One category is way out ahead of the rest globally and that is the one that delivers the most obvious ‘feel the benefit’ payload – energy drinks.

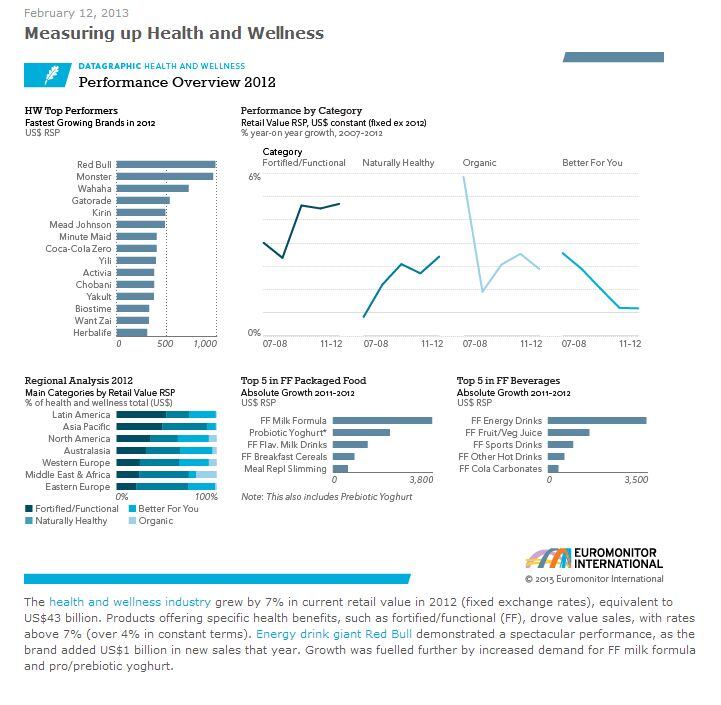

In a poll of the fastest growing health and wellness (H&W) brands globally Euromonitor International found Red Bull and Monster way out ahead of the rest – with each putting on about $1bn in sales in 2012. Red Bull sells around 5bn cans of its premium-priced, caffeine and taurine containing energy drink per year.

Notable too is how much faster 'functional-fortified' products are growing than 'naturally healthy', 'organic' or 'better for you' foods in a global H&W sector that itself grew at 7% in 2012 - about $40bn.

Behind Red Bull and Monster on the Euromonitor list is Chinese dairy brand, Wahaha, growing at about $750m for the year. Then its sports perennial Gatorade (Pepsi), which grew by just over $500m.

The rest including Coca-Cola Zero, Danone Activia, Yakult and new probiotic yoghurt player, Chobani, grew by under half a billion.

Energised

What is apparent from the list is the force of the ‘feel the benefit’ idea with probiotics and energy dominating.

Probiotics that – despite an EU claims ban – consumers have long trusted to improve their digestion.

Trust in energy drinks – again refuted on taurine-energy links at least in the EU (caffeine claims are looking more likely) – to do exactly what they say on the their slimline tins: Give energy.

That said 2012 was tough in many ways for both sectors with the regulator attacks and, for energy drinks at least, links to serious adverse events including deaths, usually due to over or inappropriate consumption.

Could any of the concerns circling the category dent its rise in 2013? Time will tell, but Monster in the US recently announcing voluntary re-categorisation as a beverage from a dietary supplement and bringing caffeine labeling into play, shows the industry is making moves to respond to some of the ‘irresponsible’ criticisms levelled at the sector.

The second fastest growing H&W beverage category in 2011? Fruit and vegetable juice. How will that perform in 2013? Stay tuned...