Walmart leads in online grocery during coronavirus, but will it last post-pandemic?

The report’s findings were based on an online survey conducted from April 22 to April 24, 2020 of 1,500 US grocery shoppers who purchase groceries at least once a week.

Growth has not only been rapid, but broad, as online grocery shopping usage has exploded at similar rates among male and female consumers from all age groups and locations.

While the survey didn’t reveal any major differences of online shopping habits between males and females and found growth to be consistent throughout all US regions, there were significant differences among generations.

Tech-savvy Gen Z leads the way in reported online grocery shopping with 32% of the generation buying groceries online in the past month. A quarter of millennials and 23% of Gen Xers reported the same. Over one in five (21%) Baby Boomers have also bought online groceries.

Preferred online retailers

According to Escalent, the clear frontrunner of online grocery during the pandemic has been Walmart with 47% of online grocery shoppers having purchased from the world’s largest grocer in the past two months.

“This lines up with other recent data that show Walmart is winning more than half of new shoppers who are placing an online grocery order for the first time. Walmart, therefore, doesn’t just have a dominant market share—it is also increasing its share at a rate faster than any of its competitors,” noted Escalent in the report.

Local grocery chains (e.g. Kroger, Safeway, and Publix) and their third-party such as Instacart or independent services accounted for 34% of online shoppers.

Amazon, which accounts for 54% of all online sales in the US, lags behind in online groceries despite offering grocery delivery through multiple channels including Prime Now, Amazon Fresh and Prime Pantry, with a base of 75 million Prime customers in the US.

One in five online grocery shoppers have used Amazon in the past couple of months with 14% of new online grocery shoppers choosing Amazon.

“Given Walmart’s strength, followed by that of local grocery brands, it is clear that when it comes to online grocery orders, consumers’ first instincts are to turn to the nearby brick-and-mortar brands that they normally visit each week. Given that 90% of Americans live within 10 miles of one of Walmart’s more than 11,000 stores, Walmart has a massive advantage in this regard,” noted Escalent.

Consumer satisfaction

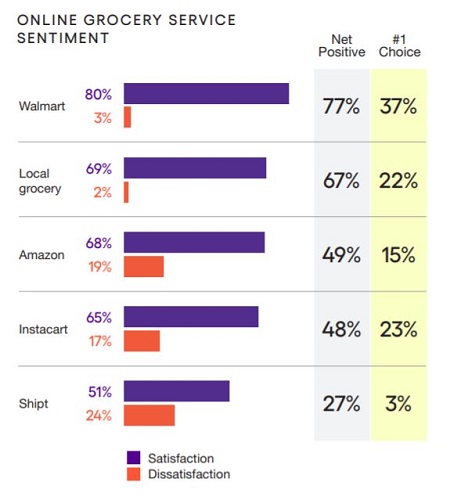

Escalent also asked shoppers to rate their level of satisfaction with online grocery retailers, and overall, satisfaction was high for online grocery services.

Again, Walmart led the pack in consumer satisfaction with 80% of consumers reported either being somewhat satisfied or very satisfied followed by local grocery with 69% consumers satisfaction, and Amazon with 68% satisfaction.

“Also notable is that the traditional brick-and-mortar retailers have almost no dissatisfaction versus their more online-dominant counterparts. There are two key drivers here: delivery times and providing convenient delivery windows. Walmart and local grocery stores are clearly better at leveraging their formidable real-world infrastructure to get produce to consumers quicker, fresher and more conveniently,” said Escalent.

Long-term love?

But will increased trial and higher consumer satisfaction lead to long-term use of online grocery services when COVID-19 is behind us?

Escalent’s findings suggest that yes, future use of online grocery shopping will remain strong post-COVID-19.

More than one-third (38%) of today’s online grocery shoppers believe that their current level of online grocery shopping will stay the same or even increase in a post-COVID-19 world. Additionally, 27% said that while their use of online services might decrease slightly, they would continue to use online grocery services on a regular basis.

Just under a quarter of consumers (24%) said their use of online grocery services will “decrease a lot” or stop altogether.

“From a long-term perspective, brick-and-mortar is not going away. The majority of shoppers inherently prefer the presentation, selection and tactile experience of grocery shopping,” said Escalent.

“The path to success for grocery retailers is, therefore, a blended approach: providing in-store, pickup and delivery options that the shopper can move seamlessly between based on need and at no perceived extra cost.”