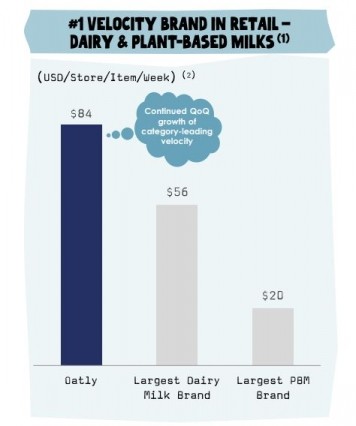

Oatly the ‘fastest turning national brand in US milk category’ in Q1 says loss-making firm; US revenues up 40%

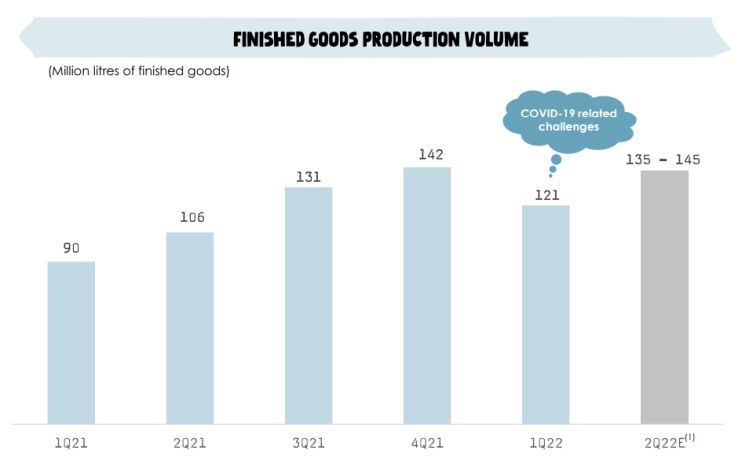

Oatly products are now in 14,500 retail locations and more than 38,000 foodservice locations in the US, which it entered in 2016, said the Malmö-based company, which posted an $87.5m net loss on net revenues up 18.6% to $166.2m in Q1 as gross margins slumped thanks to a litany of supply chain problems, inflationary pressures, “labor absenteeism” in US plants, and pandemic-related lockdowns in China.

Speaking on the firm's Q1 earnings call this morning, CEO Toni Petersson said Oatly is planning double-digit price increases in the US across all channels this summer to reflect rising costs, and said capacity was steadily ramping up, although it is not yet in line with demand.

"Our Ogden facility [in Utah] remains on track to finish ramping up by the end of second quarter. The Millville [New Jersey] expansion project is on track for the second half of this year.

"In 2022, as capacity continues to ramp and we have more supply in the US, we are looking to fill the gaps with current customers and we are selectively expanding our distribution with new customers such as CVS and Walgreens."

He added: "We have made major progress and development in our frozen business with our pints growing share, distribution and performing well on shelf. We recently launched frozen novelty bars with great market adoption so far and over 2,500 retail locations confirmed in the first six month of launch."

Oats: 'Expanding our sourcing options'

Asked about raw material supplies, CFO Christian Hanke said: "We have great relationships with our raw material suppliers that puts us in a position to mitigate raw material shortages particularly in oats, and we are also expanding our sourcing options.

"We have raw material contracts and supply in place to grow revenue at the rate we expect for 2022 and beyond."

'In the near-term, we're continuing to prioritize growth investments over profitability'

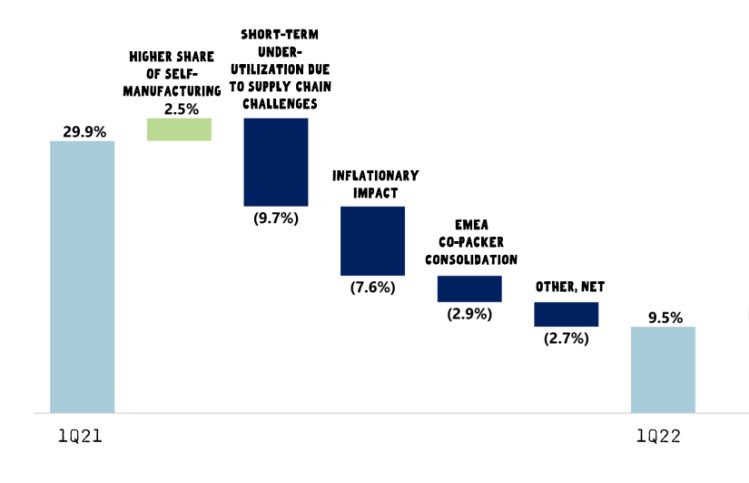

While gross margins fell below 10% in the latest quarter, the long-term goal is 40%+ as the company produces more of its products in-house and builds more localized manufacturing models, said Hanke: "We expect to see year-over-year improvement in our gross profit margin starting in the second half of 2022 and sequential improvement in gross margin starting in the second quarter."

Crucially, demand for Oatly products remains strong in all regions, added Petersson: "The opportunity in front of us remains massive. So in the near-term, we're continuing to prioritize growth investments over profitability."

But he added: "We continue to believe we can achieve much better economies of scale and greater operating efficiencies through our more localized self-manufacturing, which will help us… achieve profitability over the next several years.”

US manufacturing woes

Drilling down into the supply chain issues in the US, Petersson said some related to COVID-19, while others were weather related.

"The ramp-up of new facilities continued to be impacted by disruption of global supply chain flows and travel restrictions, specifically impacting Asia, Ogden, Utah as well as the Millville, New Jersey expansion, causing longer lead times to acquire production equipment and spare parts, difficulty in moving critical staff at these facilities during their construction and ramp-up phase, and labor absenteeism as a result of the Omicron variant.

"In addition, the company’s suppliers experienced longer lead times for equipment and, recently, the situation with truckers in Canada and difficult weather conditions in North America impacted the timing of rail transportation of oat supply for our supplier to our U.S. manufacturing locations."