While private label's brand share has in fact grown very slightly over the past few years if you exclude milk (more on this later), and there are strong pockets of growth - especially in fresh perimeter categories such as instore meals, chilled pizza and deli items - store brands are not setting the world on fire in the way that many experts were predicting a while back, said Nielsen retail insights consultant Todd Hale.

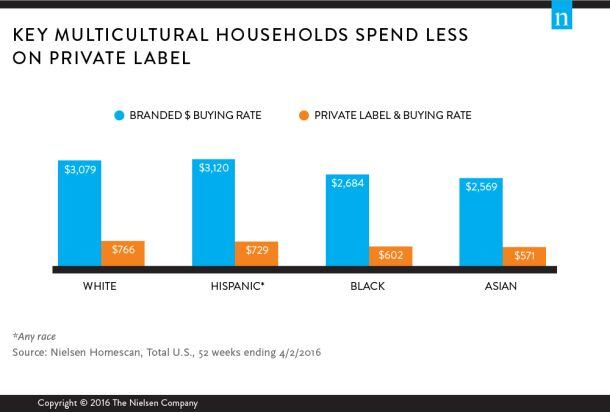

While the improved economy and the fact that some brands may be out-innovating and/or out-promoting private brands factor into the figures, he said, Nielsen Homescan data also shows that Hispanics, Asian-Americans and African-Americans spend more on branded items and relatively less on store brands.

“African-Americans households spend 18% less annually and Asian-American households spend 22% less [than non-Hispanic white households] on store brands."

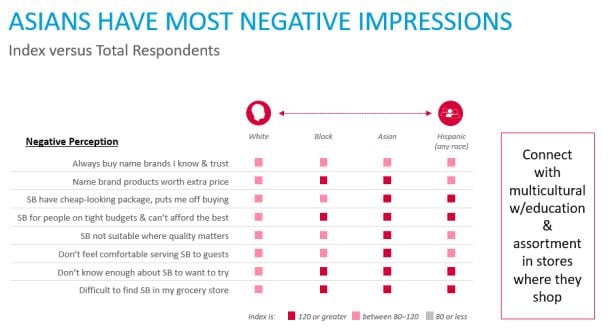

They also view store brands more negatively than white Americans, and that this is something retailers need to address if they want to appeal to the next generation of consumers, he said.

“From a retail perspective I think brands are way ahead of store brands when it comes to multicultural marketing, although it’s a complicated thing to do as all of the ethnic groups we group together [eg. 'Asian'] are themselves very diverse, but brands do seem to be better at winning over multicultural shoppers.

“When you think about ads and websites, if you see people like you, the recall and the likeability scores shoot up, so retailers have to address this with store brands.”

Asian consumers most likely to feel that store brands don’t make the grade

According to survey data from Jan/Feb 2016, he said, Asian consumers in particular are significantly more likely than white consumers to agree that store brands have ‘cheap looking’ packages, are of inferior quality, and are primarily for people that can’t afford to buy brands. They are also more likely to feel uncomfortable serving them to guests.

Hispanic and African Americans, meanwhile, are also far more likely than white Americans to agree that store brands are for people on ‘tight budgets,’ he said.

The figures also partly reflect where different groups of consumers shop, he said, with African American households for example not shopping in the supermarket channel (which has the highest percentage of private label products) at the same rate as white Americans, and over-indexing in drug and c-store channels (where private label penetration is lower).

Amazon has recently started rolling out new private-label food products, with trademarked names including Happy Belly (nuts, spices, coffee - already on the market, pictured left, tea, and cooking oil), Wickedly Prime (snacks) and Mama Bear (baby food - already on the market, and diapers). It has not talked to the media about them, but products on the site thus far have already garnered some very positive feedback.

Private label: Category winners and losers

Drilling down into the data, the categories in which private label’s dollar share of the market grew the most strongly over the past four years were instore meals, refrigerated pizza, fresh desserts, deli salads, refrigerated breakfast entrees, fresh veg and herbs, water, nuts, fresh meat, and coffee, creating big opportunities for retailers to target Millennials in particular, said Hale.

