According to Catalina’s analysis*, revenues for the top 100 brands at grocery, drug and mass stores within the Catalina network (encompassing well over 30,000 leading food, drug, mass, and convenience stores nationwide) declined 0.8% in the year to June 30, while dollar sales for all brands and categories within the Catalina network were up 6% over the same time period.

Almost two thirds (62) of the top 100 brands saw declining revenues, with an average decline of 4.4%, while for the 38 gainers, the average growth rate was 5.5%.

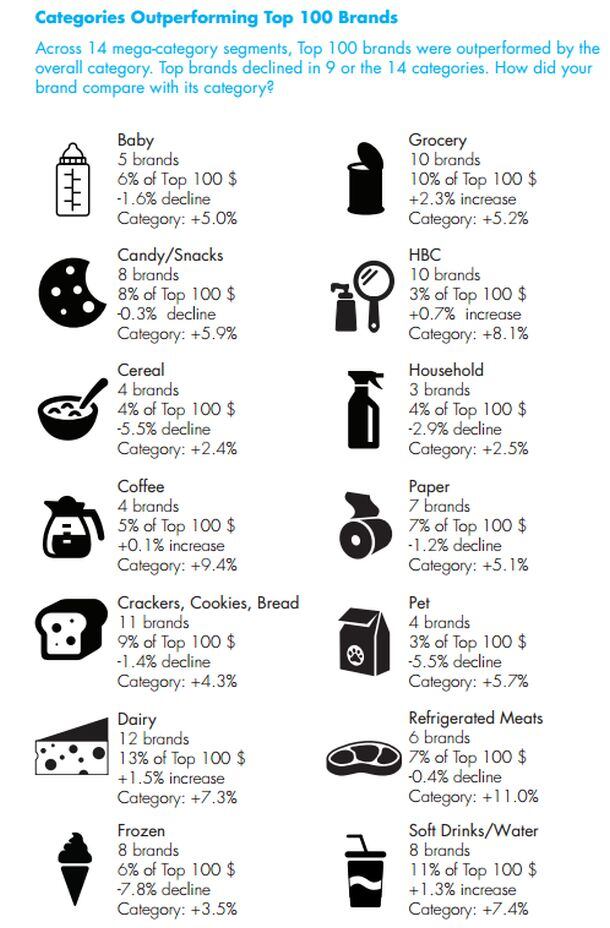

“Across all 14 mega-category segments in which the Top 100 compete, category growth significantly outpaced the performance of Top 100 brands,” observed Catalina, which said big legacy brands are struggling in an environment characterized by “continued diversification of consumer preferences, proliferating product and brand choices, and media fragmentation”.

It added: “Ninety of the top 100 brands also lost category share during the 52-week period.”

TABS Group: We’re really talking about a very lethargic sector in decline on a transaction basis

