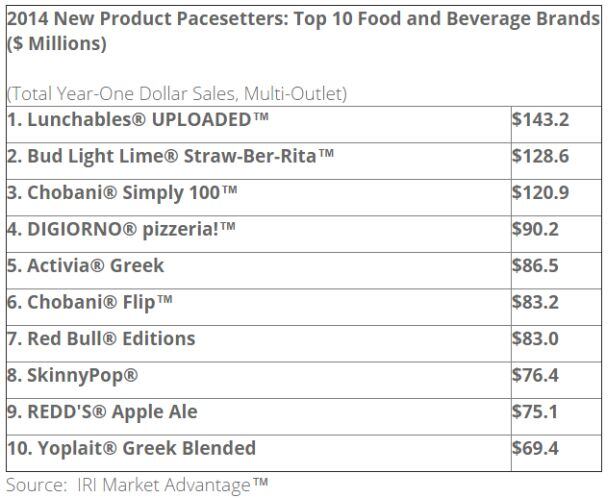

And if Chobani in particular has had its fair share of negative press this year, it can take some satisfaction in securing two spots in the top 10 and a place in the 'Rising Stars' ranking - which predicts which products might be the pacesetters for 2015.

The report looks at year one multi-outlet* dollar sales for brands that completed their first year of sales in 2014. The clock starts ticking "when a product hits 30% distribution and lasts 52 weeks", explains IRI, so would cover, for example, sales of a brand that hit 30% ACV in September 2013 and completed its first full year of sales in September 2014.

According to these criteria, Kraft's Lunchables UPLOADED was the clear #1 with $143.2m in retail sales in its first full year on shelf, followed by Bud Light Lime Straw-Ber-Rita at $128.6m. However, four Greek yogurt brands hit the top 10: Chobani Simply 100 at $120.9m, Activia Greek at $86.5m, Chobani Flip at $83.2m, and Yoplait Greek Blended at $69.4m.

These products will spur volume growth without sacrificing margin

Other notable successes – which didn’t make the top 10 but were high up the list – included restaurant crossover brands such as Starbucks Discoveries and Starbucks Iced Coffee, Olive Garden Signature Salad Dressing, Red Lobster Cheddar Bay Biscuit Mix and Dunkin’ Donuts coffee creamer.

“Despite market challenges, best practice innovation strategies are allowing CPG marketers to break through,” said Susan Viamari, editor, Thought Leadership, at IRI.

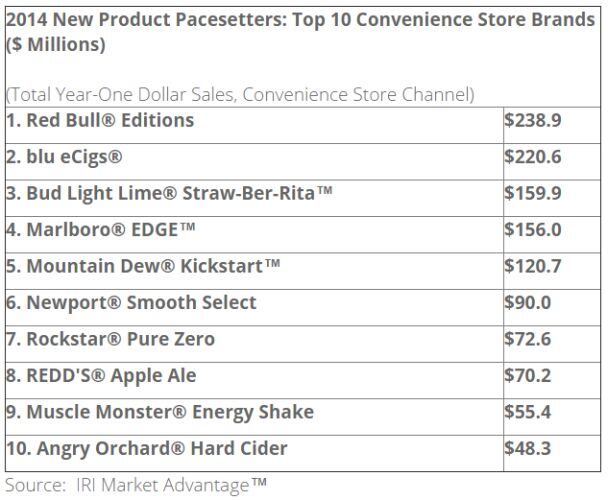

In the convenience-store arena, meanwhile, five brands notched up year-one revenues topping $100m, including Red Bull Editions and Mountain Dew Kickstart, said Viamari.

“Careful execution throughout the product development cycle produces consumer-centric products that are engaging and exciting to consumers. These products will spur volume growth without sacrificing margin, and they will protect and grow brand equity today and in the future.”

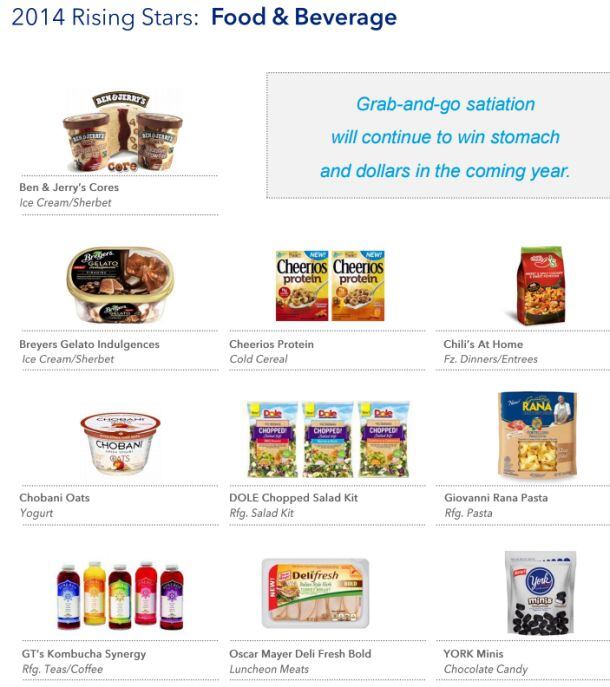

Rising stars - which IRI defines as promising new brands that have "started their year-one, based on above-referenced 30% ACV, but have not yet finished the year" - included Ben & Jerry's Cores, Breyer's Gelato Indulgences, Cheerios Protein, Chili's at Home frozen entrees, Chobani Oats, Dole Chopper Salad Kits, Giovani Rana Pasta, GT's Kombucha Synergy, Oscar Mayer Deli Fresh Bold and York Minis.

Viamari told FoodNavigator-USA: "We determine Rising Stars winners by projecting their year-one sales based on performance to date at the time of the analysis."

Consumers want quick, healthy, portable satiation

Asked whether the data suggested the Greek yogurt category has yet to peak, she said: "There is certainly still a lot of interest in Greek yogurt... there are several more big hits this year. Consumers want quick, healthy, portable satiation and this type of product provides it.

"But we’re also seeing action in other types of yogurt. For instance, Noosa Yoghurt, an Australian, made Pacesetter status this year. Like Greek yogurt, it’s a high-protein, healthier-for-you snack/meal that can be easily eaten on-the-go. But, it is a different type of yogurt in terms of texture and taste."

*IRI Multi-outlet data covers US grocery, drug, mass Including Walmart), dollar, club (including Sam’s & BJ's), and military commissaries, but NOT convenience stores or online sales.

Click HERE for more details.