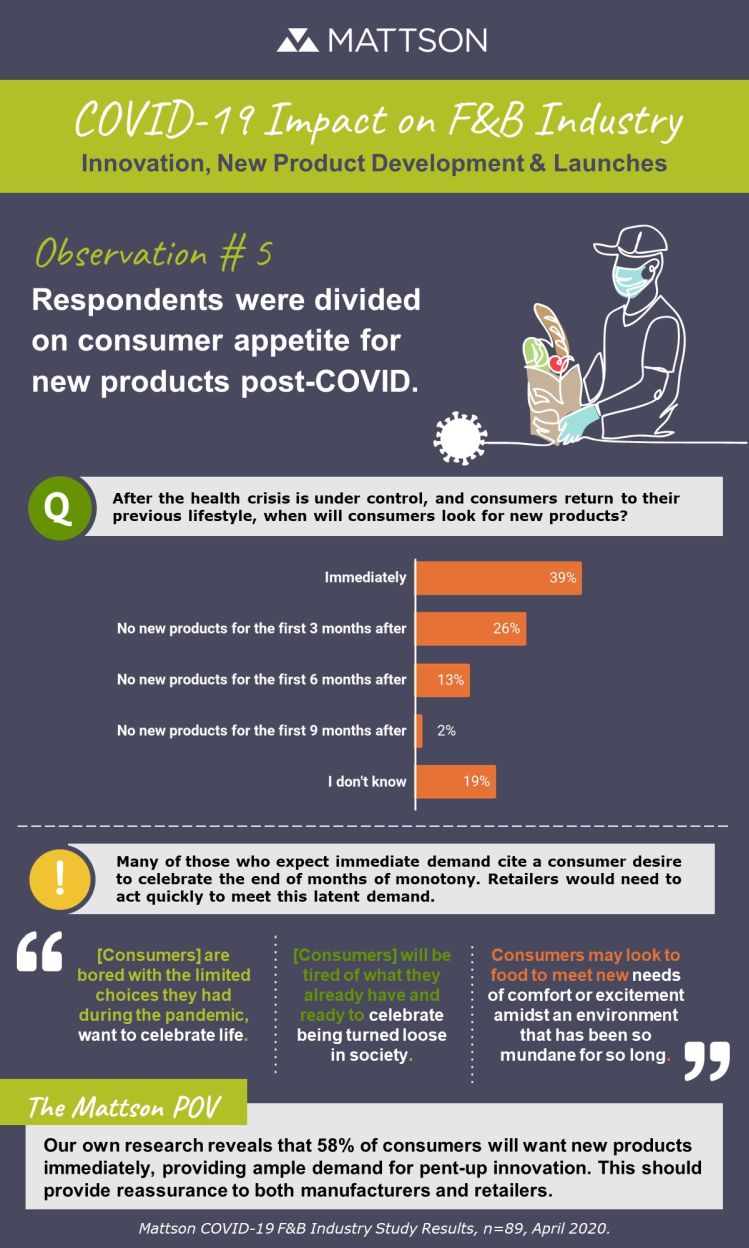

As for consumers, some respondents predicted a pent-up demand for new products to “celebrate the end of months of monotony” (although the need for social distancing and enhanced safety measures have made the shopping environment in physical stores at least far from ideal for product discovery/browsing).

