News in brief

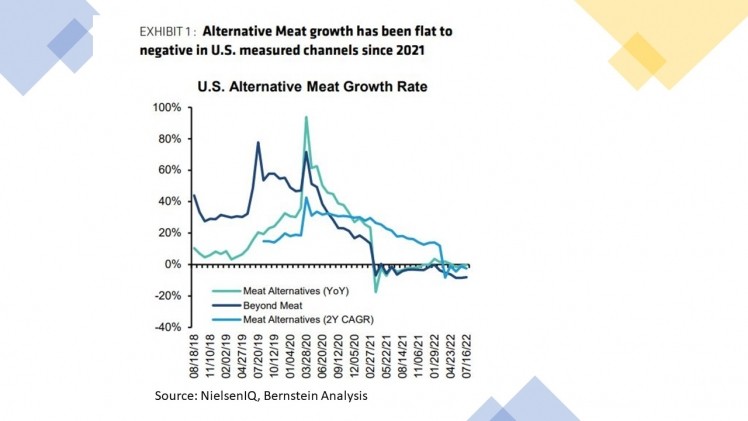

Bernstein: ‘The alternative meat space is going through a shake-out period’

Despite this weakening performance, however, the industry enjoyed “robust early stage funding during 2021, as the number of deals for plant-based companies increased 34% and total deal value increased 79% compared to 2020, likely a result of optimistic valuations across the market as a whole,” note analysts at Bernstein in a new report on alternative proteins.

“Early indications suggest that valuations marched even higher in the first quarter of 2022—albeit off of a small sample size—despite public alt protein companies performing poorly over the past year. Beyond Foods’ stock price is down -76% when comparing the average price in Q2'22 versus Q2'21.

“Adding to our skepticism are references that shares of Impossible Foods declined -17% from January to June in secondary markets that transact in private companies, while Beyond Meat fell -61% in the public markets over that same period. We believe there is a risk that private valuations within the alt-protein space have room to fall and catch up with their poorer performing public peers in the coming quarters.”

While the slowdown in plant-based meat alternatives growth has been “stark,” concludes Bernstein, “nonetheless we continue to believe the long-term growth opportunities in alternative proteins remain attractive, although improvements in product quality and innovation in emerging alternative protein categories, mainly fermented and cultivated proteins, will be key.”

Further reading:

- Plant-based meat by numbers in US retail: A tale of two temperature states

- Burger King tests plant-based chicken sandwich from Impossible Foods as frozen patties hit stores nationwide

- Stray Dog Capital: ‘Truly astonishing’ innovations afoot in alternative proteins, after you sort through me too products

- Beyond Meat Q2: CEO under pressure as firm posts $97.1m loss on sales -1.6% to $147m, lowers guidance