Planterra (OZO) enters foodservice market, gains traction at retail after delayed launch

“Our timing wasn’t great. Just as we were about to go into stores, retailers’ sole focus had shifted to blocking and tackling to keep every day products on the shelf… and they were saying, we’re really sorry, we’ll talk again as soon as things settle down…

“So we took the opportunity to build some inventory [the products can be frozen], we took on two co-manufacturers to help build the pipeline, and we hired almost 20 people virtually,” said Macken, who worked in senior management roles at Kellogg and Noosa Yoghurt before taking the helm at Planterra Foods in October 2019 as parent company meat giant JBS decided to make a significant investment in the plant-based meat category.

“We started shifting product into Kroger at the end of June, early July, and rolling out to a division of Safeway [in Colorado]; there wasn’t a big marketing splash because of the lack of national distribution so our approach has been more regional and pointed.”

Beginning in October, OZO will also be available at King Soopers locations in Colorado, added Macken, who said OZO is “continuing with sampling [via branded vans in Denver, Boulder and ski towns through the winter months] as it’s a fantastic way to get feedback; we’ve just made sure we have masks, that the burgers are covered and everyone is socially distanced.”

OZO debuted with burgers and grounds and is now adding meatballs and breakfast sausages to its retail line up, said Macken, who said early data is encouraging.

“So far so good. Velocity is picking up every single week and our trial and repeat numbers are ahead of the competition, which is fantastic. The good news is that there’s a lot of trial going on.”

The foodservice launch

COVID-19 notwithstanding, Planterra is also confident OZO can make a splash in the foodservice market, where it has just launched with plant-based chicken nuggets with a cauliflower crust, breakfast sausages, burgers and grounds, and announced a three-year partnership with the Denver Broncos (Planterra is based in Boulder, CO) involving marketing campaigns, stadium advertising and traditional media.

Fewer calories, more protein, less saturated fat

Made with textured pea protein, wheat gluten, and MycoTechnology’s pea and rice protein fermented by Shiitake mycelia (the roots of Shiitake mushrooms), the soy-free OZO product line has more protein, less saturated fat and fewer calories than 80% ground beef burgers and most rival plant-based offerings, claimed Macken.

To place this in context, each 113g OZO burger contains more protein (22g vs 20g for the Beyond Burger, 19g for the Impossible Burger), a lot less saturated fat (2g vs 5g for the Beyond Burger, 8g for the Impossible Burger) and fewer calories (210 vs 260 for the Beyond Burger and 240 for the Impossible Burger), she said.

OZO products also deliver a distinct taste and texture that sets them apart in the category, in part due to the inclusion of MycoTechnology’s PureTaste pea and rice protein fermented by Shiitake mycelia, claimed Macken.

“We’ve started our own consumer and shopper research with more than 2,000 consumers to try and understand what they are looking for and what they consider to be nutritious and healthy in this space.

“It’s not about the number of ingredients but the quality, but also the unique and ownable attributes, and we have a unique ingredient that others don’t have. We also have the least calories and the least saturated fat.”

Plant-based meat by numbers

Speaking at a webinar on Tuesday, Caroline Bushnell, associate director of corporate engagement at the Good Food Institute (GFI), noted that the top six meat companies in the US have all made significant moves into the plant-based meat category over the past couple of years (JBS via Planterra/OZO, Cargill, Tyson via Raised & Rooted, Smithfield via Pure Farmland, Hormel via Happy Little Plants, and Conagra Brands via Gardein) and increasingly describe themselves as ‘protein’ companies.

