Knorr performed well in 2015, Hellmann's grew 7%, and Magnum Pink and Black, Ben & Jerry's Cores and new Breyer's Gelato products grew strongly, said Polman.

“Ben & Jerry's achieved a second year of double-digit growth and sales are now approaching €600m ($654m). Magnum also grew double-digit … And Talenti…grew by more than 40%.”

Underlying sales growth in tea improved to around 3%, while the ready-to-drink tea (Pure leaf) joint venture with PepsiCo grew sales by 10%.

Spreads down 5%

However, spreads continued to drag down Unilever's €12.9bn food business, which accounts for just under a quarter of group revenues, he added: “Spreads continue to be a drag on the overall foods performance with another decline of 5% as we haven't been able to stem the ongoing market decline [in developed countries], which was compounded by a further fall, may I say, in butter prices.”

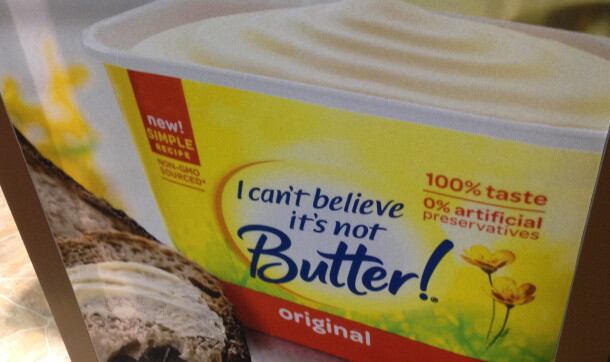

While partially hydrogenated oils (which help to make liquid vegetable oils solid at room temperature - but create harmful trans fats) were phased out by Unilever and all the leading brands a long time ago, margarines and spreads still have an image problem, with many shoppers seeing them as 'highly processed' and less 'natural' than butter, which has undergone a dramatic renaissance in recent years.

Meanwhile, headlines such as ‘Eat Butter’ on the front of Time magazine - driven by research questioning whether saturated fats deserve their bad reputation - have also given butter a PR boost.

Unilever has taken several steps to address the problem, including reformulating brands such as I can't Believe It's Not Butter (click HERE) to remove 'artificial' ingredients.

In December 2014, it also unveiled plans to put its US and European margarine business into its own 'baking, cooking and spreads' unit headed by Sean Gogarty, prompting speculation it was planning a spin off. Gogarty, however, has just resigned, with sources telling the Wall Street Journal that his departure was "motivated by incompatible views on how the spreads business should be run".

He has been replaced by Nicolas Liabeuf, formerly senior vice president of marketing operations.

Polman: We’re not going to give it away

So should Unilever sell its spreads business, which includes brands such as Flora and Bertolli? It’s an option, but it is not going to give it away, Polman told analysts:

“We will continue to look at that, if that is a good performance for the company or not, if we continue to build shareholder value by keeping it or if we destroy shareholder value. The challenge has always been we're building share in this category. We're having a great cash flow. I can get rid of this business tomorrow by giving it away to someone, but that's criminal.

“We need to be sure that we build shareholder value. So if we can find other options that are better for the unit, we shall do that. If we cannot, we should continue to focus on driving it.”

In developed markets consumer demand for our categories remains weak

As for the overall outlook, the downturn in the global economy “has been more prolonged than I suspected, which is saying something”, observed Polman.

Brazil fell further into recession; growth in China has slowing; oil exporting countries such as Russia, the Gulf region, part of Latin America and Africa, were struggling; while crop failures put pressure on India, he added.

In developed markets, meanwhile, “consumer demand for our categories remains weak and prices are still falling in Europe. In the US, our markets are now growing at around 1% to 2% but this time it's offset by ongoing customer destocking making them effectively flat.”

FY results, 2015, by region

Revenues increased by 10% to €53.3bn including a positive currency impact of 5.9%. Food accounted for €12.9bn of this, with underlying sales growth of 1.5%, he said. Group net profit fell 5% to €4.91bn.

On a regional basis, the picture was “mixed” with strong performances from India, Turkey and the Philippines, recovery in China and Japan but a weaker performance in Russia.

Latin America delivered double-digit underlying sales growth, while in North America, dry spray deodorants and premium ice cream did well, although spreads continued to decline.

Europe returned to growth in 2015 although “the contraction of the margarine market weighed on our Foods performance, particularly in the United Kingdom and Germany,” said Polman.