Like fellow Bay area start-up Gelzen, Berkeley-based Perfect Day (click HERE to read our interview with the founders) is one of a new breed of companies in the ‘cellular agriculture’ business – using genetically engineered yeasts that have been ‘programmed’ to produce proteins and other ingredients found in plants or animals on an industrial scale, without harming any animals, and with considerably less impact on the environment.

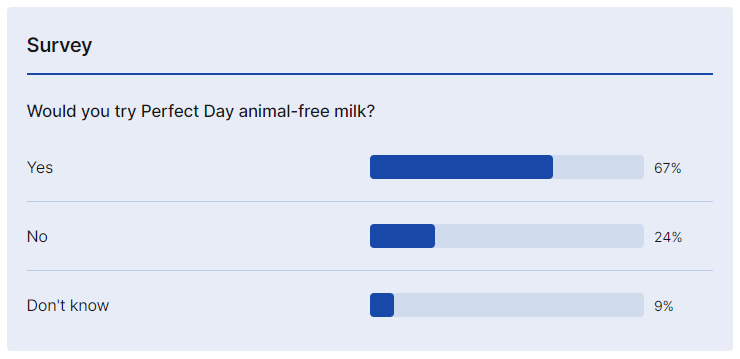

So will the milk be a hit with shoppers?

Tom Vierhile, innovation insights director at Canadean, told FoodNavigator-USA that the concept was completely novel, making it hard to predict how consumers might react: "There is nothing currently available that is even close to this concept. In some ways it is similar to the concept of cultured meat, but even that concept has not really been commercialized yet.

"This market is dynamic enough for a product like this to have the potential for success since we are not at a point where one or two brands have a stranglehold over the milk alternative space. There is a lot of taste variation from one milk alternative to another, so a product that claims to taste nearly the same as cow’s milk sounds like a potentially appealing proposition."

The challenge will be explaining to consumers what it is and how it is made, he predicted: "What is hard to gauge here is how consumers will react to a product that claims to be 'animal-free yet is made using animal proteins.

“It seems like a contradictory message, and one that may be difficult to communicate. You could easily call this 'synthetic milk,’ which does not have the same market appeal as calling this 'animal-free milk.' With hybrid products like this beginning to appear on the market, there may be an appeal for clarification of ‘animal-free’ types of claims at some point."

“Per capita consumption of grain, nut, rice and seed milks grew at a 13.7% rate in the US between 2014 and 2015 making this category the fastest-growing non-alcoholic beverage category, so the good news is that consumers are already experimenting with alternatives to traditional cow’s milk, so Perfect Day is entering a market that is on the rise and is seeing increased consumer attention."

Tom Vierhile, innovation insights director, Canadean

Animal-free, but with dairy proteins?

As for the sustainability message, however, this could definitely resonate with Millennials, although the GMO factor may put some off, he predicted (the dairy proteins in Perfect Day are produced via genetically engineered yeast, although no yeast remains in the final product).

"Younger consumers in particular may be receptive… A 2015 Canadean survey found that 70% of American consumers between the ages of 25 and 34 said they have a ‘much more favorable’ or ‘favorable’ perception of groceries if they have ethical or environmental credentials.

“That figure compares to 50% of consumers of all ages, indicating that younger consumers may be more tuned in to seeking out products with strong ethical or environmental credentials. The same survey also found that younger consumers are much more likely to buy food or drink products that are reflective of their attitudes or opinions in life. 69% of American consumers between the ages of 25 and 34 agree with this, compared to 48% of consumers overall."

It could be a tough sell for consumers

However, Dr Rachel Cheatham, a nutritional biochemist who runs the Foodscape Group consultancy, believes the technology behind Perfect Day is exciting, but predicts it could be "uphill all the way" when it comes to selling the concept to consumers.

"Articulating the starting point of genetically engineered yeast and ending with animal-free milk is not easy. Talk of fermentation like beer brewing and 'yeast farming' is fine, just nowhere near enough to garner consumer trust, trial, or repeat purchase for that matter. This is a synthetic biology curiosity, not a product platform that will overcome the woes of the dairy industry."

She added: "There are significant numbers of people who want something precisely replicating the taste and nutrition of dairy, without using animals. Of those people though, only a very tiny fraction will likely even try this product. To say 'niche' barely captures how narrow the audience is for this."

Success of fairlife shows consumers are willing to try new things in the dairy case

Finally, Emily Balsamo, research analyst at Euromonitor International, told us she thought the milk was “a good idea, and could find a loyal consumer base.”

She added: “Milk alternatives are very hot right now, even though none of them set out to replicate the taste of milk. The closest thing is fairlife, a recombinated milk (click HERE for details), which saw the highest growth in 2016 among milk brands with 7% gains in 2016 over 2015 reaching $127m in sales.

“Despite the product being initially derided as ‘frankenmilk’ by the national media; fairlife has found a stable consumer base. The product has been widely lauded on the grounds of taste, even among consumers who are not lactose intolerant.”

Meanwhile, while nut and legume based milks are performing well, they don’t have the same functionality or nutrition as dairy milk, while growing almonds also requires a fair amount of water, she said, so there’s definitely room for more players in this space.

As for the GMO element, she said, “I’m not sure. There are a lot of well informed, tech savvy consumers who are not afraid of GMOs,” while the success of fairlife suggests that consumers are opening to trying new things in the dairy case.

“Consumers are ready for elements of this product- they want a milk alternative, and are interested in more humane non-animal options but want the taste of animal products.”

Click HERE to read our interview with the founders of Perfect Day.