The yogurts are the third product to come out of a partnership between Dannon and Starbucks-owned Evolution Fresh, with ‘handcrafted’ smoothies combining Dannon’s Greek yogurt with Evolution Fresh’s cold pressed fruit and veg juices hitting Starbucks stores in March, and Greek yogurt parfaits arriving in May.

While at first glance the new fruit-on-the-bottom yogurts might appear similar to Dannon’s Oikos range, the formulations are quite different, said VP marketing and innovation Jeff Rothman, who noted that they use different cultures and have a milder flavor than traditional Greek yogurt, which can be quite tart.

They also have more fruit and no added color, flavor, preservatives or modified starch, but still retain a 45-day shelf life, said Rothman, who was speaking to FoodNavigator-USA as Dannon unveiled a digital marketing campaign to promote the new yogurts.

“We were preparing ourselves for a challenging sell in to the retailers as there are so many Greek yogurts in the marketplace, but retailers were very enthusiastic. Safeway and Kroger were so excited about the product that they accepted it in May rather than waiting for the traditional July/August window [for resetting shelves].”

The enthusiasm is in part due to the appeal of the Evolution Fresh brand and the Starbucks effect, he said, noting the success of other Starbucks products in the grocery retail channel such as Frappuccino. However, buyers also recognized that “the product truly is different”, he claimed.

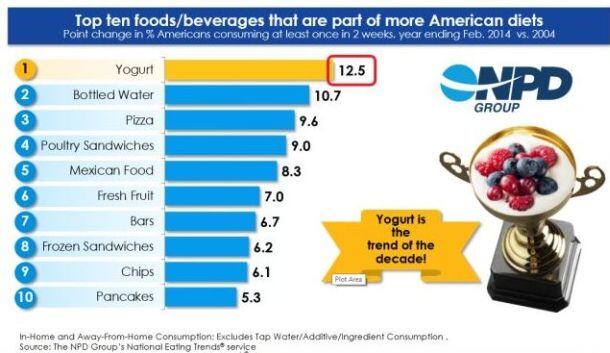

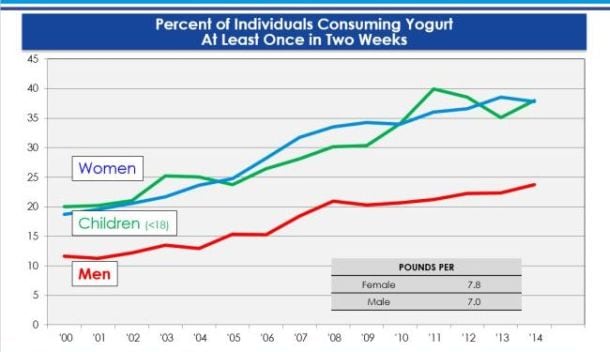

What we see in totality is a category (yogurt) that is still highly underdeveloped in the US

As for the argument that we have hit peak Greek, Rothman begged to differ: “Greek was growing at an explosive double digit rate for several years, and this year the growth has slowed down to single digits. But it’s still growing at a healthy rate and the majority of growth in the yogurt category is still coming from the Greek sub-segment.”

Retailers, meanwhile, are still allocating more shelf space to yogurt, he added. “At the last reset the data that I saw showed an increase in linear footage from around 17.5ft on average to over 18 feet.

“What we see in totality is a category that is still highly underdeveloped in the US. Per capita yogurt consumption is still one fifth what it is in some European countries.

“We anticipate that the yogurt category will grow in mid to high single digits in the coming years driven by increased investment and space from retailers, innovation, and continued education of the American population about the health benefits of yogurt.”

The lion's share of the growth is within the Greek segment

IRI InfoScan data shows that the total yogurt category grew 7.7% in 2013, 3.7% in 2014 and year-to-date is growing 2.4%, said Dannon's senior director of public relations, Michael Neuwirth.

He added: “Within that, the lion's share of the growth is within the Greek segment and in particular the light sub-segment (e.g. Light & Fit Greek, Oikos Triple Zero).”

Asked how Dannon was performing relative to its major competitors (General Mills/Yoplait and Chobani), he said: “We do not release sales data by business unit or brand, however, I can tell you that year to date our business is growing at or faster than the rate for the yogurt category.”

Triple Zero performing ‘at or slightly above expectations’

Greek yogurt accounts for roughly 48% of dollar sales in the overall US yogurt category, said Neuwirth, adding: “It is worth noting that Danone [Dannon’s parent company] is the market leader by a significant margin - roughly 34% of the total market - and the leading maker of Greek yogurt as well.”

Asked about the success of recent introductions, Neuwirth admitted that the pudding- and cheesecake-inspired Dannon Creamery range – the company’s first new brand in the US since Oikos - had "not achieved the ambitious distribution or velocity levels we initially anticipated".

However, Oikos Triple Zero - a new high-protein Greek yogurt sweetened with stevia with ‘zero added sugar, zero artificial sweeteners and zero fat’ – had “performed at or slightly above expectations”.

Asked about the Evolution Fresh products, he added: “We don’t have any hard numbers from Starbucks to share but I can tell you that anecdotal feedback has been very positive.”