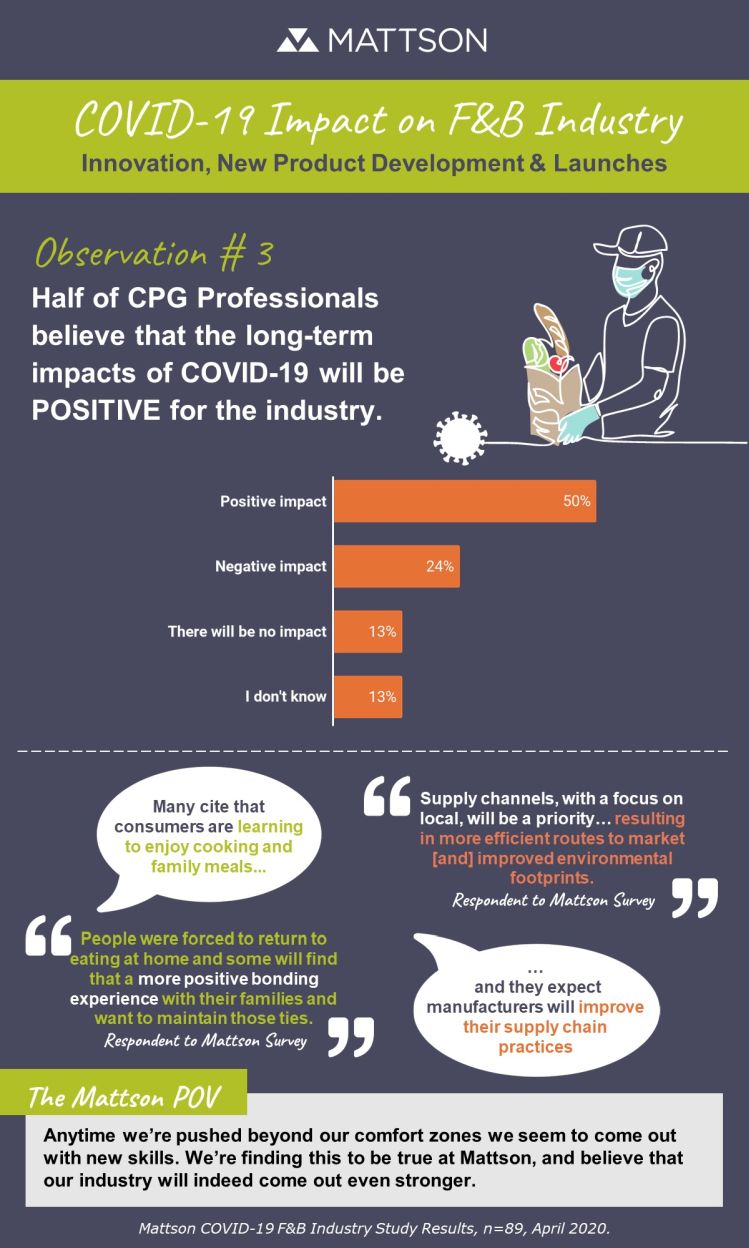

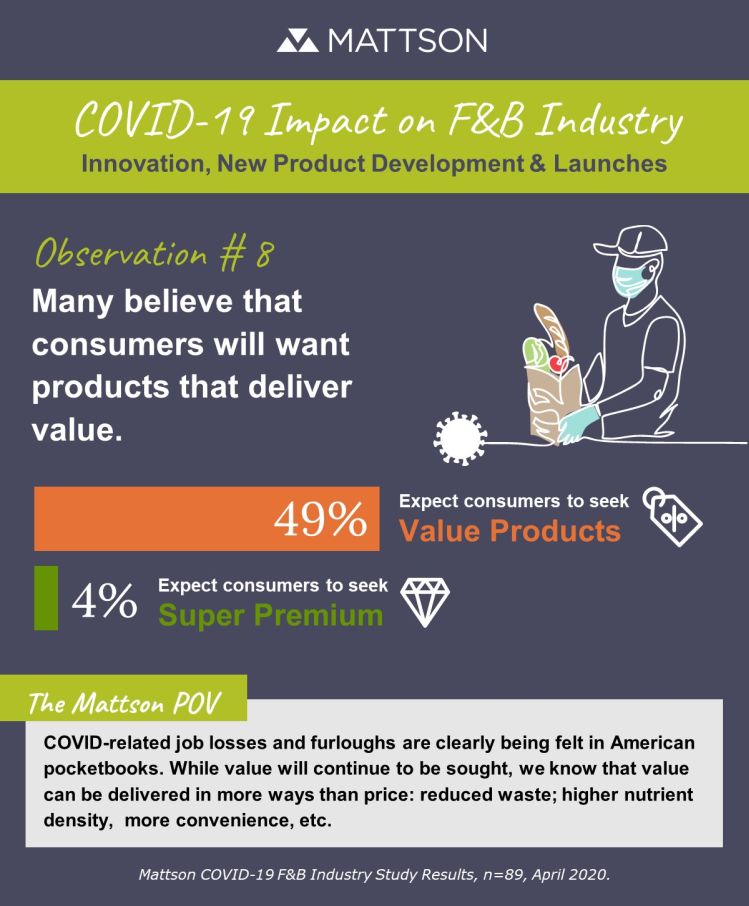

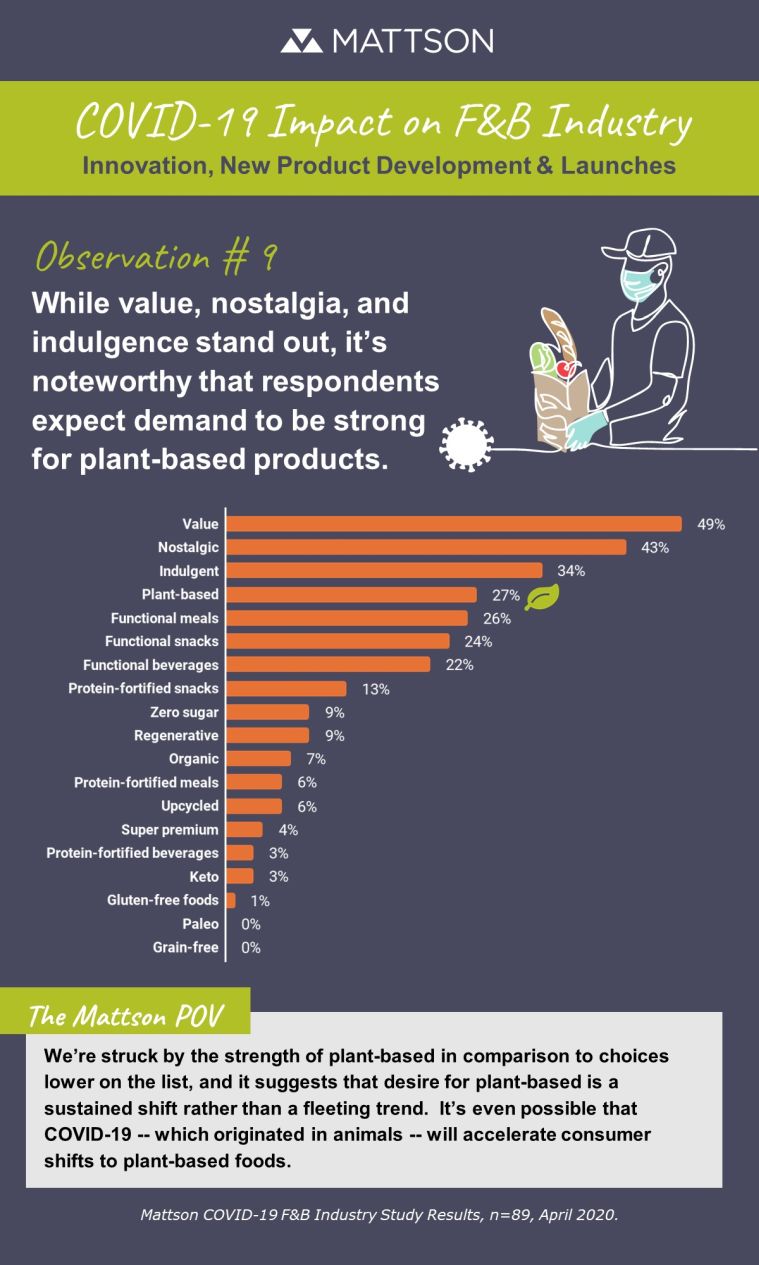

'We’re struck by the strength of plant-based in comparison to choices lower on the list'

