Snack sales are projected to increase by $35bn in the next five years, according to analysts firm IRI, which said 84% of this growth would come from core snacking categories such as chips, bars and nuts.

Speaking at the Sweets & Snacks Expo in Chicago recently, IRI executive vice president Sally Lyons Wyatt said consumers had been telling analysts for the past ten years that they were snacking more, with research showing they snacked an average of 2.7 times a day.

“But what was really amazing about 2015 compared with previous years was that 46% of consumers told us they are snacking three-plus times a day – that’s almost half the US population,” she said, adding that this was a five percentage point increase on the previous year.

Strong industry momentum

“That it is significant and shows you the momentum for this industry is still very strong,” Lyons Wyatt said. “We will reach a tipping point, there will come a time when this plateaus, but the fact consumers are actively gravitating to snacking is a winner for the industry.”

Value sales of snacks had risen 3.5% in 2015 with sales growth recorded in most sales channels, although US consumers had gravitated towards value retailers in the past few years, according to IRI, with sales through dollar stores up 7.5%.

Lyons Wyatt flagged up three trends for manufacturers to consider when developing or marketing products in order to tap into this market growth:

Kids rule

Households with kids are driving the trends in snacking, she said, adding: ”These are the households you want to be talking to.”

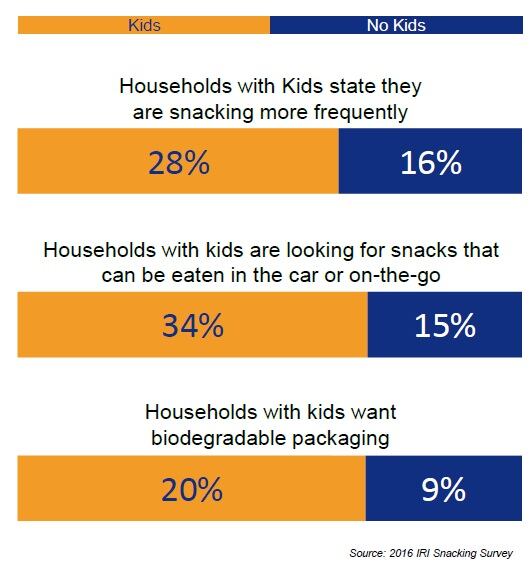

According to IRI survey data, 28% of households with children say they are snacking more frequently, compared with 16% of those without children.

Analysts also learned the environment was a concern for families, with 20% looking for biodegradable packaging versus 9% of households without children.

“A lot of these young families are millennials and sustainably is big for them,” added Lyons Wyatt.

Manufacturers were advised to bear in mind the different needs of children of various ages.

“The age of kids makes a difference in their needs, what they are buying and when,” said Lyons Wyatt. “For example, with teenagers, breath fresheners come into play because they want to talk to someone they haven’t talked to before and want to make a good impression.”

Ingredients claims

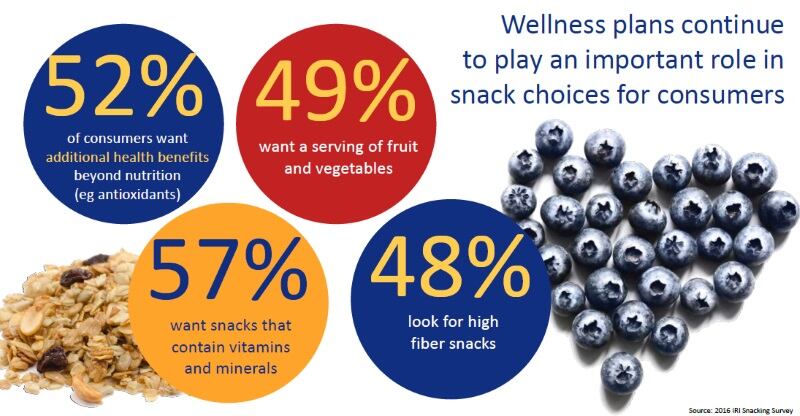

More than half (52%) of consumer surveyed by IRI said they wanted snacks that offered additional health benefits beyond nutrition, and 57% said they wanted snacks that contain vitamins and minerals.

Key benefits consumers were looking for include protection from cancer, lower risk of heart disease, weight lost, reduced cholesterol, and nutrition such as calcium and fiber.

Consumers are also looking for transparency and natural ingredients, said IRI, was has led to the development of more snacks containing plant-based proteins.

“We are seeing things like lentils, chia and quinoa go into a lot of different flavors,” said Lyons Wyatt.

“These sorts of products are grabbing a share of wallet as well as stomach.”

IRI has tipped a range of ingredients and trends for further growth in 2016/17, including ‘real’ food claims, cricket protein, acid whey, personalization and combinations of spicy and tangy flavors.

Variety

IRI has recorded strong growth in sales of variety packs offering a selection of snacks and flavors, which are growing 5.4% versus a 0.9% increase in multipacks.

The trend was being seen across a range of product categories and was tapping the family market, said Lyons Wyatt.

“The bottom line is that variety packs are giving them more options – they are giving family members the snacks that they want,” she added.

Variety packs also tap the 82% of consumers who told IRI they seek snacks that are good value for money.

“That doesn’t necessarily mean they are looking for cheap,” said Lyons Wyatt. “Value can mean different things to different people – it could be they have a disease state and need to have the right products in their home; it could be that their kids loves certain brands and that’s valuable to them; it could be that they want more healthy options.”