Categories in which private label share declined over the past four years include sugar, soft drinks, frozen poultry, RTE cereal, shelf-stable juices and drinks, baked bread, and shortenings & oils.

However, store brand milk was one of the biggest losers, with a 3.5% drop in dollar share over the past four years - while absolute dollar sales dropped 11.5% in the latest 52 weeks owing to deflationary pressures (although unit sales were pretty flat).

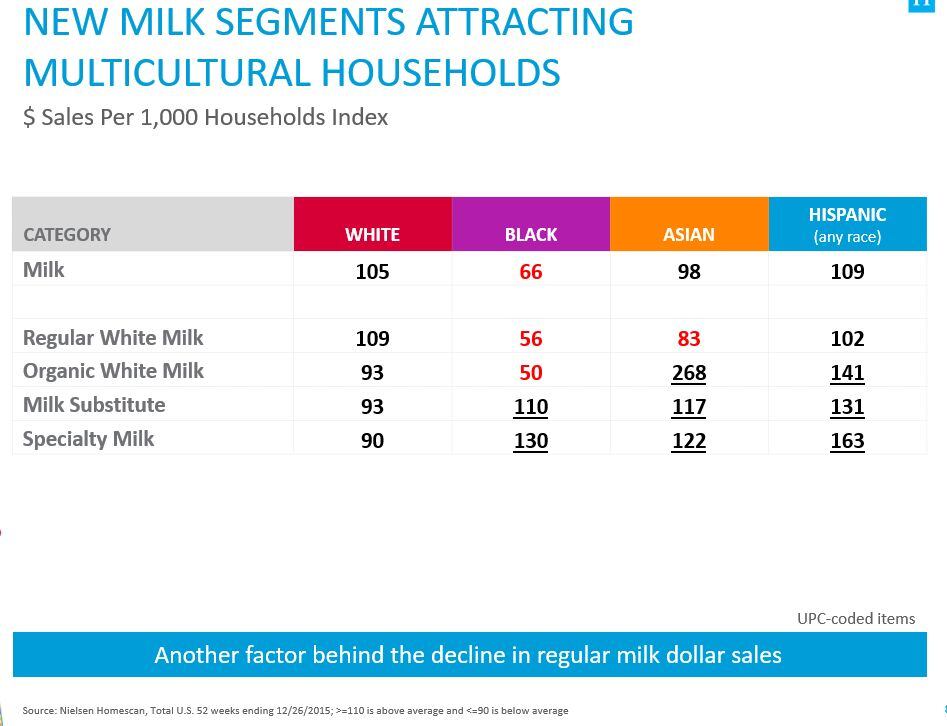

And here again, there are some interesting demographic factors at play, said Hale, with Nielsen Homescan data for the year to Dec 26, 2015, revealing that black, Asian and Hispanic consumers are significantly more likely to purchase specialty milks (eg. lactose-free) or milk alternatives (such as almond and coconut milk), two categories in which more expensive branded products are much more dominant.

Asian and Hispanic consumers also significantly over-index in the organic white milk category (which is again dominated by brands), although African Americans are by contrast less enthusiastic about it than whites, he added.

The good news…

Still, Nielsen research continues to illustrate high consumer interest in store brands, added Hale, with all of the leading retailers viewing their private label offerings as strategic and investing in them accordingly, in part because they offer the chance of higher profit margins, but primarily because they are a means to differentiate themselves and generate loyalty.

More recently, there has also been rapid growth in multi-tiered private label programs (good, better, best) and the development of unique and far more innovative products and packaging that give retailers a real point of difference in the marketplace, he said.

Meanwhile, some retailers are also beginning to put genuine marketing muscle behind some store brand ranges, while Amazon’s move into private label groceries is also likely to have a significant impact on the market in the future, he predicted.

However, it is unlikely that penetration rates will ever reach the 40-50% levels seen in some European countries, where the retail market is far more consolidated and the leading retailers have much more power, he said.

Read more HERE.