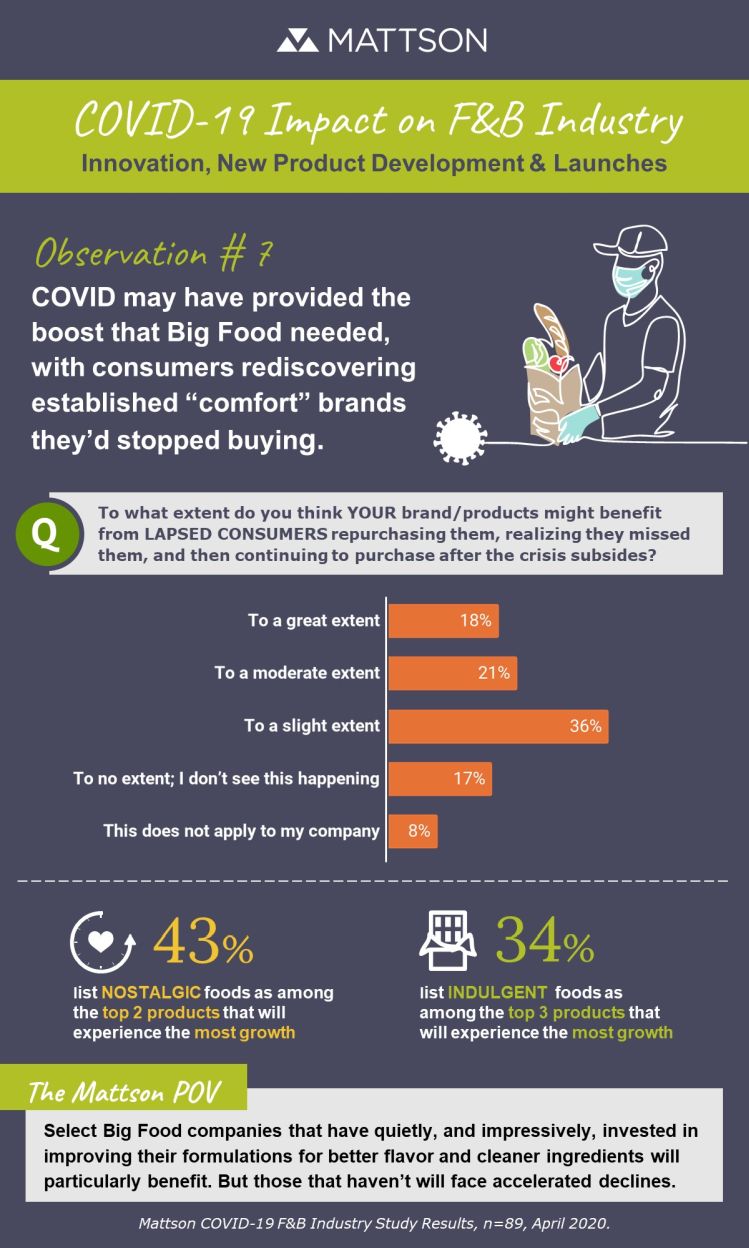

Not surprisingly, when it comes to consumer priorities in the coming months, respondents predicted that ‘value’ would be top of the list, followed by nostalgia and indulgence. However, plant-based was #4 on the list, well above organic, zero-sugar and keto, said Banisch.

"Demand for plant-based foods is in fact not a trend like keto or paleo, but a mindset shift. It reflects broad interest -- albeit at different levels of commitment -- to eating more plant-based foods and beverages. Consumers cite different reasons for doing so, but whether their reasons include sustainability, animal welfare, perceived healthfulness, or just 'feeling better,' it’s something that has continued even as we stock up on the comfort foods from our pasts.

"The nice thing about the shift to flexitarianism is that it doesn’t require sacrifice -- something none of us likes. It doesn’t have hard and fast rules about what one can eat when. Some people choose to replace meat once each couple of weeks; others change their diets more dramatically. Plus, given the huge strides that manufacturers have made in making plant-based foods taste great, the experience of eating plant-based foods also brings far less sacrifice than ever."

Shot in the arm for legacy brands?

