Seven grocery trends to watch as inflation bites, from private label growth to a return to promotions

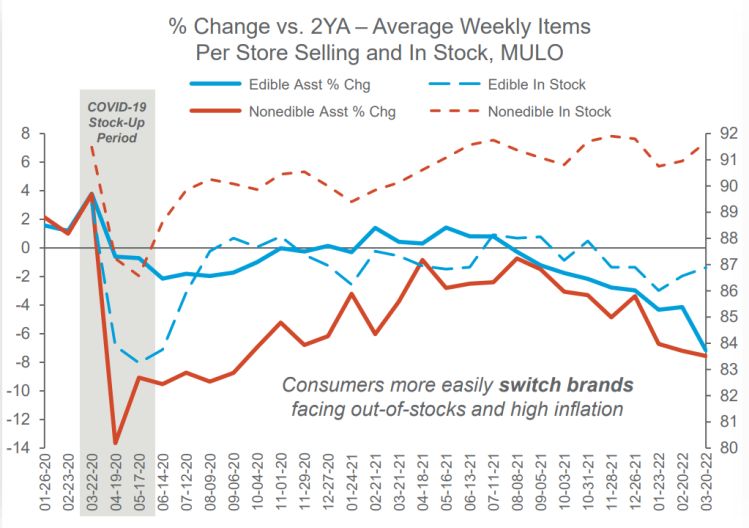

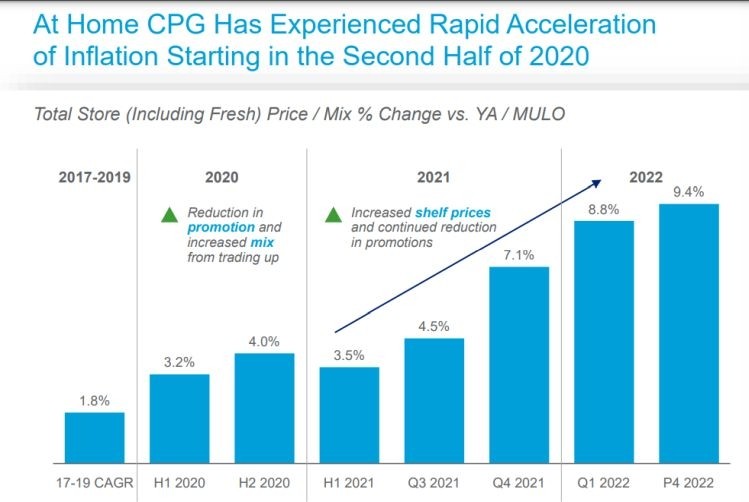

While there is “lingering elevation in CPG demand” as we emerge from the pandemic due to ongoing remote and hybrid work, many consumers are nevertheless returning to offices and social activities, prices are going up, and CPG companies have started to see low-single digit unit declines, said Davey.

Retailers, meanwhile, “are nervous and they’re pushing back on manufacturers [who are trying to push through price rises to offset higher costs]. And then the question [for both parties] becomes, what are the other levers I can pull? Just looking at price pack architecture is not going to solve the problem.”

1 - Promotions… the comeback?

While ongoing supply chain headaches make promotional activity challenging, we will likely see more promotional activity at the back end of this year, predicted Davey, who expects “elasticity will bounce back further” as inflation continues.

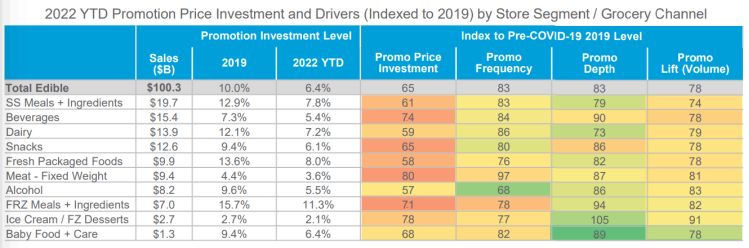

“Promotion investment levels continue to be well below pre-pandemic levels [65% of pre-pandemic/2019 levels in year-to-date 2022], but we expect to see more frequent and targeted promotions later this year.

“I expect the high-low retailers [as opposed to every-day low price players] to start promoting a bit out of their own dime to drive traffic to their stores. But manufacturers and retailers will be hard-pressed to [fund] very deep promotions.”

2 - Private label… back in the game?

