After years of largely ignoring the dairy export market, the US dairy industry is growing exports at an astounding pace.

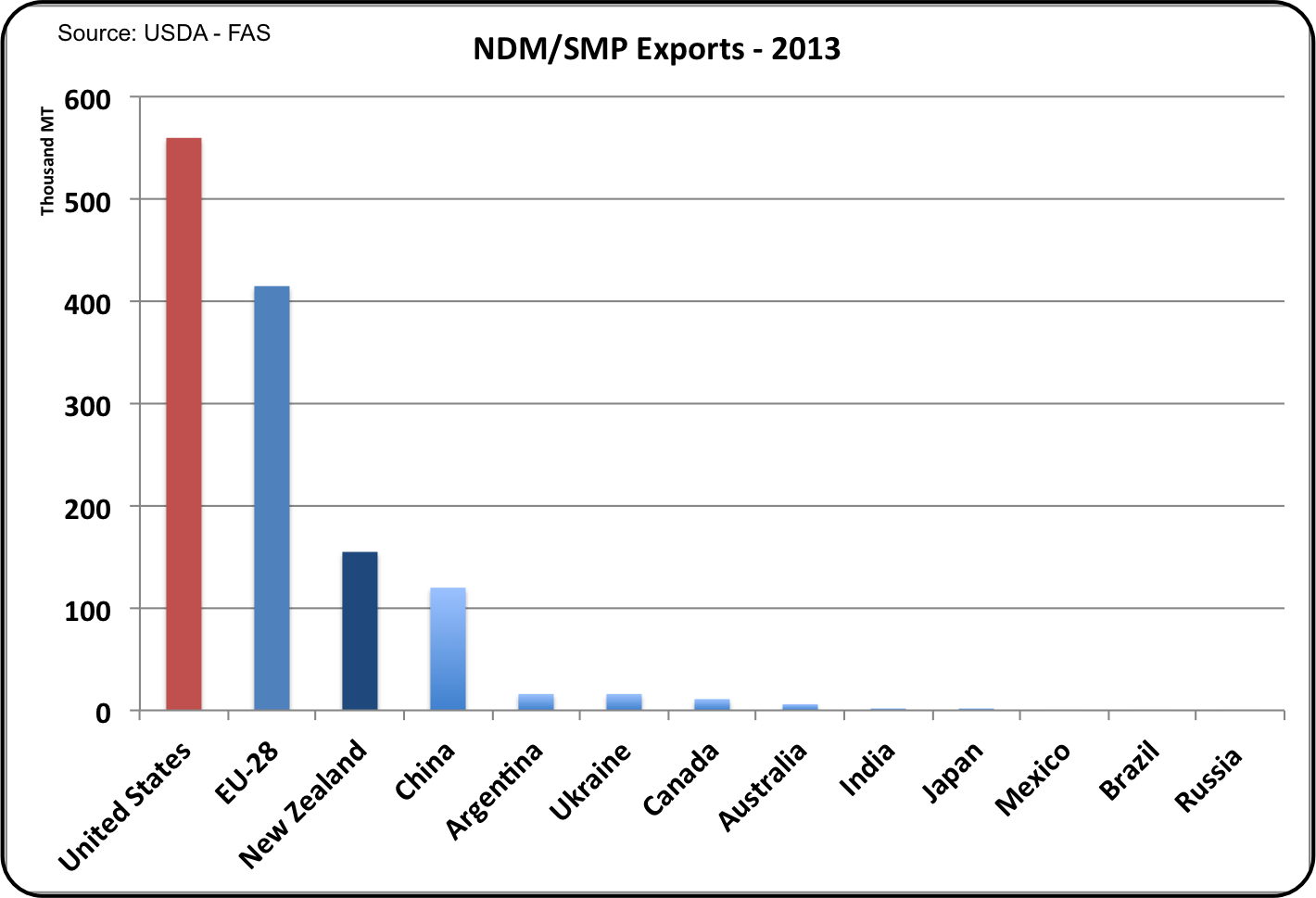

In 2013, for the first time, the US became the world’s largest exporter of NDM and SMP.

NDM and SMP are the largest export products for the US dairy industry, with 554,752 tonnes exported in 2013.

Although 2014 started below the pace of 2013, it has picked up speed and March exports totaled 51,620 tonnes, above the pace of 2013.

