IFIC: Dairy consumers show category-specific purchase behaviors for non-dairy alternatives

The report found that nearly three in four (72%) American consumers who regularly consume dairy report eating or drinking dairy-based products more frequently than plant-based, non-dairy alternatives. However, at least 1 in 4 at least sometimes choose the plant-based alternatives.

Adults over age 55 had the strongest preference for dairy, with the majority (80%) saying that they consume dairy foods or beverages multiple times a week (80%, vs. 67% of those ages 18–34 and 73% of those ages 35–54). Half (50%) of adults age 55 and over said they never consume non-dairy alternatives, compared with only 8% of 18- to 34-year-olds who said the same.

"The options in the dairy section of the grocery store are becoming increasingly diversified with non-dairy, plant-based alternatives—whether they be yogurt, milk, ice cream or cheese. But for Americans who consume dairy, how often and why do they choose dairy products versus plant-based alternatives? And how does their selection of dairy-based versus plant-based vary depending on the type of product?" said IFIC.

IFIC’s research, which was based off of consumer insights from 1,014 online surveys conducted among dairy consuming adults ages 18-80 from April 1 to April 6, 2021, dove deeper into category-specific shopping behaviors of dairy consumers.

Dairy cheese preference

And while some dairy consumers are slowly incorporating more plant-based dairy alternative products into their dietary repertoire, plant-based cheese seems to face the biggest consumer acceptance barrier among dairy buyers.

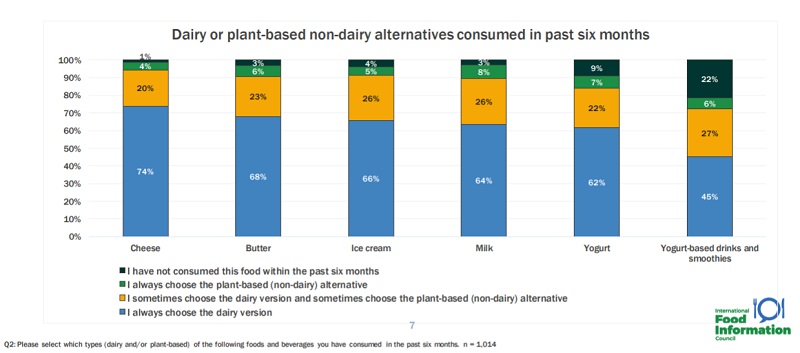

Almost three in four (74%) said they always choose the dairy version of cheese, while only 20% sometimes choose the non-dairy version.

Comparing this to other product categories, the majority of people said they always choose the dairy version of butter (68%), ice cream (66%), milk (64%), yogurt (62%) and yogurt-based smoothies or drinks (45%).

In contrast, about one in four said they sometimes choose the non-dairy version of butter (23%), ice cream (26%), milk (26%), yogurt (22%) and yogurt-based smoothies or drinks (27%). While nearly two in three always choose the dairy version of milk, women were more likely than men to sometimes choose both dairy and plant-based versions of milk (29%, vs. 23% of men).

Taste is the most important factor for yogurt

When it came to certain categories such as yogurt, taste was king in influencing consumers’ purchasing behaviors. According to IFIC, nearly half (48%) of consumer indicated 'taste' as the top reason for choosing a particular yogurt product, followed by 38% who said health benefits as a priority when purchasing yogurt.

Among the consumers who prioritized health benefits when eating yogurt, ‘general health/wellness’ and ‘digestive/gut health’ were the most important benefits. IFIC found that consumers were relatively familiar with common digestive claims made by yogurt manufacturers – nearly half of consumers surveyed were very familiar and knowledgeable about probiotics, while 45% said they have heard of’ live and active cultures’ but don’t know much about the term, but 40% had a positive sentiment (e.g. healthy, good) for the claim and understanding.

Two out of three consumers who have heard the term ‘contains live and active cultures’ believes it indicates a product that is better for them.

Of those who eat yogurt for its nutritional value, protein content was the most commonly selected component that is important to them, followed by calcium content.

Other nutritional factors of importance to one in four consumers are products that claim to be ‘natural’ while one in five seek out ‘low fat’ claims, reports IFIC.

When considering plant-based yogurts, 1 out 5 seek out products that claims to be ‘natural’ and 17% seek out ‘high protein content’ claims, according to IFIC.

Label trust

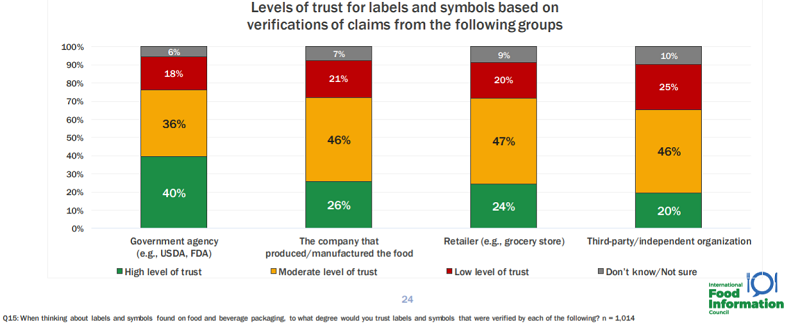

When looking at the level of trust consumers had for packaging labels for dairy and non-dairy alternative products, more than 7 out of 10 have a moderate or high level of trust for verification of packaging labels/symbols by government agencies, manufacturers, and retailers; while 2 in 3 have a moderate or high level of trust for third-party organizations.

A significantly higher proportion indicates a higher level of trust in government agencies for label/symbol claim verification than manufacturers, retailers, and third-party organizations.