Japanese cell cultured meat co IntegriCulture raises $7.4m, aims to commercialize foie gras in 2021

The round – backed by Beyond Next Ventures, multinational food company NH Foods, AgFunder and other investors – follows a US$2.7m seed round raised in 2018, and will be used to fund R&D work, build the production facility for foie gras, and support the launch of a cosmetics ingredient based on the company’s cultured serum, said CEO Yuki Hanyu.

Asked about the scale of the foie gras launch, he told FoodNavigator-USA: "Scaling is on the way, but it is somewhat tricky to say '8kg cell mass per month per bioreactor' is scaled. Our restaurant partner may serve cell-based foie gras at 100% purity, but could mix with pâté. Food company partners are very likely to mix cell-based foie gras with other ingredients for retail launch."

Producing growth factors in a different way

IntegriCulture’s CulNet system is distinctive in the cell-cultured meat arena, deploying a central tank containing the cells it wants to grow (eg. muscle, fat etc) and a series of ‘feeder’ tanks that contain other cell types such as liver or placental cells.

The feeder cells secrete growth factors (proteins that stimulate cell growth and differentiation – typically the most expensive part of any growth media) that are then fed into the central tank so that Integriculture doesn’t have to buy in growth factors from third parties (which are typically produced via microbial fermentation - ie. expressing proteins in genetically engineered microbes such as bacteria, yeasts and other hosts - and then purified).

"The feeder cells can stay effective for a very long time: at least 250 days have been demonstrated [but they could] probably [last] more than two years," he added.

"This brings the ratio of feeder cells to target cells to more than 1:500. We see regulatory problems and public acceptance problems in the use of [recombinant] growth factors [that are produced by third parties] besides costs. Also, changing the feeder cells can adapt the CulNet system to other cells, and this versatility is another strength. If we are to do this with externally added recombinant growth factors, we [would] have to develop a new set of media formulation."

The future use of CulNet technology platform “spans all scales, from industrial use to home use" and covers multiple species, "terrestrial, aquatic and avian," says the company, a spinoff from the nonprofit Shojinmeat Project.

‘We have studied and mimicked this natural system’

According to a presentation published by IntegriCulture on Medium earlier this month, the CulNet system effectively mimics natural processes in the body, where organs secrete growth factors which are circulated to other tissues via the bloodstream.

Its website elaborates: “In vivo, organs communicate each other by endocrine factors to efficiently proliferate cells. We have studied and mimicked this natural system to significantly reduce the cost of cell culture, which was otherwise impossible by conventional methods.”

The basal medium (which circulates through the interconnected flasks/tanks transporting the growth factors to the target cells) contains a variety of ingredients including sugars and amino acids, which IntegriCulture is looking to produce from algae (in collaboration with Tokyo Women’s Medical University, Japan Aerospace Exploration Agency and Japan Science and Technology Agency).

The core CulNet system patent is granted in Japan and also pending in international filing, with two additional patents pending, said Yuki Hanyu.

"While the CulNet system patent describes the hardware, the exact combination of cells and cell culture conditions can be developed by users of the CulNet System. Which means, our clients on the CulNet Pipeline can own their own secret know-hows on how exactly to make their product using the CulNet system. It is like, having patents on a frying pan does not limit the users coming up with unique recipes."

The business model

Rather than producing everything in-house, IntegriCulture plans to offer b2b enterprise solutions whereby partners can produce their own cell-cultured meat utilizing Integriculture’s CulNet System technology, with conversations underway with a range of partners from startups to multinationals such as Nippon Ham (NH) Foods, said Yuki Hanyu.

"In a democratized cellular agriculture [system], " he added, "the minimum efficient scale is made small by advanced technology, and initiatives and decision-making points on what cell-ag food to eat and how they are made and regulated are in the hands of common citizens, like hobbyists, farmers, SMEs (and big companies, but there are not many of them because they are big)."

He added: "A big meat company [NH Foods] has expressed interest, and they are part of our Series A round. There is also a big pharmaceutical & nutraceutical company. There are also startups and mid-sized partners expressing interest. We sometimes hear from totally unexpected sectors.

"We are currently working on beef with NH Foods, and avian species with cell-based foie gras and skincare cosmetics. We see the first commercial potential with cell-based skincare cosmetics."

