As more consumer goods are being purchased online—from event tickets to garments to tech gadgets—experts are pressing marketers that “e-commerce is not just a sales channel,” according to IRI’s latest report on the topic, titled Build, Drive and Earn E-Commerce Growth for Retail Success.

“More than 76% of all shopping trips begin online, regardless of whether the actual purchase is made online or in-store,” said Sam Gagliardi, senior vice president of Consumer & Shopper Marketing for IRI.

“Consumers visit e-retailers to seek out products, reviews and money-saving opportunities, so it’s a must for brands to establish a solid presence along their shoppers’ paths to purchase,” he added

Shopping for food and beverages online

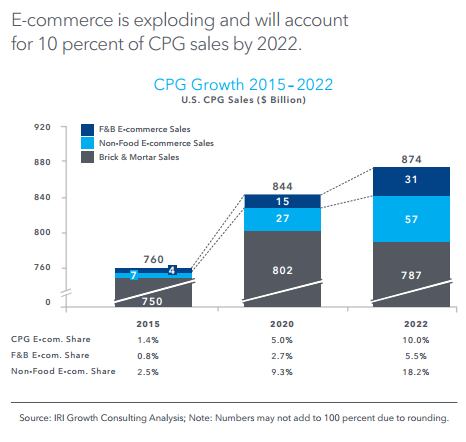

According to IRI’s report, the non-food sector of CPG is more developed online than food and beverage, which in 2015 accounted for only 0.8% of all sales. This has led to some experts, such as Dr Kurt Jetta of TABS Analytics, to declare that “online grocery is failing.”

However, both food and non-food CPG are poised for strong growth. The firm estimates that by 2020, e-commerce will account for 10% of CPG sales (5.5% for food and beverage, 18.2% for non-food).

“Click-and-collect and home delivery appear to be the most favored distribution models for grocery today, particularly among younger consumers who are looking for multiple and/or flexible fulfillment options,” the report said.

The top two retailing giants in the US, Amazon and Walmart, are testing the waters with what novel format will stick. Walmart launched a pilot delivery service utilizing Uber, Lyft, and Deliv drivers as personal, on-demand grocery shoppers, as well as a gas station pick-up model, while Amazon is playing into the ‘smart home’ trend with its Dash Button to make replenishing pantry staples as easy as pressing a, erm…button.

For now, according to IRI’s report, “e-retail models are evolving and long-term winners have yet to be determined.”

Increasing online presence outside of media advertising

One method to help increase sales includes focusing online presence in websites that matter. “It must go beyond media sites to retail sites, particularly Amazon,” the report said.

“Consumers visit these [retail] sites with a purpose in mind—to see the latest trends, products and product reviews, money-saving opportunities and so forth—because they are preparing to make a purchase. As a result, they are more open to buying than they are while they’re on media channels such as CNN.com or even Facebook.”

Additionally, established brands in the brick-and-mortar should look at how indie brands navigate e-commerce, IRI’s analysts argued. Looking at IRI’s data in the 52 weeks ending September 2016, minor brands have a higher share online than they do in brick-and-mortar stores.

“They are effectively engaging energized shoppers, winning in the search arena and thus capturing a disproportionate share of spending,” the report said. “They are driving the change that will define the CPG world of tomorrow.”