Plant-based foods sales: Plant-based meat sales stall while eggs, yogurt, and cheese gain ground, GFI, SPINS, PBFA

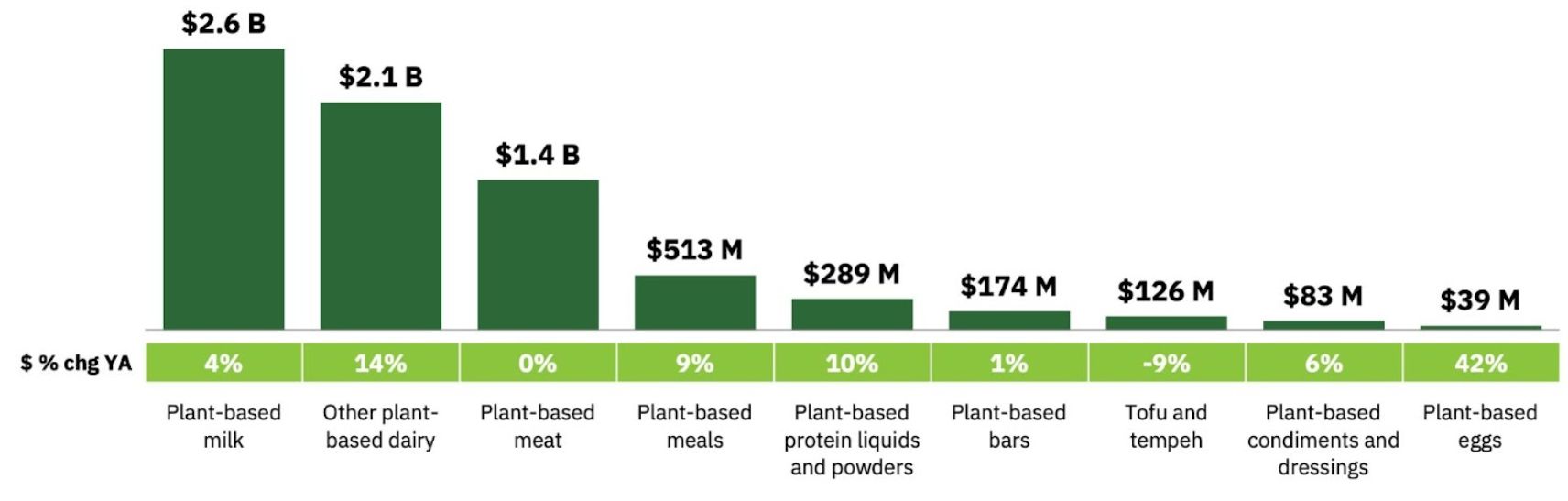

US retail sales of plant-based foods grew 6.2% to $7.4bn in 2021 vs. 2020, lapping a record-period of sales growth in 2020 vs. 2019 when sales of plant-based foods skyrocketed by 27% to $7bn.

The data showed that plant-based foods are growing three times faster than total food retail sales with most plant-based food categories outpacing their conventional counterparts. And despite a noticeable slowdown in retail sales, the plant-based foods sector is well-positioned for further growth, claimed GFI, PBFA, and SPINS.

"Just when retailers were getting ahead of challenges from the pandemic and supply chain issues, record inflation is causing them to look at alternatives to help consumers manage their shopping and wellness journeys," SPINS chief commercial officer Jay Lovelace said.

"SPINS data shows that plant-based products appear to be managing the economic issues in the U.S. better than many traditional retail products. This is a trend we expect to continue throughout this year and encourage retailers to look to expand shelf space for all plant-based products."

"The sustained rise in the market share of plant-based foods is remarkable, and makes it clear that this shift is here to stay," said PBFA senior director of retail partnerships, Julie Emmett.

"The data shows that, despite the challenges of the past two years, retailers and foodservice providers are meeting consumers where they are by partnering with brands across the entire store to expand space, increase assortment, and make it easier than ever to find and purchase plant-based foods."

Plant-based meat sales

While most major categories such as plant-based milk alternatives and eggs reported positive growth in 2021, growth of plant-based meat, the sector's second largest category, was flat with $1.4bn in sales for 2021 and accounting for 2.7% of total packaged meat sales.

However, within the plant-based meat category there were a few product types that bucked the trend and registered growth including meatballs, which grew dollar sales by 12% in 2021, followed by plant-based chicken varieties (nuggets, tenders, and cutlets), which grew by 9%, and deli slices, which grew by 8%.

Over a three-year basis, plant-based meat dollar sales grew by 74% and outpaced conventional meat sale by nearly 3x, the report noted. By unit sales, conventional meat unit sales have grown 8% in the past three years, while plant-based meat unit sales have grown by 51% during the same period.

Consumer adoption of plant-based meat held steady with 19% of households purchasing plant-based meat in 2021, up from 18% in 2020, with 64% of buyers purchasing plant-based meat more than once throughout the year as plant-based meat options are appearing across channels and retail outlets.

Price is also becoming less of a barrier for plant-based meat products that have historically been a pricier option compared to their conventional counterparts. According to IRI's Inflation Index, U.S. retail conventional meat price per unit was up 13% in March 2022 compared to March 2021, while plant-based meat price per unit was down 2%.

Plant-based milk, cheese, and yogurt

The sector's largest category, plant-based milk, continues to grow, registering a 4% increase in dollar sales in 2021 to $2.6bn. Again, a significant slowdown from the 20.4% growth seen in 2020 vs. 2019, but still a positive sign for the category, noted PBFA and GFI.

Plant-based milk accounts for 16% of all retail milk dollar sales and in the Natural Enhanced Channel, plant-based milk represents 40% of all milk sold, up from 34% in 2018.

Forty-two percent of households purchase plant-based milk, and 76% of plant-based milk buyers purchased it multiple times in 2021.

SPINS data revealed that almond milk is the still the category leader with 59% share, while oat milk shot to the No. 2 spot making up 17% of category sales.

In 2021, plant-based yogurt dollar sales grew 9%, three times the rate of conventional yogurt while plant-based cheese grew 7% (while conventional cheese declined 2%), and plant-based ice cream and frozen desserts grew 31% over the past two years to reach $458m.

Rising star: Plant-based eggs

While most plant-based food categories registered modest or zero growth sales growth, plant-based eggs were an outlier and grew by 42% in sales in 2021 while conventional egg sales declined 4% last year. In the past three years, dollar sales have grown by more than 1000%.

Plant-based eggs now represent a 0.6% share of the total egg market, up from 0.05% three years ago.