Microbes, the third pillar in the alternative protein industry: ‘The rationale is simple: Fermentation is just more efficient’

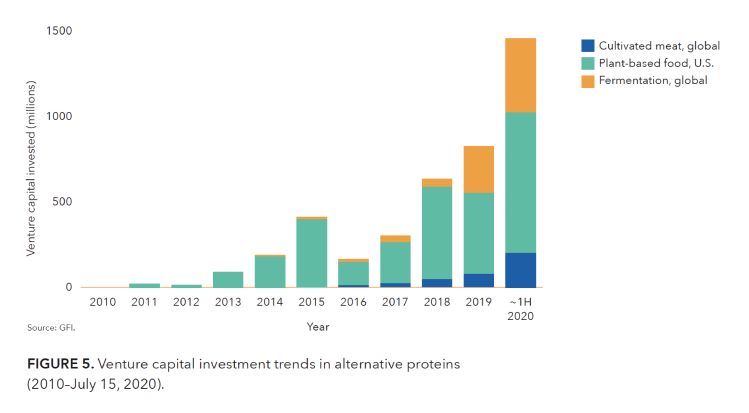

It’s early days, says the Good Food Institute (GFI), but microbial fermentation is rapidly emerging as the “third pillar in the alternative protein industry [alongside cell-cultured and plant-based]," attracting $435m in investment capital in 2020 alone.

Right now, producing protein – whether from peas and soybeans or cows and chickens – is resource-intensive and time-consuming, requiring large amounts of land, energy and water, says the GFI, which has just released a 72-page report on fermentation in the alternative protein industry, arguing that its “potential is still largely untapped.”

Put another way, it takes years to grow animals, and months or years to grow plants, while microbes can double their biomass in a matter of hours, as Nature’s Fynd CEO Thomas Jonas recently observed: “Microbes are pretty damn efficient. They make great protein and they do it really fast.”

Many microorganisms also offer innately high protein content (over 50% by dry weight) coupled with “extraordinarily fast and self-sufficient growth, requiring only simple and inexpensive nutrient feedstocks,” noted the GFI.

Fermentation-based products can also be manufactured from a distributed network of local production facilities using a fraction of the land, water, and inputs required to raise and feed animals with the added appeal of consistent quality, a lack of price volatility, and security of supply (plus it does not require killing animals on an industrial scale).

Precision fermentation vs biomass fermentation

While many food ingredients, from enzymes (chymosin, a coagulating enzyme used in cheese production) to sweeteners (Reb M), vitamins (B12, Riboflavin), and colors (beta carotene) have been made via microbial fermentation for years, investment in a new wave of fermentation players focused on the alternative protein industry has exploded over the past two years.

Approaches vary, with some startups using synthetic biology (so-called ‘precision fermentation’) to write DNA sequences that can be inserted into microorganisms to ‘instruct’ them to produce substances currently produced by mammals, from whey and casein proteins (Perfect Day), egg white (Clara Foods), and collagen (Geltor) to proteins found in human breast milk (Triton Algae Innovations).

Other are deploying precision fermentation to produce components that are found in plants, but can be produced more efficiently via fermentation. For example, Impossible Foods uses a genetically engineered yeast strain to produce its flagship meaty-tasting and red-colored ingredient leghemoglobin - ‘heme’ - which is found in nodules attached to the roots of nitrogen-fixing plants such as soy.

A third group of companies (using so-called ‘biomass fermentation’) such as Nature’s Fynd, Meati Foods, Brewed Foods (Plentify), Air Protein and Noblegen are growing naturally occurring organisms from ‘protists’ and bacteria to ‘extremophiles’ that are inherently high in protein.

Explosion in investment

Globally, fermentation companies devoted to alternative proteins received more than $274m in venture capital funding in 2019 and $435m in the first seven months of 2020 from investors such as Bill Gates-backed Breakthrough Energy Ventures, Temasek and Horizons Ventures to major CPG and ingredients players such as Kellogg, ADM, Danone, Kraft Heinz, Mars and Tyson.

By mid-2020, 44 fermentation companies focused on alternative proteins had formed around the globe, while several of the world’s largest food and life science companies, including DuPont, Novozymes, and DSM, have also been developing fermentation-derived product lines and solutions tailored to the alternative protein industry, said GFI.

But they're still just scratching the surface, argued report authors Dr Liz Specht and Nate Crosser.

“While fermentation has a rich history of use in food, as the modern era has demonstrated, its innovative potential is still largely untapped.

“The vast biological diversity of microbial species, coupled with virtually limitless biological synthesis capabilities, translates to immense opportunity for novel alternative protein solutions to emerge from fermentation-based approaches.”

Fermentation is a key means of producing animal-origin-free growth factors for cell-cultured meat production, with firms such as ORF Genetics, Richcore, and Peprotech now working in this space.

‘The urgency of the moment calls for bold research’

While some of the strain development work to identify and optimize microbes with potential in this segment uses tools such as gene editing and genetic engineering, noted the GFI, “vast progress” is also possible “through simple adaptation and breeding strategies powered by advanced genomic insights.

“The urgency of the moment calls for bold research to explore novel hosts that could significantly outperform the incumbents.”