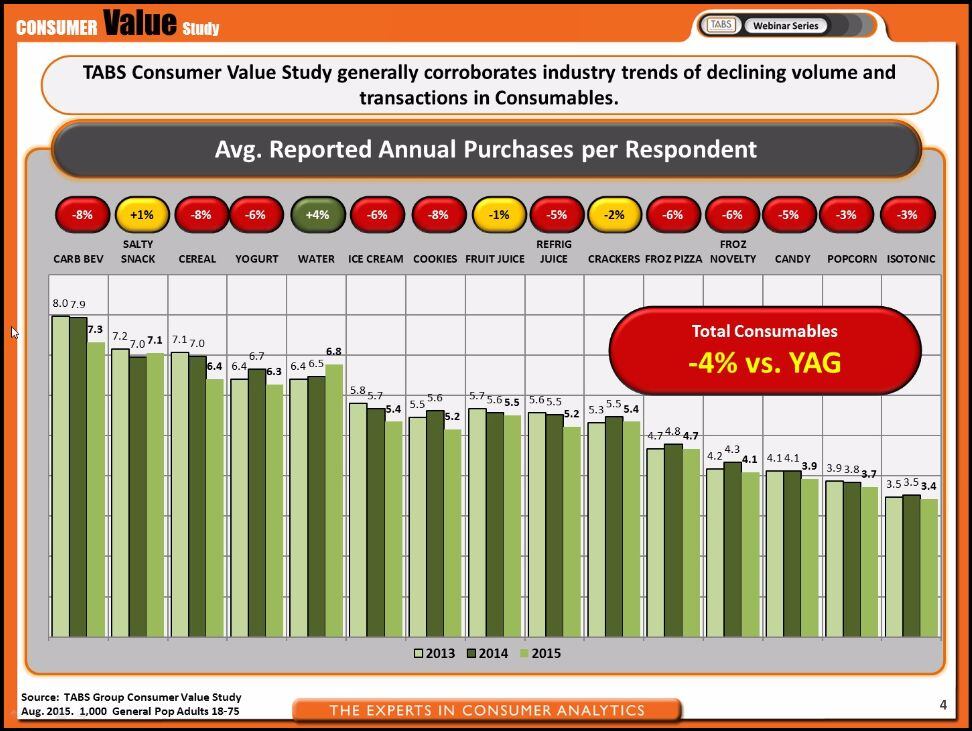

In a webinar broadcast on the same day Catalina released its report, Dr Kurt Jetta, founder and CEO of CPG analytics firm TABS Group, said consumer survey data commissioned by TABS Group revealed that transactions across 15 key consumables categories were down 4% year on year.

While the survey - which TABS Groups runs every year - is based on average reported purchases by 1,000 shoppers (how often do you buy cereal?), it closely mirrors scanner data, which shows that many retailers such as Walmart are experiencing fewer shopping trips, and that much of the grocery market is flat or in decline, said Dr Jetta.

“We’re really talking about a very lethargic sector in decline on a transaction basis. This is one of the most under-reported stories in our industry.”

Households with kids are driving volumes in consumables, but this is a declining demographic

So what’s going on?

The trend is in part a reflection of the fact that consumers are diverting cash they used to spend on CPG goods to electronics and durables.

However, in most of the categories studied, said Dr Jetta, the drop off in transactions was in large part explained by a drop off in activity from heavy buyers, notably households with kids, which drive the bulk of the volume in many of the categories in question (eg. carbonated soft drinks, cereal).

“33% of cereal buyers purchased cereal more than 12 times a year (ie. at least once a month). 100% of the change in cereal transactions was as a result of a lower number of these buyers compared with 2014.”

People are chasing niches at the exclusion of innovation and marketing to the mainstream

But as anyone that’s taken a look at the census data can observe, the percentage of households with children is falling, while the number of single person households is on the rise, he said.

But this doesn’t mean that CPG marketers should stop marketing to households with kids – traditionally the lifeblood of the industry – and focus all their efforts on wooing millennials, chasing niches in ‘sexy’ areas of the market such as organics and ditching traditional promotional tools in favor of digital coupons, he argued.

“There is just an obsession with millennials in this sector, which are an important demographic, but people are losing perspective, misallocating marketing dollars and chasing niches at the exclusion of innovation and marketing to the mainstream; millennials only account for 14% of total sales of consumables while households with kids is more than 50%.”

Organics still niche

As for organics, while sales are growing, they still account for a very small percentage of overall sales of consumables, he added, while online shopping, another area that is getting a lot of media attention, still accounts for less than 2% of category sales.

What promotional strategies work the best?

Deal tactic tips from TABS Group founder Dr Kurt Jetta:

- % Off: Go big, or go home… If you're not prepared to offer at least a 20% discount, then don't bother making one at all.

- BOGO A powerful tool, but not nearly so as offering a percentage off.

- Net Price after FSI (free-standing inserts): You need to start small and follow its progress closely.

- $ Savings: Offering $1 off here, $2 off there is not nearly as effective as the above promotion types.

- Multiple purchase requirements: Forcing the consumer to buy 2, or 3, or more to receive any discount is … generally done to achieve a short-term increase in volume, but there's just not a lot in it for the consumer.

- Buy 2, Get 50% off: Not an effective promotion… it essentially amounts to a gimmick.

The issue isn’t too much trade spending but ineffective trade spending

However, much of his seminar was focused on trade spending and promotional tactics, with many shoppers becoming disengaged, not because they don’t respond to deals anymore, but because the deals on offer are “becoming more confusing, less accessible, less compelling, and less successful”, he argued.

“There has been this shift towards ineffective strategies like loyalty and digital couponing. The percentage of consumers using digital coupons is dropping.

“The issue isn’t too much trade spending but ineffective trade spending. When deal levels are cut back, participation declines across the categories. More deals equals more sales, but the caveat is that they must be more compelling deals.”

Click HERE to read more about the TABS Group webinar.

*Click HERE to download the Catalina report: A Tough Road to Growth. The 2015 Mid-Year Review: How the Top 100 CPG Brands Performed and click HERE to download the 3rd Annual Consumer Value Study on Consumables from the TABS Group.

Dr Jetta will be explaining how to get more bang for your promotional bucks at Food Vision USA in Chicago on October 27-29.