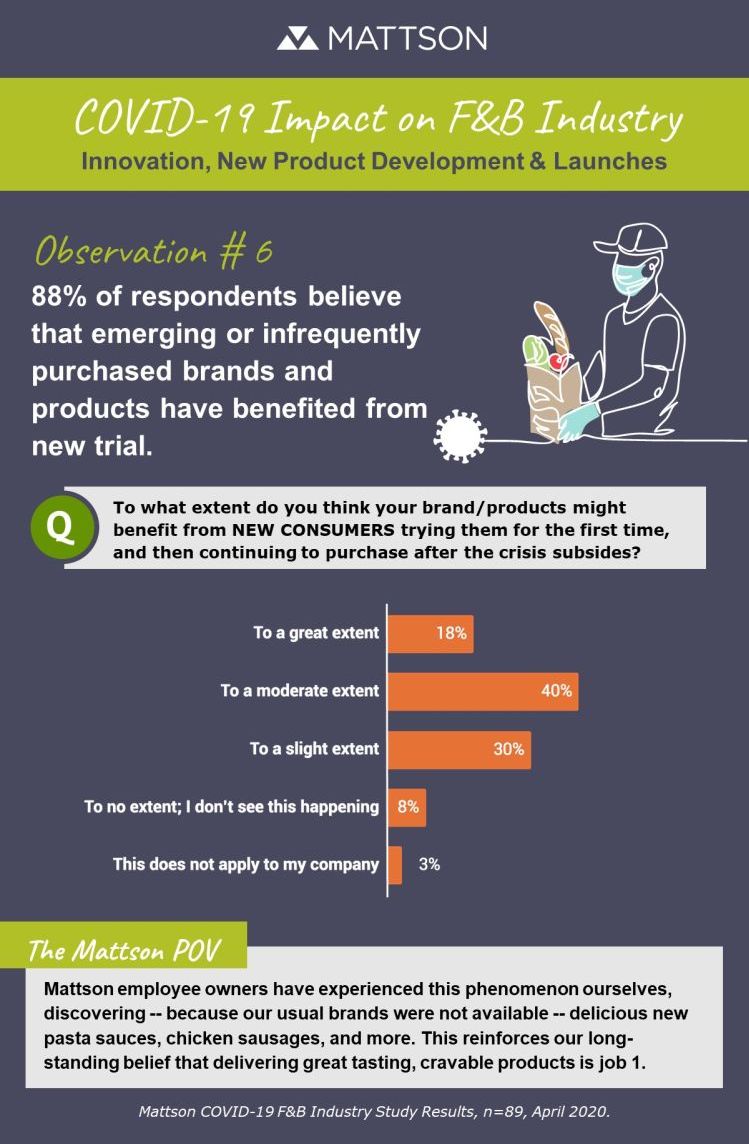

As for trying different products and brands, a large majority (88%) of respondents believed emerging or infrequently purchased brands and products have benefited from new trial as shoppers unable to find their regular brand/product have tried something new, although it’s hard to know at this stage whether these brands will retain these new customers.

It's also too early to say if Big Food’s recent resurgence will last longer than the lockdown, but some legacy brands could benefit from work they’ve put in recently to upgrade/reformulate their wares as new consumers discover them for the first time, and lapsed shoppers give them a second try, added Mattson, noting that 75% of respondents agreed with this sentiment to some extent.

“Select Big Food companies that have quietly, and impressively, invested in improving their formulations for better flavor and cleaner ingredients will particularly benefit. But those that haven’t will face accelerated declines."

Banisch added: "Manufacturers who have invested in improving their core product lines will experience long-term benefit. Whether consumers 're-tried' these legacy brands during COVID because they sought comfort or because they were more affordable, we expect that many may have been pleasantly surprised... and thus are quite likely to purchase them again."

Packaged food industry will emerge from crisis even stronger

While this is going to be a very challenging year for startups and emerging brands, some respondents predicted brands that survive this crisis will emerge stronger, with "improved supply chain, logistical, and distribution practices" and "shored up systems and processes.”