More work is also needed to identify more cost effective or sustainable feedstocks (for the microbes) via converting waste products or agro-industrial byproducts into high-quality protein biomass, says the GFI, noting that the ‘extremophile’ microorganism developed by Nature’s Fynd, for example, “exhibits wide metabolic flexibility and therefore suitability to diverse feedstocks.”

The organism used by Air Protein, meanwhile, uses components found in the air - notably carbon dioxide – as feedstock.

“This is just the beginning: The opportunity landscape for technology development is completely untapped in this area. Many alternative protein products of the future will harness the plethora of protein production methods now available, with the option of leveraging combinations of proteins derived from plants, animal cell culture, and microbial fermentation.”

Dr. Liz Specht, associate director of science and technology, The Good Food Institute

Price parity

But what about price?

According to the GFI, “there is reason to believe that fermentation can achieve price parity with most products through a combination of approaches” including increasing scale, improving volumetric productivity (better yields), and prolonging continuous bioprocessing (the longer a process runs continuously at its peak in steady-state growth, the more efficient the overall run will be because the cells are continuously harvested from their maximum productivity).

“Fermentation is not just valuable in its own right, offering competitive prices, unparalleled functionality and scalability, and validated mechanisms for establishing and ensuring safety; it stands to revolutionize the entire alternative protein industry, with spillover applications in both plant-based products and cultivated meat.”

In 2019, fermentation companies raised over 3.5 times more capital than all cell-cultured meat companies combined.

Next-gen fermentation sciences... and Grandma’s kitchen cupboard

One aspect of the technology that is less explored in the report is consumer perception, which is less of an issue for companies using microbes to produce ingredients consumers already recognize such as whey or collagen, but could present novel challenges for companies making new-to-the-world ingredients, as Lever VC managing partner Nick Cooney told FoodNavigator-USA in a recent interview.

“Consumer acceptance is definitely something we think about in the alternative proteins space when we’re evaluating companies, and I do think there will be an increased challenge for companies producing novel proteins.”

Clearly, bacteria-sourced protein is not something you’d find in Grandma’s kitchen cupboard, Brewed Foods co-founder Dr Jonathan Gordon, told Food Navigator-USA.

But it’s not some kind of sci-fi fantasy either, he stressed: “The notion of consuming bacteria has become very well established thanks to probiotics, although in our case, the bacteria are not ‘live,’ but are fully deactivated, so they’re entirely dead, and non spore-forming.”

Karuna Rawal, CMO at Nature’s Fynd, added: “What we found was that consumers just want to know what it is [the protein source], they don’t like it when companies cloud things in [euphemistic] language, and we don’t want to confuse anyone.

“But I’d say we’re in a different time to when Quorn [a soil micro-organism described on pack as ‘mycoprotein’] came to market and since then, the notion of good bacteria, and fermented products have become very mainstream and the landscape has changed.”

The GFI breaks the market down into three segments:

- Traditional fermentation – eg. Using the fungus Rhizopus to ferment soybeans into tempeh and various lactic acid bacteria to produce cheese and yogurt, or fermenting plant-based proteins with mushroom mycelia to improve flavor and functionality (eg. by fermenting rice and pea protein with shiitake mycelia MycoTechnology reduces off tastes and aromas, improves solubility, and boosts their oil- and water-holding capacity).

- Biomass fermentation – Here, the microbial biomass itself serves as an ingredient with the cells intact or minimally processed (eg. Quorn, Meati Foods, Nature’s Fynd, Plentify, Air Protein, Solar Foods, Atlast).

- Precision fermentation - Using microbial hosts as cell factories for producing specific functional ingredients that typically require greater purity than the primary protein ingredients and are incorporated at lower levels (eg. Perfect Day, Clara Foods, Motif FoodWorks, Change Foods, Final Foods, New Culture, Provenance Bio, Triton Algae Innovations).

Perfect Day, a startup producing milk proteins via microbial fermentation (minus the cows), recently expanded its Series C round from a previously-announced $140m, up to $300m through a new tranche led by CPP Investments and bolstered by long-time supporters Temasek and Horizons Ventures.

The cash injection - bringing its cumulative funding to over $360m - was announced as Berkeley, Calif.-based Perfect Day revealed a series of incremental improvements in recent months enabling it to increase the efficiency of its production process, substantially reducing costs two years ahead of expectations.

While Perfect Day is a b2b company, it recently moved into the b2c space via spinoff The Urgent Company, which is focused on consumer brands, beginning with animal-free ice cream Brave Robot.

Plentify – a novel protein sourced from a strain of bacteria that naturally produces high levels of protein – is more efficient to produce than plant-based proteins, and compared to animal husbandry, is “ludicrously efficient," claims Brewed Foods co-founder Dr Jonathan Gordon.

“The obvious advantage here is the incredible compactness of production. You can basically use waste products to fuel the process. We can produce tons of protein in an incredibly small footprint consistently and efficiently.

"Protein production is also the primary purpose of the process [whereas most plants harvested for protein also contain large quantities of starch, oil or other components that producers need to find a market for, both for economic and sustainability reasons].”

Air Protein (which utilizes single-cell organisms called hydrogenotrophs first studied by NASA in the 1960s), is using components found in the air - notably carbon dioxide - as a low-cost feedstock.