Conagra sees 'benign' impact from pricing: 'The volume effect is quite modest compared to anything we've seen historically'

Conagra delivered net sales of $2.9bn in the first quarter of fiscal 2023, a 9.5% increase over the period one year ago and up just over 24% compared to the same quarter three years ago (ie. pre-pandemic). A 9.7% increase in organic net sales was driven by a 14.3% improvement in price/mix, which was partially offset by a 4.6% decrease in volume.

In the quarter, net loss attributable to Conagra Brands was $78m owing to charges totaling $385.7m ($326.8 million after-tax) related to the goodwill and Birds Eye brand impairments, charges totaling $26.7m ($20.1 million after-tax) related to the impairment of businesses held for sale, and net charges totaling $4.9 million ($3.7 million after-tax) in connection with the company's restructuring plans, according to the Conagra's 10-Q SEC filing form.

Performance was strongest in the company's snacks and frozen divisions which continued to gain market share on a one- and three-year basis.

“Overall, Conagra delivered strong first quarter results. We had robust net sales growth across our portfolio, mainly due to the impact of our inflation-driven pricing actions coupled with ongoing limited elasticities,” said CEO Sean Connolly on the company's Q1 earnings call.

‘Highly relevant staples drive demand’

Sales of snacks and staples items in increased by 13% year on year in Q1 and were up 36% vs. 2019.

"In particular, we saw significant growth in sales of microwave popcorn, which increased more than 20% compared to the prior year," said Connolly.

“Our highly relevant staples domain also accelerated sales growth increasing 8% compared to the prior year and 15% versus three years ago. This was driven by strong performance in single-serve dinners and entrees, with toppings, pickles and canned tomatoes."

In frozen, sales of breakfast sausage, plant-based protein, and single-serve meals were all up double digits year on year.

"Frozen generated a significant acceleration of quarterly sales growth on a one and three-year basis of 8% and 27% respectively. Clearly, our focus on catering to consumer preferences for convenience, quality and great taste continue to resonate," noted Connolly.

Price and volume

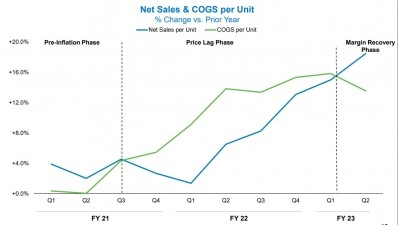

Acknowledging that recent sales gains have been due in large part to several rounds of pricing actions taken by the company, Connolly maintained that elasticities have not been heavily impacted.

“As you would expect, pricing has driven some volume elasticities both for Conagra and the overall industry. This tends to be most acute in the immediate aftermath of new pricing and wanes over time as consumers adjust," he said, noting how net elasticities have remained nearly flat over the past several quarters.

"What you've seen in our company and more broadly is that the volume effect is quite modest compared to anything that we've seen historically. And I think most important, it's been very stable from an elasticity coefficient standpoint... I view that as very, very positive news," he noted.

Addressing supply chain inefficiencies

While pleased with its recent performance, the company was impacted by supply chain disruptions which negatively impacted its business including multiple instances of off-spec products (items that don't meet manufacturer standards and therefore can not be sold) being produced.

"While production is now backing -- back up and running properly, the lost inventory effect will linger into Q2 impacting volumes and margins," shared Connolly.

"The point is, these types of challenges can result in downtime needed to determine and solve the root cause of the issue as well as proper testing to ramp production back up, that lost time can result in higher costs and less production. Looking ahead, we're not expecting these discrete supply chain interruptions to disappear overnight as the external environment remains dynamic.

"While we expect consumer response to our brands to stay strong, we are planning for this quarter's volumes to be impacted by the supply chain disruptions."

The year ahead

Despite ongoing supply chain challenges and navigating an inflationary environment, Conagra sees some upside for the year to come.

"We are obviously much longer into an inflation cycle than anybody hoped we would be. This thing has persisted longer than ever. But I do see positive things shaping up," said Connolly.

"We are starting to see moderation in certain areas and anticipate relief for commodities as the year unfolds."

"We continue to expect the inflationary environment to persist, but moderate through calendar year ‘23, which will result in a low-teens inflation rate for our fiscal year ’23 weighted towards the first half of the fiscal year," added Conagra CFO Dave Marberger.

"As always, we will continue to monitor inflation levels and price as needed to manage future volatility."