On the face of it, nothing good, VP of content management at IRI Carl Boraca told FoodNavigator-USA, with IRI data suggesting that 44% of consumers are likely to cut spending on groceries if gas prices rise by 50c/gallon, while 49% of Millennials - the largest group of c-store shoppers - saying they will make fewer, larger shopping trips to reduce gas consumption.

Conversely, 11% of consumers shop the convenience store channel more frequently during times of high gas prices due to their proximity, although this only tends to benefit stores in urban locations, said Boraca, who has just penned a report: ‘Gas Price Fluctuations Fuel a Convenience Channel Opportunity’.

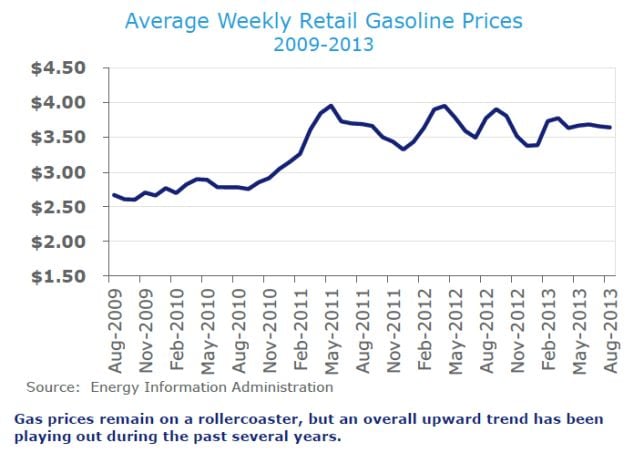

“Since more than 80% of convenience stores sell gas, and changing gas prices affect shopping trips and basket size, convenience store decision makers must develop approaches for rapidly adapting their offerings and promotional strategies in an environment of variable and generally upward trending fuel prices.”

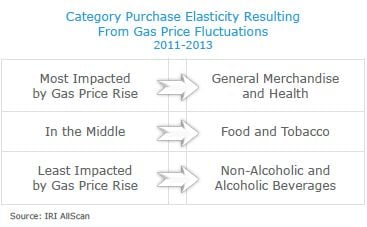

Beverages do not typically see a sharp fall-off in sales when gas prices climb

Typically, when gas prices rise, healthcare and general merchandise categories are impacted the most in c-stores, while beverages do not typically see a sharp fall-off in sales, says Boraca.

However, with 95% of gas-selling c-stores offering pay-at-the-pump options and fuel-to-shopping conversion rates at just 27%, c-store marketers need to work harder to get consumers into the store via outdoor advertising, pump toppers, window displays, stacks/displays outside the store (soda pallets etc), and ad or video displays on top of pumps, says Boraca.

“Product growth is twice as high when outdoor causal advertising is used compared to when it is absent across a variety of key convenience categories.”

Outdoor ads are underutilized by c-store marketers

However, outdoor ads are massively underutilized by c-store marketers, he says, while less than 5% of c-stores’ all commodity volume (ACV) is supported with outside displays in the key summer months.

So why aren’t more c-stores using these approaches, especially given the potential pay off?

(Fill-up motivated trips contribute $19bn+ to c-store revenues each year, and IRI estimates that a one point increase in the current 27% conversion rate would bring more than $700m to the industry’s bottom line in a single year?)

“One reason you don’t see more products stacked outside the store is because owners might be concerned about theft, but on the plus side, the use of pump toppers has been growing”, says Boraca.

Online marketing

As for wooing Millennials, marketers at some of the larger c-store players are also getting more creative, he adds, and some chains have been test-marketing tools that highlight promotions or other offers on the mobile phones of people within a certain radius of the store.

While passers by might not be lured in, those standing at the pump for a couple of minutes checking their messages while refueling are a more captive audience, he suggests.

“Anecdotally, we’re hearing some positive things about these initiatives, but I’ve not seen any hard data yet.”

Chilled beer, wine, healthy snacks, fresh produce

As for the longer-term prospects for the c-store channel - which was the only food retail channel to post positive growth in unit sales and dollar sales in 2012 - the key will be whether operators can find sustainable growth beyond cigarettes, and see off growing competition from drugstores and dollar stores, says Boraca.

“Electronic cigarettes are helping a bit. While it’s off a small base, growth rates in c-stores are in the triple digits. But there are lots of other opportunities we see in healthy snacking, cold beer and wine, and more fresh food and fresh produce.”

Click on the link below to see detailed stats from IRI on the US convenience store market.

Where are the biggest growth opportunities in the US convenience store sector?

Click on the links below to see the latest data on the broader US food retail market.

The future of US food retailing: 'The pendulum is swinging back to smaller store formats'

The future of food retail: Dollar, natural, fresh, limited assortment and e-commerce?