In America’s Supermarkets in Transition, Hartman Group CEO Laurie Demeritt and James Richardson, Ph.D. SVP, Knowledge & Innovation at Hartman Strategy, argue that the be-all-things-to-all-people strategy that made supermarket chains such a success 40-50 years ago is no longer working.

Yet the majority of operators continue to base strategies around capturing a larger share of pantry staples, which places them in direct competition with Club, Wal-Mart, ALDI, dollar stores and Amazon Prime Pantry and Subscribe and Save - with whom they cannot compete on price, argues the report.

“Everyone needs to premiumize their merchandising mix as legacy brand sales continue to drift to discount, club and online channels. Learn to upsell and stop working so hard to save your shoppers money; you will never save them as much as Walmart, ALDI and others already do.

“Bolstering your portfolio of premium brands is more critical than ever before to capture additional special occasion and trade up dollars at neighborhood supermarkets and to replace revenue and profits disappearing from price pressured staples whose volumes will continue to shift to discount channels.”

You can’t compete with Amazon or Walmart on price

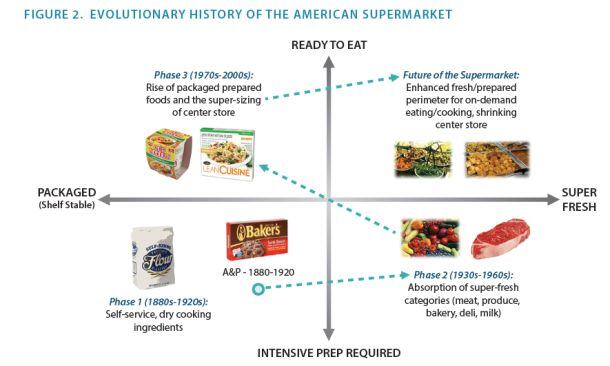

Supermarkets in the future, contend the authors, “will be far less focused on being ‘super’ in terms of offering a massive variety of products, and much more on a well-curated set of high quality offerings with special focus on what drives growth in local neighborhood retail: fresh unpackaged foods.

“They will design themselves to upsell constantly to consumers in key fresh perishable categories and for special occasion buying, using the center of the store as a cash-flow anchor, not an engine to drive growth in trips, profit, revenue or share of wallet.”

Shoppers want more stores that are perimeter first or fresh first

Above all, they say, supermarkets have to up their game on fresh.

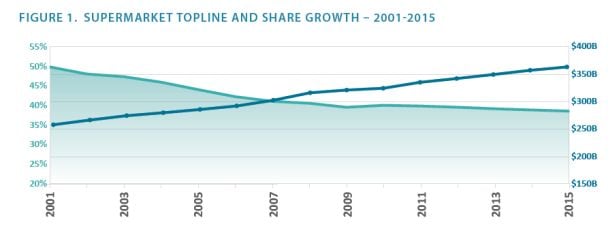

“From 2011 to 2015, 74% of supermarket annual revenue growth occurred in fresh unpackaged perimeter foods [such as deli items and organic produce]… It is the fresh perimeter that holds the key to stabilizing the supermarket channel or even growing its market share after decades of decline.

“Shoppers want more stores that are perimeter first or fresh first.”

While new retail formats such as Main & Vine (Kroger), 365 by Whole Foods Market, Simply Fresh and bfresh (Ahold) are still at the experimental stage, acknowledges the report, “The trends in broader food culture and supermarket dollar growth support these kinds of experiments.”

America is becoming a nation of par-cookers, snackers and meal assemblers

Experimental new formats from Kroger et al notwithstanding, many supermarket chains are struggling to cope with the changing climate, and getting fresh right is difficult and expensive, acknowledges the report.

“In fact, many are [instead] tending towards EDLP, a dangerous strategic trap that is leading towards consolidation and store closures across the mid-Atlantic, South and Northeast…

"In our view these chains are merely postponing long-term profitability problems caused by hemorrhaging traffic and dollars if they do not focus on rising consumer demand for the supermarket to become a fresh foods emporium.”

Retailers must embrace the ready-to-eat culture

America, they add, is becoming a “nation of par-cookers, snackers and meal assemblers, where jarred pasta sauce is now considered an ingredient and meal components are just heated and then assembled on the plate,” and retailers have to embrace this “ready to eat culture” or they will continue to lose market share.

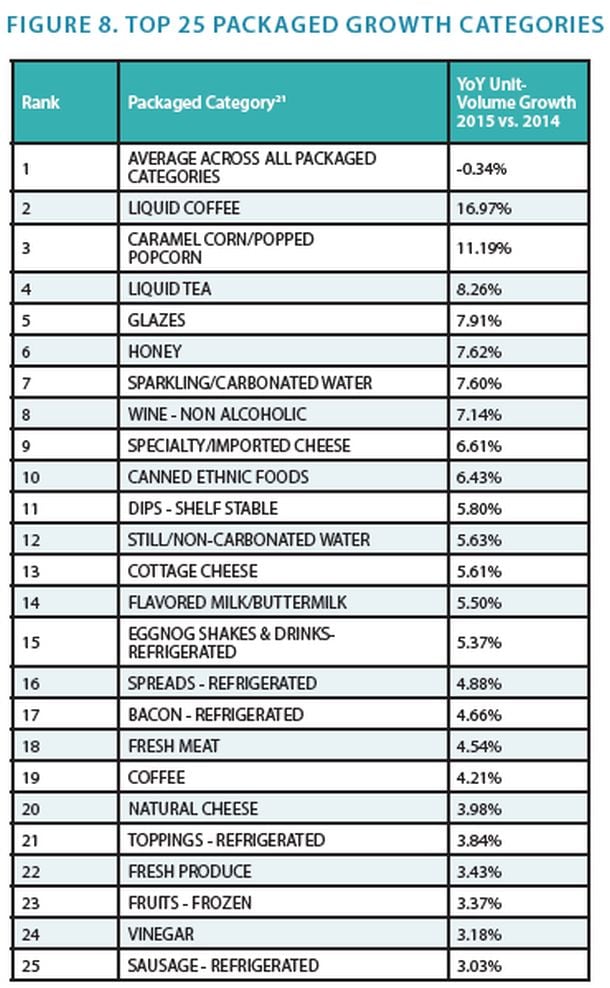

“50% of the top 25 supermarket growth categories in 2015 were fresh and/or chilled items compared to 30% in 2012,” adds the report, which also notes that Americans have increased their restaurant spending faster than their average growth in income while their grocery spending grew by less than their income in the past three years.

Want to hear more from Hartman Group CEO Laurie Demeritt on how the aspirations and behaviors of the so-called 'progressive consumer' are affecting mainstream consumer expectations?

Head to Food Vision USA 2016, where Demeritt will be joined by an array of speakers exploring how to improve the retail experience.