To answer this question, we assembled our own star-studded panel at FOOD VISION USA in Chicago featuring Jon Sebastiani, founder of KRAVE Jerky and Sonoma Brands; John Haugen, head of General Mills’ 301 INC incubation arm; Jason Starr, head of funds at CircleUp; and Seth Goldman, co-founder of Honest Tea and executive chairman of Beyond Meat.

The conversation spanned everything from meal kits to plant-based foods, but here are some highlights:

Going to Expo West now is like going grocery shopping when you’re really hungry

On the subject of how to pick winners, the sheer number of new players entering the space now means that wandering around trade shows hoping you’ll stumble on the next Chobani or KRAVE jerky is no longer a winning strategy, said Haugen.

“There’s always going to be a blend of art and science, but going to a show like Expo West now is like going grocery shopping when you’re really hungry, so one of the reasons we partnered with CircleUp [which tracks everything from sales to consumer engagement on social media platforms] was so we could apply some metrics to [our search]. We’re looking for brands that have demonstrated in-market velocity, scalability, and evidence of early passionate engaged consumers, as well as passionate founders.

“When you invest in a business you’re investing in three things - the stuff, the brand and the people, and not necessarily in that order - and their stories and their passion are at the heart of the business. Big companies have got great product knowledge, great marketing capability, great sales relationships, and great manufacturing and distribution, but when you put that up against the authentic story and mission of the founder, it’s super hard to replicate that.”

Millennials are very good at sniffing out bulls**t

Finding a business with a great product is critical, added Goldman, but investors are thinking more holistically about the people and the brand, and the scalability of the platform: “The goal is to not think about the lifecycle of the product, but of the brand. At Honest Tea, for example, we want to be people’s partners throughout their lives, so that creates a platform for lots of products.”

As to whether you need a social mission as a consumer products business, it definitely helps, he said, but it has to be woven into the DNA of the company from the outset or it can look opportunistic and inauthentic: “Millennials are very good at sniffing out BS.”

Whether they are as good at sniffing out junk food masquerading as health food as they are, say, green-washing, is less clear, he said (when asked if consumers see terms such as natural, non-GMO or gluten-free as a proxy for ‘healthy’), but companies of all sizes would be wise to avoid making claims they can’t support, he said.

“If anything you should under-promise.”

"At CircleUp, we're making available investment in small companies on an unprecedented scale. We're a little bit different from other crowdfunding sites, we're not Kickstarter, we're a closed system dealing only with accredited investors doing real equity rounds, so they are becoming shareholders in companies but can do that by writing $10,000 or $25,000 checks."

Jason Starr, head of funds, CircleUp

When we think about innovation it’s not just about product innovation, it’s brand innovation

Sonoma Brands, meanwhile, is looking to develop or invest in brands that have their own character and distinctive appeal but can scale quickly and reach mainstream consumers as well as the natural and organic set, as he achieved with KRAVE Jerky.

As to what innovation is, not every new food product that succeeds is the culinary equivalent of the iphone or the electric car, he said; in many cases innovation is about taking a familiar product – such as marshmallows – cleaning up the label, adding a gourmet twist, and presenting it in re-sealable packaging as a snack (Smashmallow – the latest innovation from Sonoma Brands), and creating a new category/usage occasion.

“When we think about innovation it’s not just about product innovation, it’s brand innovation, it’s about reinventing categories, it’s about telling stories and creating new usage occasions, new times and ways to enjoy products, so with Smashmallow, we’re the only snackable marshmallow brand, so I don’t have to spend time differentiating myself from nine other brands on the shelf.”

We’re placing bets on products that are scalable and we believe have a pretty short runway

While some brands that are now big hits spent their formative years slogging away in the natural channel before achieving mass market success, there is more pressure now to move more quickly, he said, which forces companies to make some decisions and think more strategically a little earlier than they would have done few years ago.

“Because of the increased availability of capital, companies are having to show big strides at a much earlier stage; there’s more of this big bang approach. It’s not necessarily wrong but it changes the dynamic."

He added: “It’s a challenge to create awareness for products outside of the natural and specialty channel. It’s one thing to succeed in Whole Foods and Sprouts and a different thing to succeed in middle America, so we’re placing bets on products that are scalable and we believe have a pretty short runway.”

“I’m still around [at Coca-Cola, several years after the company he co-founded, Honest Tea, was fully taken over] because I want to make sure that it’s done right. I’m not worried about the brand, it’s more about the innovation and the entrepreneurial edge.

"Since Coca-Cola invested in Honest Tea we've grown ten-fold, from $20m to now over $200m.”

Seth Goldman, co-founder, Honest Tea, executive chairman, Beyond Meat

301 INC is a way for an $18bn company to be much more nimble

As to the question of whether big brands can still innovate, and indeed whether they should even bother given that it’s far easier to buy in innovation than do it yourself, Haugen said: “Big companies really struggle to move at that pace, and they also struggle to have the perseverance to commit to an idea. I do think it is difficult for big companies to create new businesses and new categories although there are a lot of places that you can extend current brands to – in our case at General Mills, something like gluten-free Cheerios is a great example.