IntegriCulture anticipates launching cell-based foie gras in 2021, processed meat products in 2023, and steak by 2025.

Scale out vs scale up

Asked to comment on IntegriCulture's approach, Good Food Institute senior scientist Elliot Swartz told FoodNavigator-USA that, "As far as the business model goes, they are going the route of 'scale-out' versus 'scale-up.'"

But he added: "I don’t think we will be able to feed the world with 'scale-out' models."

As for the approach to use other cells to secrete growth factors rather than growing them via microbial fermentation, he said: "The idea behind CulNet is to produce a more complex protein formulation... that may be more effective for cell growth/proliferation than adding in a select few proteins that are produced via fermentation."

GFI senior scientist: 'It is almost certain that it will be more affordable to produce growth factors in microorganisms through recombinant technology'

However, he added, "you also need to keep the other cell types alive and that has energy and metabolic costs. It is almost certain that it will be more affordable to produce growth factors in microorganisms through recombinant technology. The inputs needed to grow those cells are more affordable and the amount of protein yield that you can get will be higher. This may not be true right at this moment, but it should be true when experienced recombinant protein providers with large volume infrastructure begin to produce growth factors for the industry at food-grade standards.

"I’m skeptical that the potential pros outweigh the cons. Additionally, it is entirely feasible to further characterize proteins secreted by cells and capture and recycle or exogenously produce and add in those proteins that stimulate proliferation. We could also think about capturing and removing proteins that are secreted and are inhibitory. I would expect the standard replacement strategy to improve over time as we discover more about the biology of the species and cell types used in cultivated meat and the proteins they respond to."

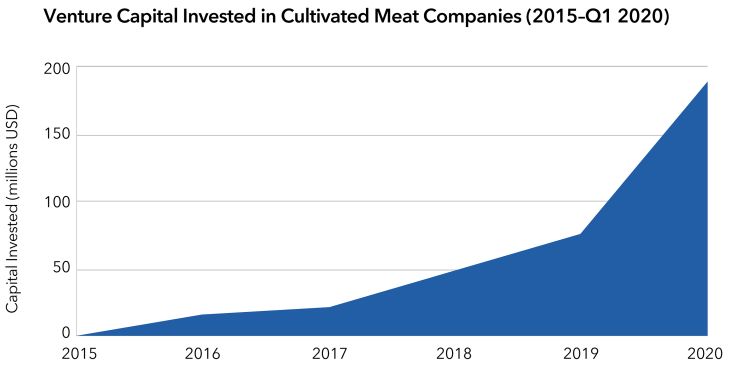

Despite all the hype, most startups in the space are still working in a laboratory (as opposed to a factory), although several have recently raised more substantial sums (Memphis Meats: $161m, BlueNalu: $20m; Future Meat Technologies: $14m, Wild Type: $12.5m, Aleph Farms: $12m, Meatable: $10m) to support the construction of pilot-scale facilities.

Maastricht-based Mosa Meat – which is gearing up for a small scale commercial launch in 2022 assuming it has cleared regulatory hurdles - recently joined forces with Nutreco (which has invested an undisclosed sum in the firm along with Lower Carbon Capital) to work on growth media; Delft-based Meatable hopes to have a small scale pilot facility online in early 2022; Emeryville, CA-based Finless Foods is gearing up for a Series A; while Jerusalem-based Future Meat Technologies plans to release hybrid products in 2021 and a second line of 100% cell-based ground meat products suitable for burgers and nuggets at a cost of “less than $10 per pound” in 2022.

According to the Good Food Institute (GFI), which recently published a report on cultivated meat companies, "by the end of 2019, 55 cultivated meat and seafood industry startups had publicly announced themselves."

While most cell-cultured meat companies are vertically integrated, notes the GFI, "2019 saw a surge in companies focused on selling to or collaborating with cultivated meat producers.

"At least six startups—Agulos Biotech, Back of the Yards Algae Sciences, Biftek, Cultured Blood, Future Fields, and Multus Media—concentrate on low-cost, serum-free cell culture media or media ingredients, such as growth factors or growth factor mimetics, for producers and researchers in the cultivated meat field."