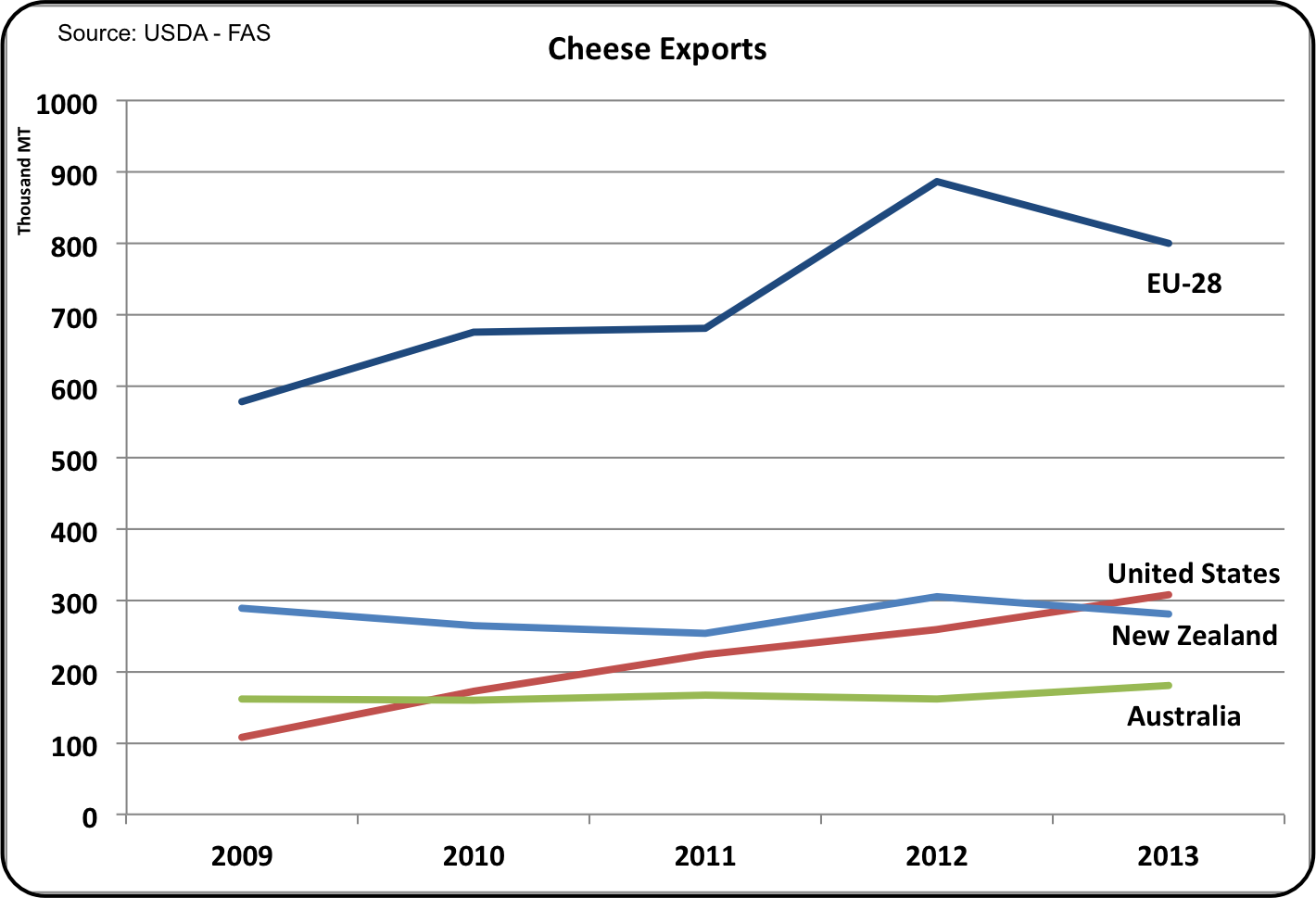

Cheese exports are the next largest export item with 2013 exports of 316,558 tonnes, representing 6.3% of cheese production.

The US milk pricing system is largely based on the wholesale price of cheese.

Increased exports can have a big impact on cheese prices and therefore US producer milk prices.

So far in 2014, cheese exports are up 42% over 2013, so inventories are low and in April, cheese prices as measured by the National Agricultural Statistical Survey (NASS) were at an all time high.

The European Union (EU) dominates cheese exports on the global market, but in 2013 the US became the worlds second largest cheese exporter.

This still pales in comparison to the EU exports of cheese, but with a growth rate of 42%, the US is becoming a world player.

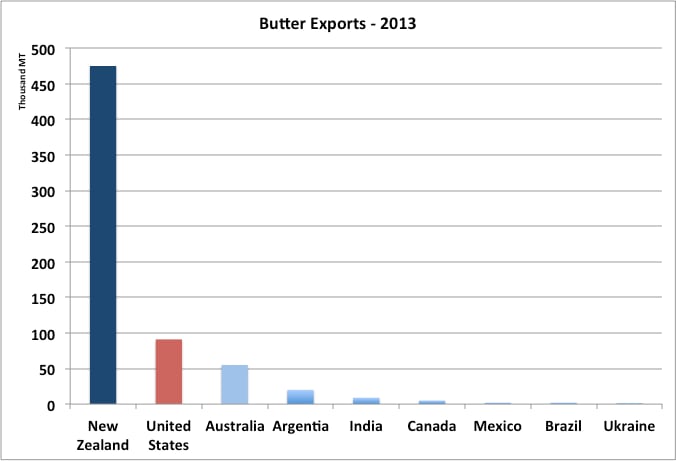

Butter exports are dominated by New Zealand with exports of 475,000 tonnes in 2013.

The US was in second place with a much smaller 91,000 tonnes exported.

The US is a very small butter exporter compared to New Zealand. However, in the first quarter of 2014, US butter exports were up 115%, more than double 2013 levels.

The whole milk powder (WMP) international export market is significantly larger than the NDM/SMP market.

New Zealand also dominates this market with exports of 1,275,000 tonnes in 2013. By comparison, the US exported only 12,000 tonnes. There is no domestic market in the US for WMP and one buyer, China, dominates the international import market.

Because of this, US dairy processors have been reluctant to enter this market. However, while still small, US exports are up 236% over the prior year for the first quarter of 2014.

The demand created by these exports is driving producer prices to record levels in the US.

When this happens there is typically a significant growth in herd sizes and increased milk production. If the international market cannot absorb this new volume, prices will plunge as they did in 2008.

It’s a little like running on a treadmill that continues to run faster and faster.

The question this time is, will the US dairy export markets continue their rapid growth, or will there be a retrenchment of exports and producer milk prices?

John Geuss (left) is the editor of US dairy commodities blog, MilkPrice.

For John's detailed month-by-month examination of American dairy commodity movements, visit MilkPrice.