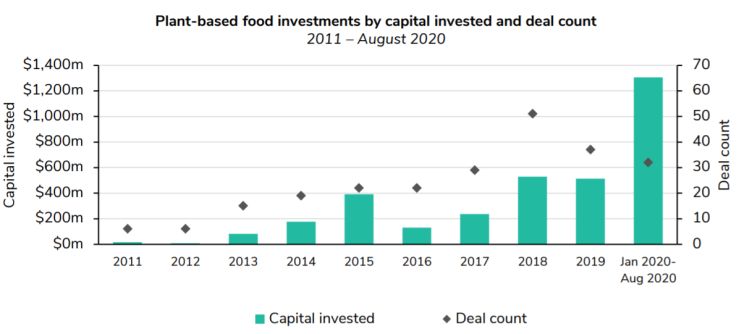

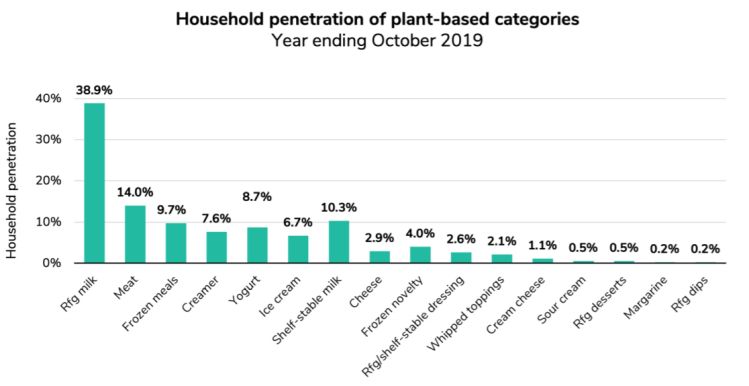

According to SPINS data commissioned by the GFI and the Plant Based Foods Association (PBFA), US retail sales of plant-based meat rose 18% to $939m in 2019 in measured channels, while IRI data suggested that 14% of US households now purchase plant-based meat (vs 42% that buy plant-based milk).

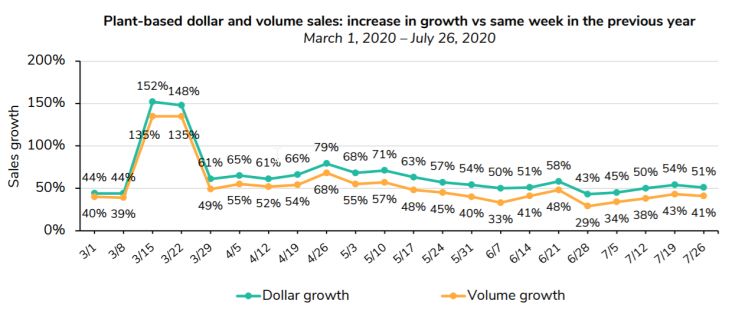

Retail sales jumped significantly during the early weeks of the pandemic, although sales of regular meat – a far larger and more mature market - also enjoyed an uplift as consumption shifted towards the home, said the GFI, which notes that predictions about the addressable market vary widely, with Wells Fargo forecasting that plant-based meat will capture a 4% share of the US meat market over the next decade, while Bernstein analysts predict the figure could be as high as 12%.

Merchandising lessons

One thing that is very clear from the data is that merchandising plant-based products in the meat case increases sales, noted corporate engagement strategist, Emma Ignaszewski. “After working with GFI to switch meat, dairy, frozen and deli categories to integrated/segregated merchandising [Midwest food retailer], Heinen’s saw dollar sales of plant-based foods increase 43% in the year ending February 2020 compared to the prior year.

“Kroger also found that plant-based meat sales grew 23% compared to control stores when products were shelved in an integrated segregated set in the meat aisle.”

Plant-based more ‘inclusive’ than vegan

As for marketing, “inclusive” terms such as ‘plant-based’ or ‘plant-powered’ also increased sales compared to more traditional signage calling out ‘vegan’ or ‘vegetarian’ products, she added (echoing research by Mattson showing that consumers tend to see plant-based as a positive dietary choice, whereas following a vegan or vegetarian diet is seen as a lifestyle associated with serious commitment, deprivation, and allegiance to a ‘cause’ (animal rights, environmental activism).

When it comes to product selection within the category, taste, price and convenience are the top drivers, claimed research analyst Kyle Gaan, although health may become more of a factor in the future, he predicted.

INGREDIENTS (OZO burgers): Water, textured pea protein (pea protein, pea fiber), canola oil, wheat gluten, sustainable palm oil, pea and rice protein fermented by shiitake mycelia, methylcellulose, maltextract flavor, natural flavors, yeast extract, ascorbic acid, salt, vegetable and fruit juice (color).

Interested in plant-based meat?

Join Darcey Macken at Planterra, David Lee at Impossible Foods, Chuck Muth at Beyond Meat, Dr Tyler Huggins at Meati Foods and Dr David Welch at The Good Food Institute at our FREE webinar October 14: Plant-based meat in focus to explore where the market is going next.