This is particularly evident in markets such as sports nutrition, healthy snacks and yogurts, where manufacturers of ‘regular’ foods and sports and fitness products are increasingly seeking to appeal to weight conscious shoppers, US analyst Virginia Lee told FoodNavigator-USA.

“The US weight management market is facing increased competition from standard foods that Americans are turning to to help with weight management.

“For example, Greek yogurt makers have been able to appeal to weight-conscious women by positioning the thick, protein-rich yogurt as offering satiety, while newer products such as Yoplait Greek 100 offer the additional benefit of low calories.

“Active men also like the high-protein concept of Greek yogurt as it provides fuel for building muscle.

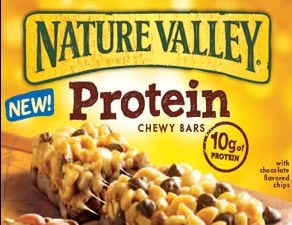

“Snack nuts makers have also benefited by emphasizing the high-protein nature of their products, and manufacturers of snack bars are introducing more high-protein products that blur the line between snack bars and meal replacement products.”

Accentuate the positive: Protein, fiber, energy, satisfaction…

And while obesity rates remain sky-high (35% of US adults are obese), messages about ‘dieting’ and self-denial are not inspiring consumers, adds fellow analyst Matthew Hudak: “Manufacturers are definitely moving more toward positive messaging, and protein has become a very big part of that.

“Snack bars, snack nuts, weight management, and convalescence products being introduced are consistently higher in protein and are all highlighting their protein content on the packaging."

Meanwhile, as Datamonitor innovation insights director Tom Vierhile noted earlier this week, the word ‘diet’ is “pretty rarely seen now for weight management or for snack bars”, says Hudak.

As for other on-pack claims, he says, “protein does well, seemingly better than fiber… ’Fuller for longer’ is not used as much as ‘satisfying’, and again I think this is part of marketers trying to get away from the idea of a diet, and more toward the idea that weight loss can easily fit in to daily life.

“Lower in fat or reduced sugar are claims that, while still useful, are not advertised quite as much, as it seems lower calorie advertising or satisfaction advertising works a little better at getting across a friendly idea of weight loss.

“In addition, the claim of ‘added energy’ does very well as it gets across the idea that you can be more active using the product, which would obviously help with weight loss.”

Cleaner labels

Meanwhile, shoppers in the meal replacement or weight management aisles are becoming more concerned about clean labels and natural claims, says Lee.

“They are increasingly reading labels and seeking out ‘simpler’ products with a shorter ingredients list that does not contain artificial sweeteners, preservatives or flavors.

“One example is Abbott Laboratories’ Perfectly Simple by ZonePerfect limited ingredient nutrition bars that contain very few ingredients and is also certified gluten-free.

“The new South Beach Diet Snack Smoothie drinks tout ‘no artificial flavors or sweeteners’ as well as a 100 calorie count.

“CytoSport’s new Muscle Milk Evolve protein drink is targeted at female health enthusiasts with the message of natural (sweetened with stevia, cane sugar and monk fruit), functionality (Tonalin CLA [conjugated linoleic acid] that may help muscle to burn fat), food-minus (gluten and lactose-free), and health benefits (12g protein, 20 vitamins and minerals).”

Many of these ingredients are considered to be too niche with a limited consumer following

Asked whether functional ingredients used in dietary supplements are making headway in foods and beverages, there have been pockets of success for ingredients such as CLA (see above), but in general, the answer is no, said health & wellness analyst Diana Cowland.

“Many of these ingredients are considered to be too niche with a limited consumer following”, although there have been some successes in beverages, she observes.

“Green tea continues to perform well, sales reached $24.8bn in 2012. A less conventional fortification in green tea was the launch of Nature’s Farm green tea with pine extract.”

However, with on-pack claims being increasingly scrutinized by regulators, “without strong scientific studies behind these ingredients, their use may have a limited time span and a declining trust among consumers”, she predicts.

A growing market, but one with limited product development?

According to Euromonitor International’s data, the retail value of the US weight management market grew by nearly $4.5bn between 2007 and 2012 to reach $46bn, says Cowland, although there has been “limited product development” over the period, she argues.

The top brands are Coca-Cola Zero - which garnered a 2.2% share of the US weight management market in the US in 2011 compared with 0.9% in 2007 - ConAgra’s Healthy choice range, and Kellogg’s Special K, which posted a 22% compound annual growth rate over 2007-2011.

“Products associated to weight loss programmes where consumers have invested their time and money, such as Herbalife, also continue to see strong sales. If consumers are witnessing positive results from these programmes then they are more likely to continue to purchase these products outside of their subscription packages.”