Will online shopping be the norm post-coronavirus? Not entirely, say Brick Meets Click and Symphony Retail AI

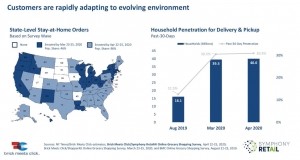

"As of August 2019, we had a household penetration rate of 12.5% for those households that had used either home delivery or store pickup within the last 30 days, accounting for 16.1 million households.

"As we then fast forward to March [2020] -- 19 states at that point were under some state-level stay at home order -- what we see is penetration jumped to over 30.5%, representing almost 40 million households," said David Bishop, partner at Brick Meets Click, said in a webinar held earlier this week.

"What you’re seeing is a doubling of penetration within a course of 30 days essentially."

Looking to April at the point when 96% of the US population was under some sort of stay-at-home order, online grocery penetration remained almost the same, increasingly only slightly (0.05%).

"Why did penetration not grow that much? [Because] Customers responded extremely rapidly to this effect, and whether they lived in a state that had a stay-at-home order or not in March, the majority of households adjusted their behavior within the first two weeks," Bishop explained.

"What we can draw from this is that because behavior rapidly changed because of the COVID crisis and everything that’s ensued, it’s fair to assume that we can expect some relatively rapid adjustments as we move through the next phases of COVID."

Fear, a powerful motivator

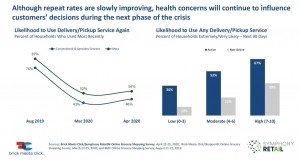

According to Bishop, as concerns around the coronavirus decrease subside, especially individual fears of catching the virus, a gradual return to in-store shopping will follow.

"We recognize that fear is an extremely powerful motivator. Fear motivates us more importantly in what we don’t do," said Bishop. And in this case, fear of catching coronavirus motivated consumers to stay home, shop online, and avoid stores.

Brick Meets Click data showed that of the 47% of US households that were highly concerned about catching the virus, 38% opted for online grocery delivery or pickup services (see chart below).

"What happens when concerns about catching coronavirus decrease? As people become less concerned about catching the coronavirus, they’re going to become less motivated to shop in certain ways, namely online," said Bishop.

"The evidence is clearly showing that as the concerns mitigate, what we’re going to see is some return of behavior back to in-store or changes within how they shop online between delivery and pickup."

When looking at the next 90 days, however, many consumers will stick with online shopping services (see chart below).

Understanding 'true demand' during a crisis

Out-of-stocks, brands reporting record sales, and retailers struggling to keep in-demand products on shelves seem to all be indicators that demand has been through the roof over the past two months or so.

"As we know, demand exceeded sales," said Kevin Sterneckert, chief marketing officer at Symphony RetailAI, a company which uses AI and machine learning to analyze sales data at the transaction level across 8,000 retail locations.

However, he said, "The challenge the retail industry has is that it was using a calculation of sales as a surrogate for demand. In this case, as in every case, sales and demand are not the same thing. And when you have demand that exceeds your forecast or quantities, you will have outages."

Products that are out-of-stock and empty store shelves create the illusion of increased demand, according to Sterneckert, because consumers can't purchase what they came to the store for. But once inventory returns, demand settles down, he added.

"It’s when they do not believe that it will not be available that demand is at a dramatic rate compared to the normal trends of demand," he said.

"If replenishment and forecasting systems would’ve been able to understand true demand and supplies would’ve met the demand on day two and day three, not just what was sold in first two hours, likely the runs on toilet paper and other categories within the stores would’ve been muted dramatically."

For example, if you have a thousand units of an item and you sell out within the first two hours, the system doesn’t know what you could’ve sold throughout the rest of the day (i.e. true demand), explained Sterneckert.

Fundamental shift in consumer behavior

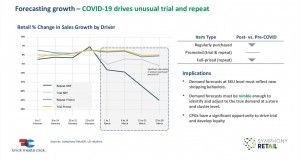

"The behaviors before COVID will not be the same behaviors as we emerge fully from COVID. Our data is showing that regardless of being in Europe or here in the US, that the customer has fundamentally changed, and that there are new behaviors."

According to Sterneckert, shoppers' brand preferences and willingness to try new products is one of most drastic shifts in behavior.

"We saw an amazing change of how shoppers were shopping within the stores. We saw increases in trial. We saw that repeat purchases were dramatically down," he said.

"Most interestingly, is that the customer has been forced to try new things, and in many cases the customers liked what they tried."

"This gives CPGs, that were maybe second or third tier brands in the past, the opportunity to become more valued by customers. I think this represents a great season ahead for everyone."