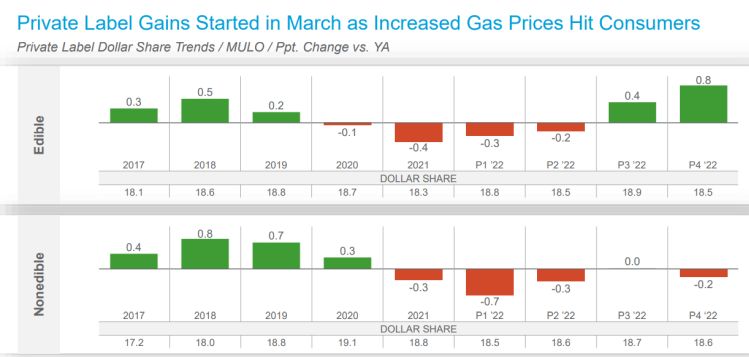

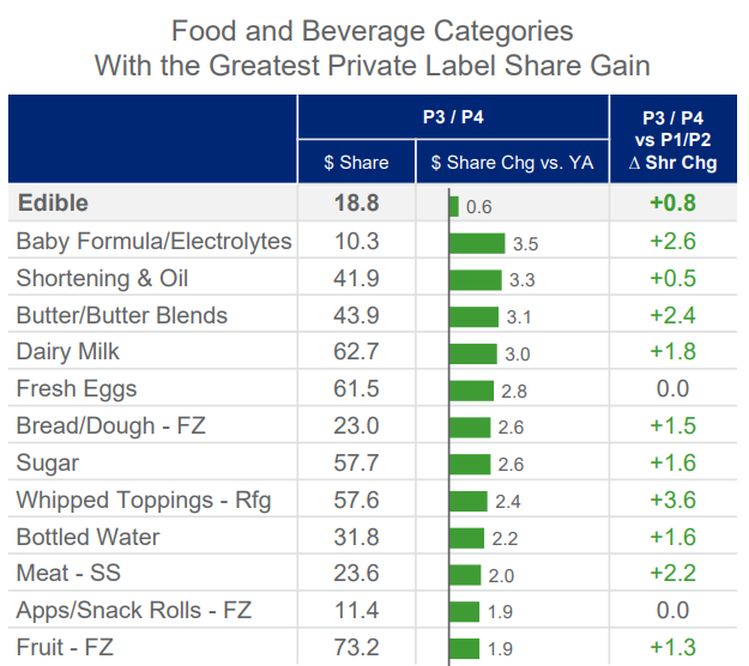

Unsurprisingly, perhaps, private label is gaining share in many categories where there is significant inflation such as oils and shortenings, milk, and sugar, said Davey, noting that private label food & beverage grew its dollar share to 18.5% (up 0.8 points) in the four weeks to April 17, 2022, vs the same period last year, and also grew (by 0.4 points) vs the previous four weeks.

“All of the retailers have invested in their private label offerings and we expect them to gain share. The pricing gap between private label and branded has also increased, so there is also room to take some pricing [on private label] to offset commodity costs, but still remain attractive vs branded.”

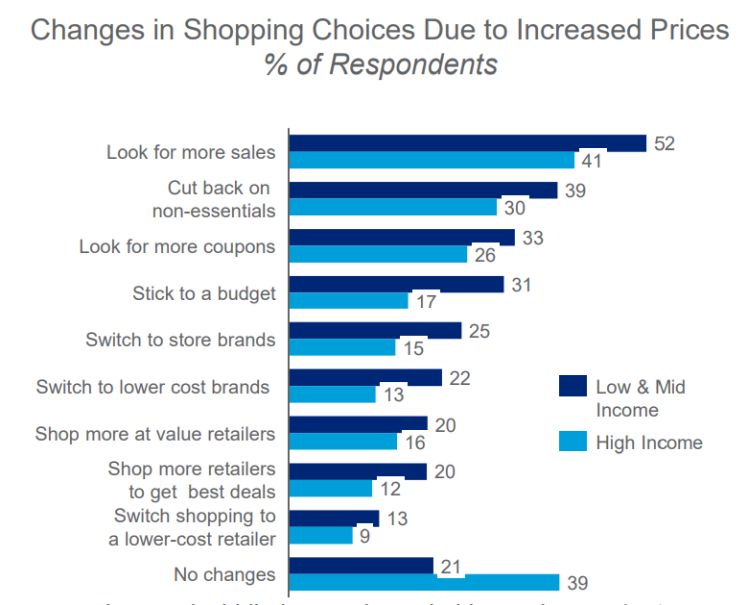

3 - Value shopping behavior and channels

“As inflation is picking up we are seeing a trend towards value shopping behavior,” said Davey, with more business going to club, dollar, limited assortment channels (such as ALDI) and mass merchandisers (Walmart).

4 - But! Premium products still performing in many categories

That said, premium offerings in some categories such as pasta sauce and sports drinks are still growing strongly, he said, while in some cases, consumers have replaced an out-of-home experience with a premium at-home experience to save money (a fancy at-home-coffee experience is still cheaper than going to Starbucks).

“I think it’s driven by hybrid and remote workers, so we do see premium in some areas continuing to thrive.”

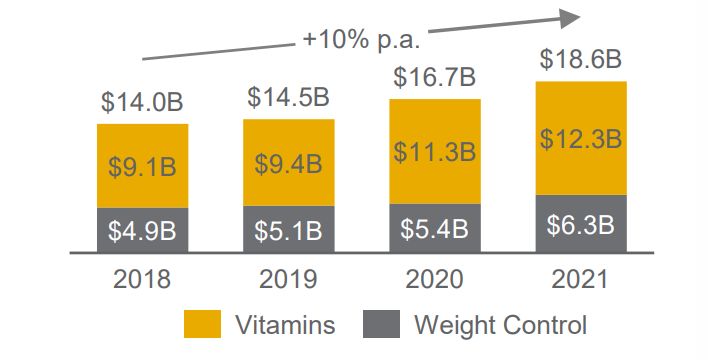

5 - Continued interest in self-care, preventive health

IRI expects continued growth in self-care products such as vitamins, said Davey, with the pandemic boosting interest in immunity, for example.

6 - The club channel keeps growing

“People are still buying larger packs compared to pre-COVID,” said Davey. “In 2020 it was more multi-serve, and in 2021, more multipacks. And that trend is continuing versus 2019, but as prices keep going up, we might get more bigger packs [better value]. And also, the club channel keeps growing and we think it will continue to grow, it’s a value proposition for middle income families.”

7 - Pandemic-fueled baking and scratch cooking trends have waned

If some pandemic-fueled habits have stuck (like working from home for at least some of the week), others have proved more transient, said Davey. While many consumers developed a penchant for baking in the early weeks of the lockdown, for example, sales of baking ingredients are right back to where they were pre-pandemic.

Similarly, while food at home consumption is still slightly higher than it was in 2019, this hasn’t led to a sustained interest in scratch cooking, with most consumers still looking for more convenience, he said.

Sales of chewing gum, which suffered a big drop during the early months of the pandemic, meanwhile, have also recovered, he added.