Meat, chicken and seafood alternatives: Latest retail sales data shows slowdown

Volume sales (lbs sold) fell more sharply than dollar sales, with pounds sold of frozen meat alternatives down -8.1%, and pounds of refrigerated meat alternatives declining -4.6% over the same period (52 weeks to Feb 27, 2022).

Sales of conventional meat also dropped over the same period, with dollar sales down -1.7% to $17bn for frozen meat, and down -1.1% to $83.2bn for refrigerated meat. Volumes were down -8.7% for frozen meat, and -7.4% for refrigerated meat.

On a two-year basis, however, while volumes of meat alternatives were up double digits (frozen +14.1%, refrigerated +57.4%), volumes of conventional meat, which dwarf those in alt-meat, were also up solidly off a far larger base, with frozen meat in particular seeing a huge surge in volumes (+18.1%), and refrigerated meat up +3.2%.

Price per pound, alt-meat vs conventional… frozen: $6.90 vs $4.79; fresh: $8.15 vs $4.14

On a price per pound ($/lb) basis, the retail price of frozen meat alternatives averaged $6.90/lb in the 52 weeks to Feb 27, 2022 (+10.7% vs two years ago) vs an average of $4.79/lb for frozen conventional meat (+14.3% vs two years ago).

In the refrigerated segment, the price gap between conventional and alt meat is wider, with prices of refrigerated meat alternatives averaging $8.14/lb (+5.9% vs two years ago) vs $4.14/lb for conventional fresh meat (+16.8% vs two years ago).

Volumes in refrigerated dinner sausages -15.5%, grounds -12.4%, patties -28.2% in Feb ’22 vs Feb ’21

In the latest month (February 2022), US retail sales of plant-based meat alternatives (refrigerated and frozen) were up +1% vs February 2021, while volume sales were down -5.6% YoY. Sales of conventional meat were up +6.4%, with volume sales down -5.1%.

Sales of frozen meat, chicken and seafood alternatives rose +8.8% in February 2022 vs February 2021, while volume sales fell -2.2% YoY.

Sales of refrigerated plant-based meat alternatives did not fare so well, declining -10.3% in Feb 2022 vs Feb 2021, while volume sales plummeted -11.8% YoY.

Volumes in the top three refrigerated meat alternatives categories dropped markedly in Feb '22 vs Feb '21, with dinner sausages down -15.5%, grounds down -12.4%, and patties down -28.2%. However, strips and cutlets were up +6.6%, and lunchmeat was up +2.5%, albeit off a very small base, said 210 Analytics president Anne-Marie Roerink.

“A few of the newer, smaller formats grew, but they were unable to offset the losses in the bigger formats.”

81.7% of meals in February 2022 were prepared at home

Right now, inflation is having a big impact on grocery shopping patterns, with 90% of shoppers aware of price increases and 96% “extremely concerned,” according to the IRI shopper research, said Roerink.

“81.7% of meals in February 2022 were prepared at home. This remains well above the July 2021 low of 77%.”

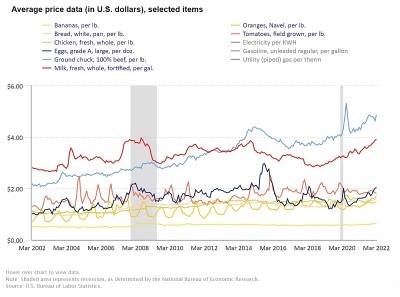

Meat pricing

“The average price per pound in the meat department across all cuts and kinds, both fixed and random weight, stood at $4.42 in February 2022, up 12.2% versus February last year. Inflation is a little milder when looking at the full 52 weeks ending February 27, 2022, with an average price per pound of $4.14, up 8.3%. Fresh meat has experienced above-average inflation especially in recent months compared to other areas of the store.

“On the fresh meat side, virtually all proteins saw price increases in the double-digits when compared with February 2021. when removing the effect of high inflation, the retail supply chain continued to move more pounds through the system in February 2022 as shoppers bought more when compared to February 2020 (+3.3%).”

Anne-Marie Roerink, president, 210 Analytics