As for consumers, the trend of cooking more at home could continue even as restaurants open up again, due to tightened budgets, lingering anxiety about taking unnecessary risks, or because they have learned new recipes or skills and bonded with families during this enforced period of lockdown, said Banisch.

"We know that consumers have been forced to try new things at home. Like cooking! And we believe that many will come to realize that home-cooked foods do more than nourish the body. While being cooped-up for weeks has been difficult, the social benefits of engaging with family members to make and enjoy foods is something many of us will want to continue -- probably more frequently than pre-COVID."

"Our belief that there will be strong consumer demand for new products isn’t just glass-half-full optimism; it is directly informed by consumer feedback. In addition to our industry insider survey, we also queried Mattson’s national consumer panel. 58% of consumers said that they would look for new products immediately after the health crisis ended.

"Naturally a lot depends on how long we’re wearing masks and lining up to get into stores. As long as walking through the grocery store feels dangerous or uncomfortable, our tendency will be to get in and get out -- not to browse for what’s new. So certainly there may be increased online discovery.

"That said, right now it seems like a lot of 'discovery' is happening in kitchens with foods and ingredients that have been around for years. As such, consumers' appetite for new products will not just be about relieving pent up demand, but also about celebrating the end of COVID-19."

Al Banisch, EVP, new product strategy and insights, Mattson

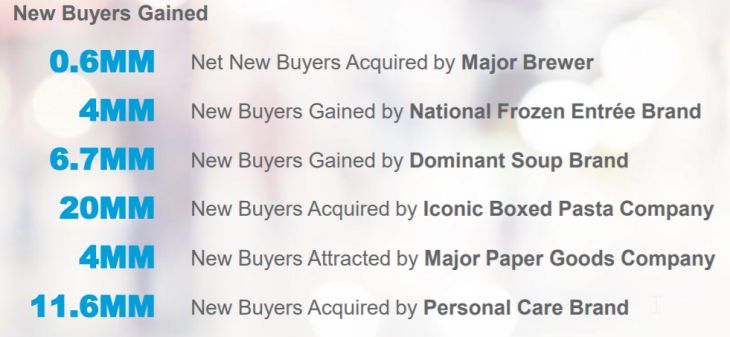

According to IRI, "brands across categories have acquired new and reacquired lapsed buyers in the past few weeks," adding: "As consumers go back to iconic brands in stay-at-home phase, marketers must determine the best way to retain these buyers for the long haul."

For big CPG brands, the long-term value of retaining even a fraction of new consumers gained during the lockdown could amount to hundreds of millions of dollars of revenue per year, it adds.

*Based on IRI benchmarks, reaching new buyers through advertising within 4 weeks of their initial purchase results in an average of 12.6% of those trial buyers becoming repeaters Source: IRI Loyalty database, IRI Consumer Panel. 12 weeks ending April 12, 2020

“People are stocking up and they’re stocking up with foods of all kinds, across all temperature states including categories like frozen, so just logically we know we are getting higher levels of trial here during this phenomenon.

“In the world of e-commerce, what we are seeing is that we are reaching a large number of new triers that we had not reached previously.

“When you get new triers like this, you tend to be getting lighter users. But the point of all of this is it should help categories like frozen, it should help some of our other categories that people may have forgotten about, but it’s just too early to quantify the impact of that.”

Sean Connolly, CEO, Conagra Brands

“We are taking this opportunity to reshape our innovation pipeline to eliminate a longer tail of smaller projects and allocate resources to fewer, larger, more scalable, and more relevant solutions for this environment.

"Will more choice, more innovation come back when [the] new normal and economy reestablishes itself? Yes, I'm sure it will. But in this period it's going to be a question of focus."

James Quincey, CEO, Coca-Cola

"It's been an opportunity to trim back significantly the long tail, which, as we've highlighted in previous calls, that tail is typically comprised of some of the more – the younger explorer and challenger brands, which by nature are lower margin."

John Murphy, CFO, Coca-Cola

See Matton's full survey results below: