Tracking inflation: 'Ready-to-eat cereals is a category that has been particularly impacted by inflationary pressures'

By now, consumers are well aware that inflation is having a direct impact on their daily spending habits including grocery shopping. Packaged food products in particular are seeing prices rise across the board with companies struggling to maintain stable prices, noted Jared Conway, head of research of product development and training at Euromonitor.

Some of the industry's largest brands including Conagra, Mondelez, Kraft Heinz, General Mills, and Kellogg have all raised prices over the past year to battle inflation.

To put the impact of inflation into context, Euromonitor used its e-commerce tracking tool Via to look at the median price for ready-to-eat cereal, a staple product for many US households even as many consumers returned to work and spent less time at home.

"Ready-to-eat (RTE) cereals is a category that has been particularly impacted by inflationary pressures and many leading companies have had to make public announcements about their need to raise prices to address the inflation situation. With so much uncertainty from internal and external factors, monitoring inflation has never been more important," wrote Conway in a recent insights article.

'Consumers are seeing a stronger rise in online prices of cereal'

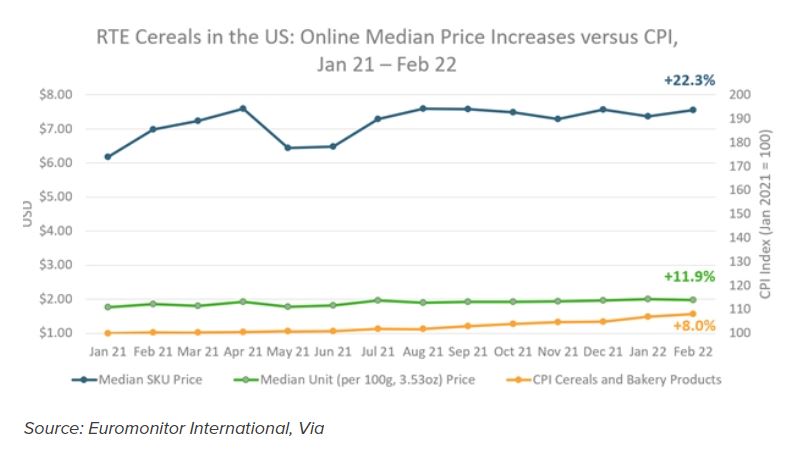

Tracking 7,903 different SKUs across leading e-commerce websites, Euromonitor found that the media price for cereal increased from just above $6.00 in January 2021 to $7.56 in February 2022, a 22.3% price increase.

However, Conway pointed out one major caveat: "Monitoring how online prices at the SKU level are rising might not always be the best indicator of inflation as this measures the price of the entire product being offered by a retailer, regardless of pack size or the number of packs... many SKUs are simply larger or are being offered in multi-pack options, which command a higher SKU price."

Accounting for this, Euromonitor analyzed the median per unit price (per 100g or 3.53 oz level), which also showed a double-digit price increase of 11.9% in the 14-month time period from January 2021 to March 2022.

Compared to the Consumer Price Index (CPI) for cereal and bakery products from the US Bureau of Labor Statistics, Euromonitor's per unit price growth was nearly 4% higher than the CPI.

"This indicates that consumers are seeing a stronger rise in online prices of cereal compared to the larger basket of goods being tracked in the Bureau’s coverage of cereals and bakery products," noted Conway.

Price increases by company

But are price increases equal across the board for the RTE cereal categories major players?

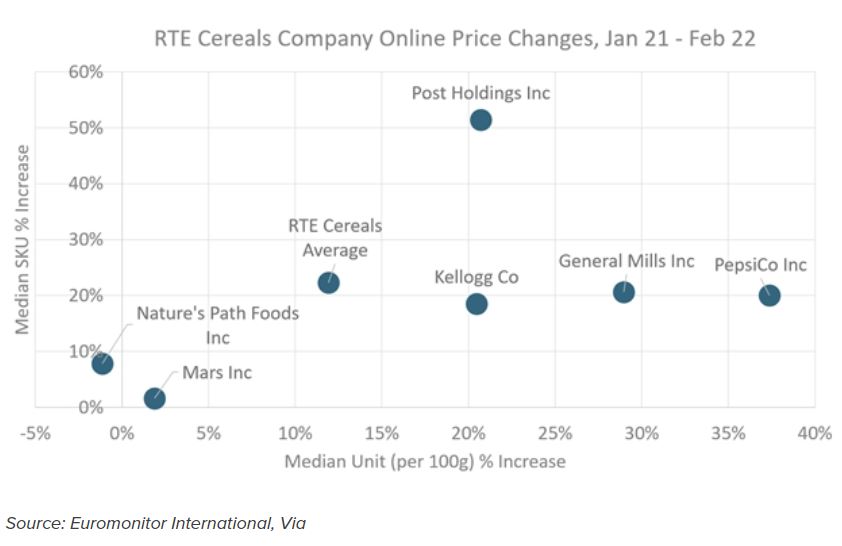

According to Conway, Euromonitor's Via tool can also show how the category's largest players (Kellogg, General Mills, Post, etc.) are each stacking up against price hikes.

"Based on sales data from Euromonitor International’s Passport system in 2021, the category is heavily concentrated, with the three leading players - General Mills, Kellogg and Post Holdings - accounting for over 80% of retail value sales," said Conway.

"Looking at the x/horizontal axis [of the chart above], it is evident that the four largest players are all significantly higher than the average price increase of 11.9% with PepsiCo cereals seeing the largest per 100g (or per 3.53 oz) increase in online retail prices."

Prices by package size

Monitoring price changes by different pack sizes can also provide valuable insights into inflationary trends, added Conway, who found that price increases varied by the size of the packaging.

According to Euromonitor data, “normal” sized boxes of cereals (under 14 oz) saw a per unit increase of 5.9% while larger or “family boxes” (over 14 oz) saw a per unit increase of nearly 13% over the 14-month period leading to a significant reduction in the per unit price difference between the two sizes, challenging the common consumer notion of buying in bulk to save money.

"Companies must closely observe how prices are rising across a variety of perspectives as consumers are carefully watching prices and looking for additional ways to stretch their budgets," added Conway.