Speaking to FoodNavigator-USA about his new report ‘The Future of Private Label Food’, Dr James Richardson, senior VP at Hartman Strategy, agreed there are big growth opportunities for private label in fresh perimeter categories such as cheese, chilled pizza, ready meals, cut fruit, sushi, prepared salads, and deli items.

Meanwhile, ‘pure play’ private label experts such as Trader Joe’s and ALDI are making strong gains, and Kroger and Safeway have both worked hard to attract more lucrative upmarket shoppers via premium private label ranges, he acknowledged.

"But I don't think every mid-market retailer can pull this off."

Just because a category is declining… that doesn’t imply that private label is somehow destined for glorious market share gains

At most mainstream retailers in the US, he said, brands are retaining their market share in center of store categories such as breakfast cereals, canned meals, frozen ready meals and dehydrated soup, making it hard to see where the predicted growth is going to come from.

“Just because a category is declining… that doesn’t imply that private label is somehow destined for glorious market share gains.”

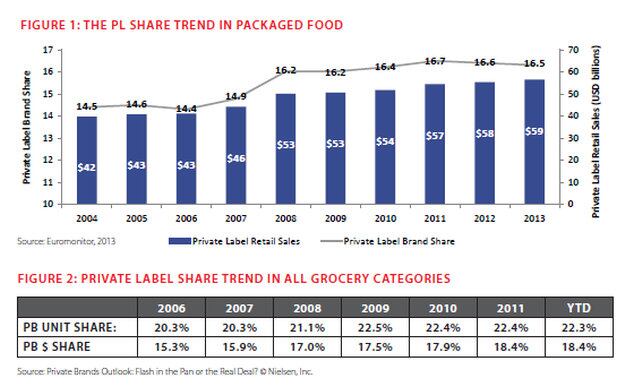

Indeed, more than half of packaged food’s major categories have exhibited flat private label share growth from 2009 through 2013, “precisely at a period when economic theory would suggest that private label share should be creeping up generally”, he said.

Meanwhile, several core private label categories (canned tomatoes, frozen potatoes, canned fruit) “are on the wrong side of long term trends in American food culture”, he noted.

"It is unlikely the US will ever see the kind of penetration rates seen in the UK - where the retail market is far more consolidated and the leading retailers have much more power."

ConAgra Foods CEO: Private brand is going to continue to be a big growth vector in this industry. I am absolutely confident of that

So what does the nation’s leading private label manufacturer have to say?

Speaking at the Consumer Analyst Group of New York (CAGNY) conference this week, ConAgra Foods CEO Gary Rodkin was quizzed about why he was so confident about the prospects for private label.

He said: “We're all well aware of the decades of continual growth of private label in the food industry. It has flattened over the last year, as it has every so often, but we are highly confident that the growth will pick up again. Why? For starters, the retailers who have prioritized private brand have enjoyed growth that is dramatically better than the rest of the retail fields.

“Specifically, the customers with the heaviest focus on private brand are growing almost twice as fast as the rest of the top-30 retailers. Retailers are clearly looking for growth in a very competitive marketplace and are trying to differentiate however they can.

“Private brand is going to continue to be a big growth vector in this industry. I am absolutely confident of that.”

Asked why growth rates in private label had stalled, he said branded manufacturers had been engaged in a race to the bottom, narrowing the price gap with store brands.

Click here to find out more about Dr Richardson's report, The Future of Private Label Food’