General Mills exec talks growth of natural and organic segment: 'It’s amazing to me that 92% of households have natural and organic products in them'

Sales of the Natural & Organic segment for 2021 are projected to be up +6.6% to $271bn and expected to surpass $300bn by 2023, outpacing total food and beverage growth, according to New Hope.

Speaking to FoodNavigator-USA, Priscilla Zee, business unit director for General Mills' Natural & Organic portfolio overseeing brands including Annie's, Cascadian Farms, and Muir Glen, noted how sales are even more elevated when looking at pre-pandemic levels.

"Natural & Organic food and beverage continues to outpace total food and beverage growth. If you look at the last two-year CAGR, Natural & Organic food and beverage has grown +9.3% vs. total food and beverage at +7.5%," Zee told FoodNavigator-USA.

"It’s amazing to me that 92% of households have natural and organic products in them. We have seen a significant number of consumers come into both our Annie’s and Cascadian Farms brands throughout the last 18 months."

'Annie’s is one of the places where we saw explosive growth'

The influx of new consumers has been most notable for Annie's, which now spans 20 categories of the grocery store.

"Annie’s is one of the places where we saw explosive growth. With kids at home, parents needing quick easy meals for their kids, Annie’s delivers on that so well. It’s a meal that kids are excited about and moms can feel good about too," noted Zee.

"Annie’s is one of the brands where we have the highest index with Latinx consumers. With one in four babies being born being Latinx, I think this is going to continue to grow."

However, to continue increasing its household penetration with new consumers, the company will be challenged to deliver on taste, convenience, and accessible price points especially as many manufacturers grapple with inflation.

"Consumers are buying both natural and organic items, and mainstream items. Our challenge is how we do continue to deliver on taste and then how can we make sure we’re delivering on accessibility at large," said Zee.

"I think we’re going to definitely need to have an eye towards taste and prep and convenience. So ease is going to continue to be a focus for us, no question," noted Zee, who added that its Annie's single-serve micro-cups have been leading the growth of its macaroni and cheese business.

Zee added that the brand is in the process of converting its micro-cups from plastic to 100% recyclable paper and has already begun rolling out the more sustainable packaging to some retailers.

"We hear from consumers that they want more products that deliver on sustainability."

'I’ve seen us move more quickly and innovate faster than ever before'

Another component to its strategy of growing its audience of natural and organic customers is maintaining a laser focus on consumers' evolving needs, according to Zee, who has been with General Mills for 15 years.

"Over the years I’ve been a part of General Mills, I’ve seen us move more quickly and innovate faster than ever before," she said.

This approach has led to successful new product innovation such as its Autumn's Gold grain-free granola line launched in partnership with Costco.

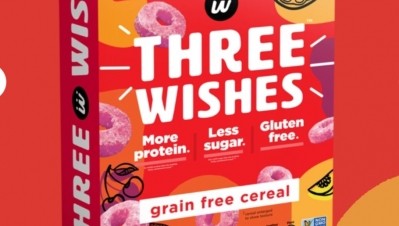

"There were a lot of consumers walking away from the granola and cereal category because they didn’t want to eat grains. We heard from consumers that said there are a lot of grain-free granolas on the market, but they don’t have that same crunch that they miss from granola that they used to eat," said Zee.

Learning from this consumer insight, General Mills launched Autumn's Gold grain-free granola and bars made with a variety of nuts to provide the crunch consumers were missing.

The product has since become a top-selling item at Costco, according to Zee, who said agile product innovation will continue to be a focus for the future of General Mills' natural and organic business.

"Where I see the most opportunity for natural and organic is ensuring we are reaching all types of consumers and not just a subset of consumers," she said.