“But 301 INC [a venture arm set up to incubate and nurture small brands] is a way for an $18bn company to be much more nimble and to be able to take our capabilities and apply them to emerging brands. And it’s also a great time to be a food entrepreneur, there’s such a great amount of energy, access to capital and to talent is much better, and people want to discover new brands in all channels.”

While buying an early-stage business that is generating a few million dollars in revenue is not going to move the needle on the P&L for a multibillion dollar business such as General Mills for some time, investing or buying five or 10 of these companies could substantially change the complexion of the company’s portfolio in the medium-term, he said.

"The best ideas start small, but they don't stay small together. A $15m brand on a $5bn revenue company, that's still one point of growth and when you think about how hard they are working to scratch and claw for every point of growth in the marketplace, it's natural that they are looking at these smaller brands."

“When it comes to food, big isn’t bad, big is just big; after all, at some point if they are successful, these small brands we’re all talking about will get big.”

John Haugen, general manager, 301 INC

Meal kits: The drivers are there, but does the business model make sense?

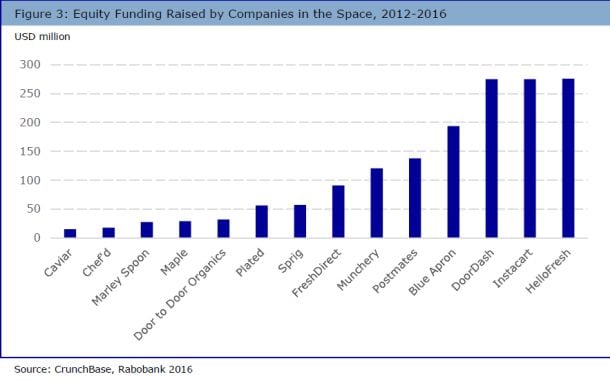

As for what’s trending when it comes to food investment, direct to consumer models such as meal-kit companies were a hot topic of conversation, with panel members agreeing that the consumer drivers were there, but less certain about the commercial and environmental sustainability of the business model.

At 301 INC, Haugen said meal kits tapped into consumer demand for customization and convenience, adding: “The Betty Crocker website always used to blow up at around three-o-clock in the afternoon as people started to think, what’s for dinner, so it’s not a new problem to solve. And what we have today is a lot more small and single person households, and frankly we’ve got a generation of Millennials that doesn’t know how to cook, so all the drivers are there. But that doesn’t mean that any of these business models are necessarily sustainable, profitable or interesting to the investment community.”

He added: “There’s a lot of shakeout in the marketplace; you read about the big checks going to Blue Apron or HelloFresh and the latest valuation numbers, but there’s probably five or 10 others that went under the same week because they ran out of money that we don’t even know about. Our job is to pick winners but also to pick business models that are sustainable and profitable.

Food delivery firms meet demand for mass personalization and convenience, but do the numbers add up?

“There’s as much packaging as there is food on the delivery vehicles, and then there’s the challenge of the last mile. But this space will continue to evolve and we’re very interested in the omni-channel approach.”

Goldman agreed: “The concept makes sense but the distribution model has to be looked at… maybe existing platforms such as FreshDirect could be a platform for meal kit companies so that you could get these delivered with other things, as there are already relationships in place.

Meal kits: Scalability and execution risks

Starr at CircleUp, meanwhile, said he was paying close attention to churn rates, adding:

“The challenge is that they [meal kit companies] are inherently less scalable than a traditional CPG business and repeat business is absolutely critical because it's a subscription; some of them have successfully raised money through our platform, but because of those scalability and execution risks we’ve tended to veer more towards more traditional CPG businesses.

"I think these [meal kit] companies are struggling to hold onto customers beyond the first three to six months."

That said, “One of the appealing characteristics of the meal kit companies is that they have a direct relationship with the consumer,” noted Sebastiani.

As for CPG brands, he said, “Direct to consumer is an important component to early stage brands,” a way to prove to retail buyers that you have a product that resonates with consumers, and that people are willing to pay for it.

Plant-based foods: Quality is now at parity with meat and dairy counterparts

As for plant-based foods, another hot topic in the world of food investment, said Goldman, companies like Beyond Meat (he is executive director) and Ripple Foods (in which he is an investor and board member) are changing the game by creating products “that are at parity or superior” to their animal-based counterparts, and can sit alongside them in the meat counter or dairy aisle.

Indeed, the fact that meat and dairy companies are expressing an interest in meat and dairy alternatives simply underscores the fact that in future, these products will just be part of the mainstream – another protein option, or something else to add to your cereal or coffee, rather than a niche product for vegans or vegetarians, he said.

As for the new breed of companies using techniques such as synthetic biology or ‘cellular agriculture’ to grow milk proteins, or gelatin, or other things from yeasts and other micro-organisms, much will depend on how they are marketed and positioned as to whether they are seen as “science projects” or kinder, greener, and cleaner options, he said. “I think people want to look at a label and see ingredients that they understand, but there are so many opportunities in this space.”

He added: “When people pick up a cellphone they don’t go through a moral dilemma about the risks or whether they should use a landline, they just want to make a call. It should be the same with burgers, if you make a good burger – whether it’s made from animals or something else, it’s a good burger and it will come down to consumer preference.”