As inflation hits, consumers opt for store brands and exhibit some trade down behavior, says Kroger CEO

Kroger reported total company sales of $44.6bn in the first quarter, compared to $41.3bn for the same period last year. Excluding fuel, sales increased 3.8% compared to the same period last year.

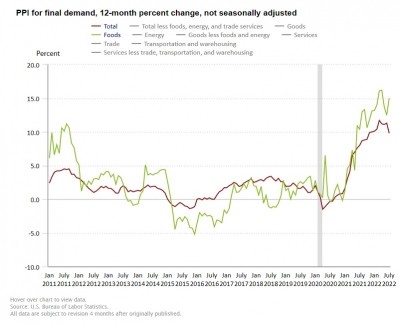

Rising inflation is having a significant impact on how consumers are shopping at the grocery store as they struggle to balance the 11.9% increase to the price for food at home, according to the latest Consumer Price Index (CPI) for the month of May from the Bureau of Labor Statistics (BLS).

The typical US household is now spending approximately an additional $460 more per month on groceries, according to Moody's Analytics grocery trends data.

"Rising inflation has consumers rethinking their shopping and eating habits. While customers continue to cook more, we are seeing different shopping behaviors based on how individual customers are experiencing the current inflationary environment," said CEO Rodney McMullen on the company's Q1 2022 earnings call.

"Many customers continue to shop premium products throughout the store, including Private Selection, Murray's cheese, and Deluxe Meal Solutions. For other customers, whose budget are more directly impacted by food and fuel inflation, they are actively looking for ways to save. We're doing everything we can to help this customer stretch their budgets."

Customers "aggressively moved to pork" over beef in the quarter

For instance, in some categories such as meat, customers "aggressively moved to pork" over beef in the quarter and being conservative with the amount of items they purchase when at the store, McMullen noted.

"What we're finding is customers were coming in more frequently before, but they're not buying as many items on each shop," said McMullen.

"We're also seeing customers, especially customers that aren't as sensitive to their budget upscaling with, or buying bigger packs, especially earlier in the month, depending on when people are getting money. So we continue to see both of those dynamics."

Kroger is not alone in the shift to customer shopping habits and dynamics. Other retailers such as Walmart noticed this trade down behavior in some areas of the store such as milk where its customers were switching from buying whole to half-gallons of milk in its latest quarterly earnings report.

Inflation strategy: Fresh first, prioritize own brands, personalization on pricing and promotion

To help customers with more affordable options at the grocery store, Kroger is meeting heightened demand for fresh items.

"We are meeting their needs with operational efficiencies and new technologies that extend days of freshness and grow our selection of quality fresh products," said McMullen.

"In the first quarter, we achieved 5.2% identical sales growth in our Fresh categories. These gains were led by the expansion of our end-to-end fresh produce program, which elevates standards and improves our ability to maintain freshness throughout the supply chain. We certified 355 stores this quarter and the customer feedback has been overwhelmingly positive."

The second prong to providing consumers with affordable in-store options is prioritizing availability and variety of the retailer's store brands, which saw a bump in sales for the quarter.

"Our brands are also proving to be an important differentiator for our customers in this environment," said McMullen.

Kroger's 'Our Brands' sales which include Private Selection, Simple Truth, and others, outpaced all national brands with 92% of household purchasing at least one product from its store brand portfolio.

"We launched 239 new and innovative products during the quarter, reflecting many of the top food trend predictions we made at the beginning of the year," he said.

"All of our new products continue to be tested and validated to ensure that they are as good or better than the comparable national brand. We continue to invest heavily in the quality of our brands, which preserves our strong price position and drives higher profitability."

Another part of Kroger's strategy to drive customer loyalty with affordably-price options at the store is continuing to invest in its personalization capabilities and provide customers with tailored cost savings and promotional offers on the items they shop for most frequently, added McMullen.

"Our data science platform provides unique insights that creates personalized customer experiences. In this dynamic environment where customer behaviors are changing rapidly, we use our data and insights to be nimble and react quickly to ever-changing needs. Our broad based data science approach helps us determine how to best implement price, promotion, and display," he said.

Full-year outlook

With supply chain challenges and rising inflation far from exiting the rearview mirror, McMullen said, "We will continue to leverage these proven and unique capabilities to help our customers manage their grocery budgets more effectively and maintain a strong value proposition relative to our competitors, as we believe inflation will remain front of mind for many of our customers for the remainder of 2022."