While there are many factors behind the lackluster performance, writes senior analyst Nick Fereday in his report, ‘A Nation of Suckers’, the primary problem appears to be that chewing gum is just not as cool as it used to be.

Teenagers, historically the biggest consumers of gum, says Fereday, are losing interest: “We are witnessing a cultural shift where chewing gum along with other habits such as smoking are no longer viewed as cool.”

We are witnessing a cultural shift where chewing gum along with other habits such as smoking are no longer viewed as cool

So how bad is it?

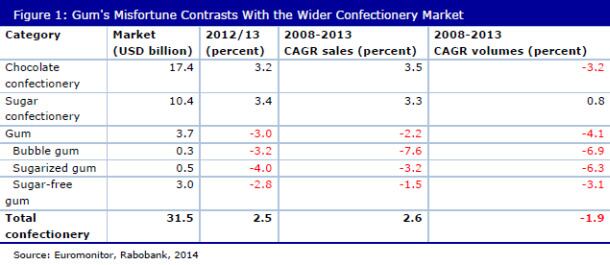

According to the sales data, pretty bad, and getting worse, notes Fereday, who says the decline accelerated in 2013 with sales down 3% and volumes down 5%, driven by a dismal performance across every category (bubble gum sales -3.2%, sugared gum - 4%, sugar-free gum -2.8%).

“Sugar-free gum volumes turned negative in 2011 and have been falling faster than sugarized gum sales ever since.”

Meanwhile, IRI data for the first three months of 2014 show sales were down almost 5% compared to the same period in 2013, driven by weak performances from market leaders Mondelez International (Trident, Dentyne, Stride) and Mars (Orbit, Extra, 5, Eclipse, Doublemint). However, both Hershey and Perfetti bucked the trend, with the Ice Breakers and Mentos brands both delivering double digit growth, he says.

Too many new launches have left consumers dazed and confused

But what’s behind this dismal performance in gum? Four key factors, argues Fereday:

1 - Teenagers are losing interest: “Back in the day, Bob Dylan sang, ‘Don’t wanna be a bum, you better chew gum,’ but now it seems the opposite holds.”

2 - The ‘ick’ factor: Consumers are suspicious of aspartame and partially hydrogenated oils, notes Fereday. However, the success of PÜR gum, which uses xylitol (from NON-GMO corn) as its sweetener but keeps an artificial gum base, “reminds us that not all artificial ingredients have to be removed” (sales at PÜR gum - launched in 2010 by entrepreneur Jay Klein - have been growing at about 200-300% per year each year since 2010).

3 - Overblown brand and flavor extensions: “Too many new launches have left consumers somewhat dazed and confused when it comes to gum choices.”

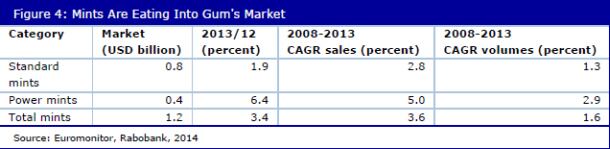

4 - We’re eating mints instead (which are more discreet than chewing gum, and leave no waste): “Mint sales have grown by almost 20% over the past five years with power mints growing by 27% to $435m (up 6.4% in 2013 alone) and standard mints growing by 15% to $810m .

”Savvy mint marketers have matched gum in terms of selling us fresh breath, oral hygiene and low calories and then gone the extra mile by trumping gum on convenience and value.”

All-day grazing culture presents more opportunities for breath-freshening

As to whether the category’s big guns can salvage the situation, Fereday says the jury is out, but he has the following suggestions for how they can pull themselves out of the funk:

Go all - or at least more - natural: Manufacturers should explore using natural sweeteners such as stevia, erythritol and xylitol, experiment with natural gum bases such as chicle, and eliminate more artificial-sounding ingredients that consumers don’t want to see on pack, says Fereday.

Sell the health benefits: “Tout the oral health and hygiene benefits of chewing gum – saliva production, tooth decay prevention, stress release, and focus.”

Make it fun: “Promote the fun aspects of chewing gum to the youth market.”

Fresh breath: “Today's culture of snacking and all-day grazing offers many opportunities for post-snack breath freshening.”