“We’ve always known food and beverage is major in Ontario—it produces more revenue than the auto industry,” Sue Bennett, director of university and community relations at the University of Guelph (part of the Ontario food cluster), told FoodNavigator-USA. “The province, which is Canada’s largest, produces more than 200 types of agricultural commodities. So we looked at different food cluster models around the world to see if we had the firepower to develop an idea here where companies, organizations and universities get together and supported the development of the food industry.”

Representatives of Ontario’s agri-food cluster attend three international food shows a year (this year, it was SIAL Brazil in São Paulo; ANUGA in Cologne, Germany; and PLMA in Chicago), where they pursue leads researched by consultants ahead of time to see if they appear “investment ready.” Bennett said the group has a number of prospects lined up for meetings before the end of the year.

“Essentially, the consultants look at the capitalization of the companies and see if their products are a match for Ontario—it’s a lot of work,” she said. “Here in Ontario we also have to watch the selection of companies because we are supply managed in the dairy and chicken sectors. So if a cheese company wanted to move in, they would have to buy a quota and get on the list.”

She noted that companies specializing in bakery, confectionary and specialty products are an ideal fit, given that the province’s biggest agricultural industry sectors are in bakery and cereals. Currently, Ontario’s agri-food cluster also consists of Heinz Co. of Canada, Labatt Breweries of Canada, Canada, McCormick Canada, Cargill Canada and George Weston Ltd.

Why Canada?

Canada is the first G-20 member to have made itself a tariff-free zone for manufacturers by eliminating tariffs on inputs, machinery and equipment. Combined federal and provincial credits can return to foreign investors up to 30% of their R&D investment in Canada on average.

The corporate tax rate is 25%, compared to 35% in the United States, and the banking system is stable and much more simplified than the US, based on Canada’s Big Six: the National Bank of Canada, Royal Bank, The Bank of Montreal, Canadian Imperial Bank of Commerce, The Bank of Nova Scotia and TD Canada Trust.

More than 80% of all research and development in Canada is done at universities, and Ontario alone invests roughly $88 million annually in University of Guelph innovations, with a return of about $1.15 billion in economic impact across the province.

“That’s probably unique to any of the other food clusters in North America,” Bennett said, “that the University of Guelph has been part of the team since the start.”

Over the past five years, agri-food companies from 14 countries have invested $24 million in the U of G’s research capabilities, with US and German firms leading the charge.

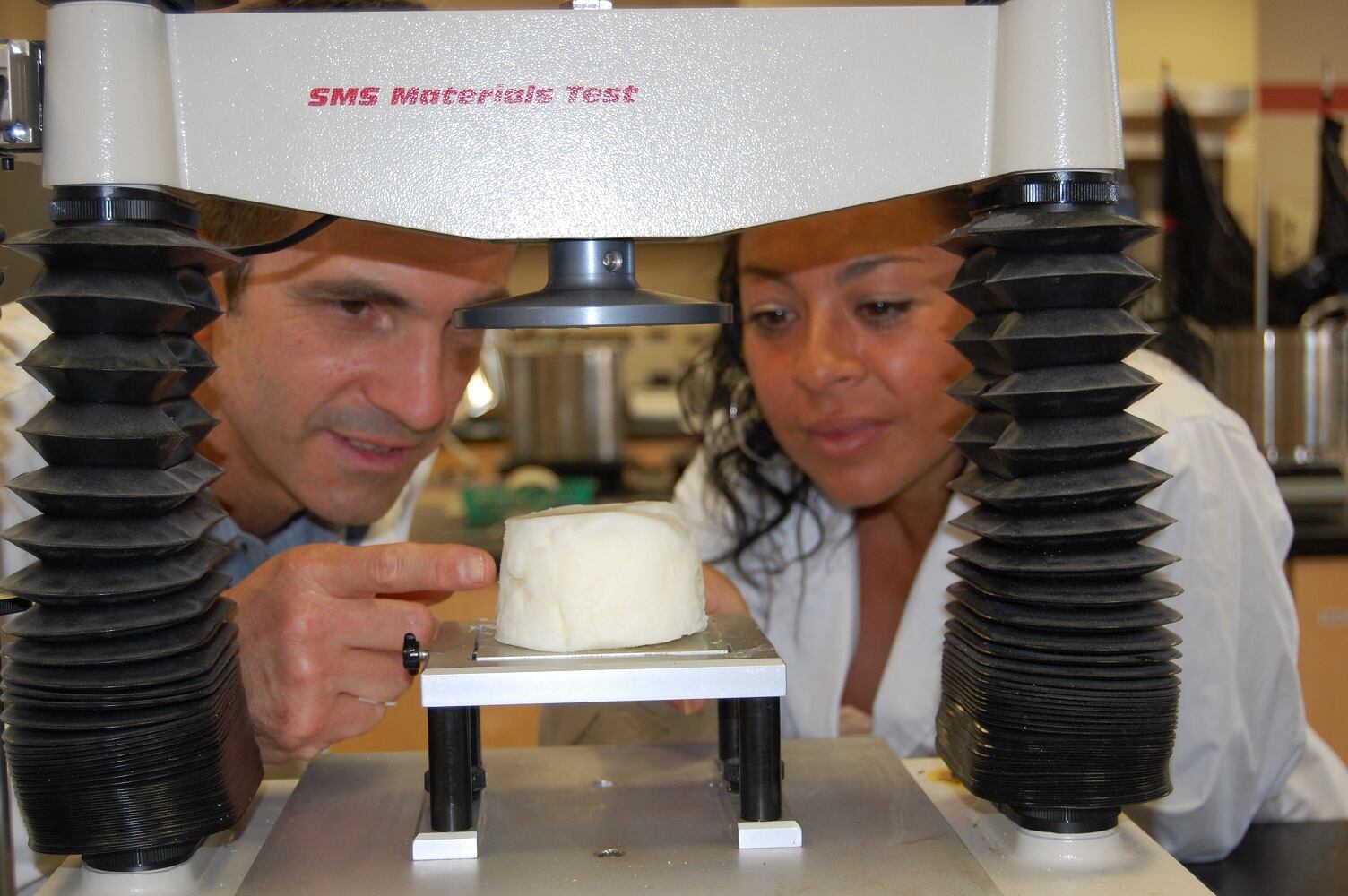

Recent U of G innovations include zero-trans, low-saturate roll-in shortening for healthier croissants and danishes; an improved WOW (Water-Oil-Water) double emulsion system without the use of heat for beverages and chocolate bars; and cheese products made from mixed soy and dairy proteins to achieve health benefits and cost savings.

“The U of G’s Industry Liaison program is the best way for global agri-business companies to access our R&D expertise and resources,” said Bennett. “Working closely with over 800 researchers and 33 academic departments, our industry liaison team will quickly find the most appropriate resource and leverage corporate R&D funds at the same time.

“If a company has an address here, provincial and federal Canadian governments that support industry-sponsored research can leverage industry R&D dollars 2:1 or 3:1, up to 8:1,” she added. “There’s lots of access to R&D here.”

The Ontario agri-food cluster cities and regions include the cities of Brantford, Hamilton and London; counties of Elgin and Middlesex; the Greater Toronto Marketing Alliance, Guelph, Niagara Region, Southwestern Ontario Marketing Alliance, Waterloo Region and Windsor-Essex. The cluster also partners with Ontario’s Ministry of Agriculture and Food and Ministry of Rural Affairs; Agriculture and Agri-Food Canada (AAFC) and Canada’s Department of Foreign Affairs, Trade and Development.